All commodities markets have their levered funding bets. Crude oil has wildcat exploration and manufacturing corporations; gold and valuable metals

All commodities markets have their levered funding bets. Crude oil has wildcat exploration and manufacturing corporations; gold and valuable metals have the mining operations out doing the soiled work within the floor. A commodity of the long run, bitcoin, isn’t any exception to the rule that when there is a scarce useful resource to take advantage of on the planet, and traders are inserting rising worth on it, miners will rush in to stake their declare to the riches.

Latest good points in what stands out as the most high-risk bitcoin wager of all led Leeor Shimron, vp of digital asset technique at Fundstrat World Advisors, to check out the “digital gold rush” in buying and selling of bitcoin miners.

These mining corporations are pretty new and younger, they lack observe information, and a few got here to market in “roundabout methods” — and a few of the largest, like Riot Blockchain, attracted regulatory scrutiny of their early days. Additionally they have been working at losses, however Shimon famous they’ve reached over $1 billion in market cap after investing closely in the course of the bitcoin downturn within the {hardware} and services that helped them to “strike it large” within the present bitcoin bull market cycle.

Excessive-beta, high-risk bitcoin buying and selling

Shimron described the miners in a be aware final week to purchasers who expressed curiosity within the surging shares as a “excessive beta play” on bitcoin. Through the latest bull run for the cryptocurrency, throughout which bitcoin is up 900%, the common return among the many largest publicly traded miners was 5,000%, in response to his evaluation.

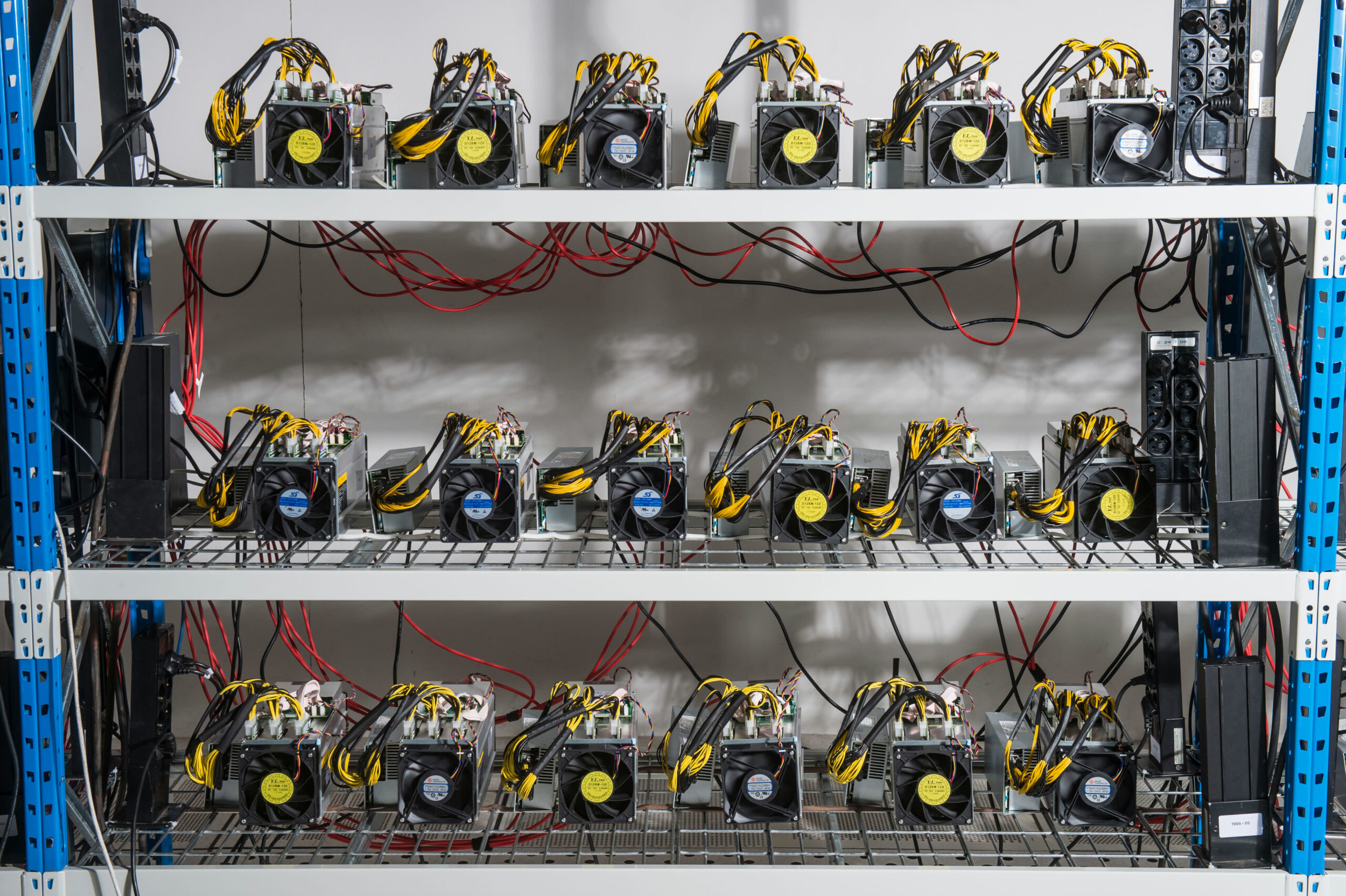

Bitcoin miners, in Shimron’s phrases, type the core spine of bitcoin’s blockchain, as they “burn electrical energy to computer-generate guesses aiming to unravel cryptographic puzzles” and generate income within the type of mined bitcoin. Because the bitcoin is mined, the miners promote the belongings to cowl their bills. Many select to additionally maintain a portion of their mined bitcoin on their company stability sheet, a pattern which is beginning to acquire traction with the extra digitally-oriented, disruptive CEO class within the broader market, corresponding to Jack Dorsey at Sq. and Elon Musk at Tesla. Musk simply added “Technoking” to his government title and the Tesla CFO lately had “Grasp of Coin” added to his. The North American mining firm, Marathon Digital Holdings, lately introduced it had bought a further $150 million price of bitcoin to carry on its stability sheet.

The biggest publicly listed mining corporations which the Fundstrat analyst reviewed embrace the 2 Nasdaq-listed corporations, Riot Blockchain and Marathon Digital Holdings, and two over-the-counter market shares, Hive Blockchain and Hut 8.

Over the previous 12 months, bitcoin miners drastically outperformed bitcoin, a dynamic that Fundstrat World Advisors says will proceed because the bull market performs out, however may flip violently to the draw back in any correction.

Fundstrat World Advisors

Shimron’s evaluation reveals that the beta these bitcoin mining corporations exhibit generates a return of two.5% for each 1% transfer within the cryptocurrency. Whereas there’s not sufficient historic knowledge to attract agency conclusions, the miners’ efficiency is clearly tied to the value of bitcoin, and their buying and selling profile amplifies the upside and draw back, he stated.

It’s a “notoriously aggressive trade,” in Shimron’s phrases, the place the flexibility to be worthwhile can come right down to low-cost electrical energy and entry to specialised mining {hardware}. As bitcoin’s value will increase, “miners spin up new rigs or improve their {hardware} with extra highly effective and environment friendly machines.”

Marathon lately made a $170 million deal for 70,000 S-19 ASIC miners from Bitmain, which when totally deployed later this 12 months, will up its mining energy to 103,000 machines.

This excessive value of doing enterprise in bitcoin mining leads to low or unfavourable free money movement and muted earnings, Shimron writes. However the mining corporations have for the second captured the expansion of the present bitcoin bull cycle because of their spending. (They noticed wild buying and selling within the bitcoin increase of 2017, too.)

Now they’ve additionally attracted consideration from a few of the market’s latest forces, as a latest Bloomberg piece famous of the bitcoin miners getting mentioned throughout the WallStreetBets message board on Reddit which fueled the mania in shares of GameStop.

“For traders seeking to acquire publicity to miners, that beta makes it an awesome alternative in the course of the center of a roaring bull market. …There are suits and begins and pullbacks, however we nonetheless have numerous room to develop right here,” Shimron stated in an interview with CNBC.

Investing in bitcoin in 2021, and past

It’s the broader bull market in cryptocurrency that has fueled the miners and Shimon thinks that may proceed in 2021, pushed by macroeconomic and demographic elements. Fears of inflation will help bitcoin costs, and even amid latest yield stress from the 10-year Treasury which might act on cryptocurrency because it does on know-how shares, he stated it’s clear from Fed signalling that the central financial institution needs to maintain its dovish insurance policies in place till 2023.

One other driving pressure is sustained adoption of latest digital know-how and digital belongings from youthful traders. “You see youthful individuals gravitate to bitcoin and different digital currencies versus gold and commodities and it speaks to a demographic shift. … To them it is not loopy to work together with cash in a purely digital approach,” he advised CNBC.

Final week, Morgan Stanley turned the primary large Wall Avenue financial institution to supply its rich purchasers entry to bitcoin. It restricted entry to purchasers with not less than $2 million given the dangers concerned.

There already are methods into the crypto market aside from the underlying currencies, such because the exchanges which commerce coin and shortly will probably be obtainable to extra traders. Coinbase was lately valued at $68 billion within the non-public market and is planning a direct itemizing on the Nasdaq.

Ready for a bitcoin ETF within the US

There are three bitcoin ETFs in Canada, and in some unspecified time in the future, there could also be a bitcoin ETF obtainable within the U.S. The newest try on the Securities and Alternate Fee was filed mid-March by VanEck ETFs, however with traders not holding out excessive hopes the SEC will approve a bitcoin fund quickly, they’re trying elsewhere for cryptocurrency funding concepts that transcend shopping for bitcoin itself.

Shimon, who ran an early-stage cryptocurrency and blockchain enterprise fund earlier than becoming a member of Fundstrat, stated he does view the miners as being a basis for the crypto house. “The highest corporations will probably be right here to remain,” he stated, pointing to the economies of scale investing in gear which newer entrants may have a harder time competing in opposition to.

After making the “good transfer” in the course of the bitcoin bear market to construct out operations, present tech sector provide chain shortages attributable to Covid could additional assist the positioning of those miners after the capital they’ve already put into specialised machines for the house.

Nonetheless, like many merchants and hedge funds do with gold miners and small-cap oil explorers, he’s inclined to commerce the bitcoin miners in a bull market run, somewhat than see them as investments to carry for the long-term.

The outperformance of the SPDR Gold Shares ETF relative to a VanEck ETF monitoring an index of gold miners, since 2006.

Shimron continues to want bitcoin as a long-term funding, in addition to any ETF finally accepted by the SEC for U.S. traders. “It’s only a matter of time earlier than the SEC approves a bitcoin ETF,” he stated. “When a BTC ETF comes, the charges will probably be low and will probably be the most secure and easiest method of utilizing conventional rails to get publicity to bitcoin,” he stated.

The miners have confronted criticism over the large quantities of electrical energy required in bitcoin operations, however Shimron’s view comes right down to the financials and market efficiency. (He says there’s a lot to criticize concerning the fiat foreign money system’s impression on the world, too.)

“It’s fairly clear the U.S. greenback as a worldwide reserve foreign money is on its final legs, not disappearing any time quickly, however we’re within the later levels of the U.S. greenback because the reserve foreign money, and decentralized is the subsequent stage.”

Even when the bitcoin mining shares are too excessive threat for many traders, he’s assured in saying that the world of cryptocurrency ought to be on everybody’s radar. “That is the place all the pieces goes. Finance has been the final vestige that hasn’t been touched by the web,” Shimron stated.