Acorns cell utilityAcornsAcorns is increasing into the hiring market.The eight-year-old fintech firm introduced a partnership with on-line job mark

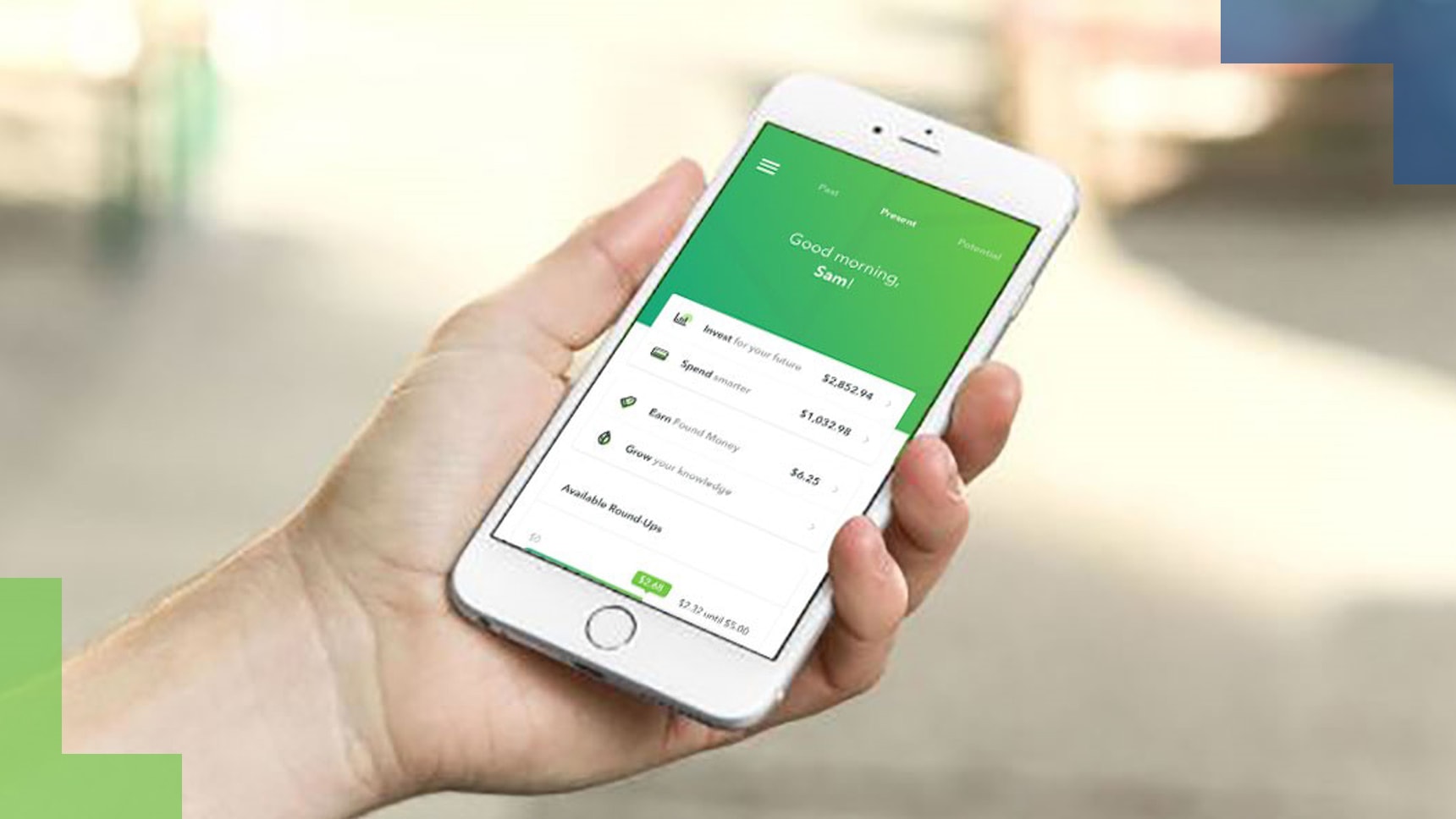

Acorns cell utility

Acorns

Acorns is increasing into the hiring market.

The eight-year-old fintech firm introduced a partnership with on-line job market ZipRecruiter on Monday, which permits Acorns shoppers to browse and apply for jobs throughout the app.

Acorns’ hiring portal is the primary of its variety for a monetary providers firm. The launch had been on the corporate’s street map, however was accelerated by sky-high unemployment through the pandemic, based on Acorns CEO Noah Kerner.

“The extra you earn, the extra it can save you and make investments for the long run — we wished to attach these dots for folks,” Kerner instructed CNBC in a cellphone interview. “By aligning that inside Acorns, we will help folks earn extra cash, to allow them to make investments more cash.”

The job portal will present full and part-time jobs, in addition to distant job alternatives. It additionally permits customers to arrange job alerts, and see profession growth content material.

Kerner pointed to an absence of earnings as Individuals’ greatest barrier to investing. Thirty 4 % of respondents in an Acorns survey launched Monday mentioned not investing, or reaching their financial savings objectives, was as a result of not making sufficient cash. The earnings difficulty was a extra widespread financial savings barrier for males than girls, at 39% and 30%, respectively.

Pandemic-related shutdowns and an financial slowdown have left thousands and thousands of Individuals sidelined from the labor market. The newest complete for jobless claims hit the best quantity since late August because the labor market struggles to get again to the pre-coronavirus mark. The unemployment fee has fallen to 7.9% however remains to be greater than double its pre-pandemic degree.

The Irvine, California-based firm’s hottest providing permits clients to mechanically make investments the spare change from debit or bank card purchases. For instance, if an Acorns person purchased a cup of espresso for $2.75, the cell app would spherical as much as the closest greenback and put that remaining 25 cents into an Acorns funding account. That cash is then put into professionally managed index funds. It has since added different monetary providers and training choices.

The common Acorns buyer is roughly 32 years outdated with an earnings of $50,000 to $60,000. The corporate mentioned it has grown to greater than 8.2 million buyer accounts — up from 4.5 million roughly eighteen months in the past, and $3.2 billion belongings below administration.

Regardless of volatility through the pandemic, Kerner mentioned extra clients had been sticking with an investing plan and holding their cash within the markets.

“There are intervals in time when there have been actually rocky markets, and folks tended to tug cash out,” Kerner mentioned. “It is encouraging see increasingly more folks saving and investing, particularly throughout a troublesome time.”

Disclosure: Comcast, which owns CNBC’s mum or dad firm, NBCUniversal, is an investor in Acorns.