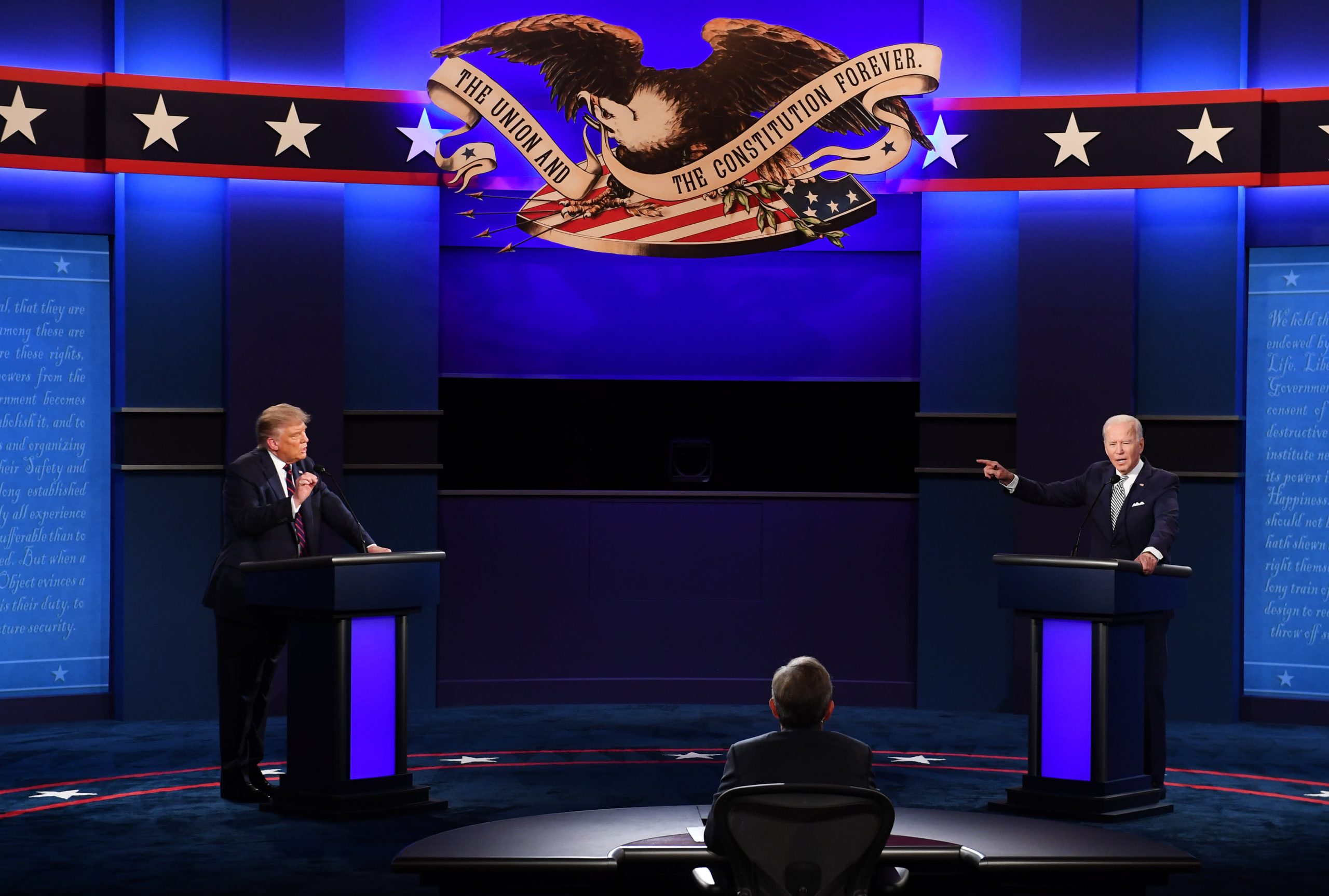

Joe Biden and Donald Trump converse through the first U.S. presidential debate on Sept. 29, 2020.Kevin Dietsch/UPI | Bloomberg | Getty PhotosInvent

Joe Biden and Donald Trump converse through the first U.S. presidential debate on Sept. 29, 2020.

Kevin Dietsch/UPI | Bloomberg | Getty Photos

Inventory market analysts in Asia clearly don’t agree on who will win the U.S. presidential election. However they’re fairly unified on how they plan to play it.

CNBC requested 30 strategists a sequence of questions in regards to the U.S. election and their present investments, providing them anonymity in alternate for his or her views. All 30 respondents had been primarily based within the Asia-Pacific area.

CNBC carried out the email-based early final week, and subsequently adopted up with the strategists to ask if they’d modified their outlook following the primary presidential debate and the information that President Donald Trump examined optimistic for coronavirus. (Of the 30 respondents, three modified their predictions on the election’s end result.)

Who wins in 2020?

The Asia-based buyers had been sharply divided on the central political query. Twelve analysts predicted a victory for former Vice President Joe Biden, 11 predicted a contested election, and 7 picked Trump to win.

The Democrats have given no indication that they are going to be any simpler on China than the GOP.

Asia-based market strategist

“This (analysis) information provides some uncertainty, and Biden has gained a bit with market predictors,” one analyst mentioned by way of e-mail. “However an excessive amount of remains to be unknown to anticipate a change but.”

How strategists are taking part in the vote

A transparent majority of market analysts polled by CNBC are elevating money and shopping for comparatively secure belongings akin to gold forward of the Nov. three vote. Nineteen of the 30 strategists mentioned they’re rising their money holdings, together with the U.S. greenback and Japanese yen. They’re additionally shifting into gold and U.S. Treasurys.

We’re constructive for 2021 outlook and anticipate Asian markets to bounce again finally, ought to we see volatility within the subsequent couple of months round U.S. elections.

Ten of 30 mentioned it is a good time to rotate out of costly shares akin to know-how shares and into much less common sectors: They recognized journey and tourism, in addition to shares that monitor the broader financial system together with banks and industrials. Shopping for extra “defensive” shares like well being care, client items and dividend shares is one other funding technique that was recognized.

Solely one of many 30 market gamers polled by CNBC sees worth in various investments together with actual property funding trusts (REITs), infrastructure bonds, or the much-discussed “ESG” funds that issue environmental, social and governance elements into their holdings.

China tech vs U.S. tech

Requested which they discover extra engaging between U.S. know-how shares or Chinese language tech names, a transparent majority — 18 of the 30 Asia-based analysts — cited Chinese language corporations as their most well-liked selection.

“Asian tech is cheaper than the U.S., much less danger of tradable choices, and fewer regulatory danger,” mentioned one, who defined that speculative choices buying and selling linked to U.S. tech names makes them extra risky than their Asian counterparts.

One other strategist mentioned that “a Biden win may topic U.S. know-how to larger regulation.”

The IPO markets in Hong Kong, mainland China and South Korea have drawn a lot investor curiosity in 2020, and “that curiosity is simply set to develop,” mentioned one other respondent.

The scheduled preliminary public providing of Chinese language monetary know-how firm Ant Group “will spur upward revaluations in tech” in Asia, mentioned one other analyst. Alibaba affiliate Ant Group, which remains to be managed by Alibaba founder Jack Ma, operates the wildly common Alipay cell cost app in China.

Outlook for Asia markets

Sixteen of 30 market specialists mentioned they’re bullish on Asian markets, regardless of the near-term volatility. These respondents mentioned they consider Asia has extra upside as soon as the election danger is out of the way in which, given the obvious fading of the coronavirus in Asia and indicators of financial restoration.

“We’re constructive for 2021 outlook and anticipate Asian markets to bounce again finally, ought to we see volatility within the subsequent couple of months round U.S. elections,” mentioned one strategist.

“That mentioned,” the strategist continued, “Asian equities will seemingly outperform U.S. equities within the close to time period,” particularly if Biden wins the election, “which may weigh on U.S. equities however will seemingly have restricted direct elementary impression on Asian equities.”

Biden vs Trump: Which international locations profit?

The strategists mentioned a Biden victory could be most optimistic for China, Japan and South Korea, whereas a Trump win could be helpful for India, Vietnam, the Philippines and likewise Taiwan.

Biden as president could be anticipated to take a extra reasonable method towards China, whereas a Trump reelection could be seen strengthening India’s place with a view to counterbalance China’s dominance.

U.S.-China relations

However a reasonable tone towards China from a President Biden might not translate into much less pressure between the world’s two largest economies.

“The Democrats have given no indication that they are going to be any simpler on China than the GOP” has been, mentioned one of many contributors.

That view got here by way of clearly among the many 30 ballot respondents once they had been requested what a Biden presidency would imply for U.S.-China relations. Even below Biden, tensions with China will proceed, as a result of “your entire international coverage, protection and intelligence institution within the U.S. are anti-China,” as one mentioned.

Nonetheless, most analysts mentioned {that a} second Trump time period may carry increased pressure round Hong Kong, human rights and the Covid-19 pandemic. And an financial “decoupling” between the 2 international locations would stay within the playing cards.

—CNBC’s Naman Tandon and Celestine Francis Xavier contributed to this report