Have you been trying to find a

Have you been trying to find a inventory that is likely to be well-positioned to keep up its earnings-beat streak in its upcoming report? It’s price contemplating Acuity Manufacturers (AYI), which belongs to the Zacks Constructing Merchandise – Lighting business.

When trying on the final two experiences, this lighting maker has recorded a powerful streak of surpassing earnings estimates. The corporate has topped estimates by 18.49%, on common, within the final two quarters.

For the final reported quarter, Acuity Manufacturers got here out with earnings of $2.12 per share versus the Zacks Consensus Estimate of $1.69 per share, representing a shock of 25.44%. For the earlier quarter, the corporate was anticipated to publish earnings of $1.82 per share and it really produced earnings of $2.03 per share, delivering a shock of 11.54%.

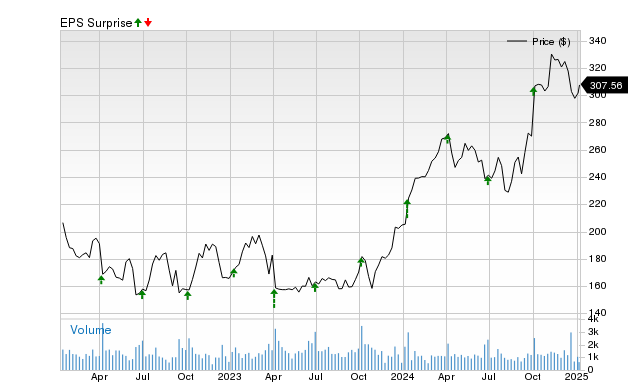

Value and EPS Shock

With this earnings historical past in thoughts, latest estimates have been transferring increased for Acuity Manufacturers. The truth is, the Zacks Earnings ESP (Anticipated Shock Prediction) for the corporate is optimistic, which is a superb signal of an earnings beat, particularly whenever you mix this metric with its good Zacks Rank.

Our analysis exhibits that shares with the mix of a optimistic Earnings ESP and a Zacks Rank #3 (Maintain) or higher produce a optimistic shock practically 70% of the time. In different phrases, in case you have 10 shares with this mixture, the variety of shares that beat the consensus estimate may very well be as excessive as seven.

The Zacks Earnings ESP compares the Most Correct Estimate to the Zacks Consensus Estimate for the quarter; the Most Correct Estimate is a model of the Zacks Consensus whose definition is expounded to vary. The concept right here is that analysts revising their estimates proper earlier than an earnings launch have the newest data, which might probably be extra correct than what they and others contributing to the consensus had predicted earlier.

Acuity Manufacturers has an Earnings ESP of +7.90% in the intervening time, suggesting that analysts have grown bullish on its near-term earnings potential. While you mix this optimistic Earnings ESP with the inventory’s Zacks Rank #2 (Purchase), it exhibits that one other beat is probably across the nook. The corporate’s subsequent earnings report is anticipated to be launched on July 1, 2021.

When the Earnings ESP comes up unfavorable, traders ought to be aware that this can scale back the predictive energy of the metric. However, a unfavorable worth is just not indicative of a inventory’s earnings miss.

Many corporations find yourself beating the consensus EPS estimate, however that is probably not the only foundation for his or her shares transferring increased. Alternatively, some shares could maintain their floor even when they find yourself lacking the consensus estimate.

Due to this, it is actually essential to verify an organization’s Earnings ESP forward of its quarterly launch to extend the percentages of success. Ensure to make the most of our Earnings ESP Filter to uncover the most effective shares to purchase or promote earlier than they’ve reported.

Click on to get this free report

Acuity Manufacturers Inc (AYI): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.