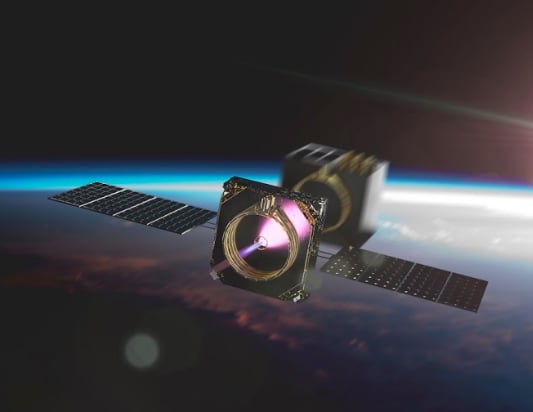

An artist's rendering of a Momentus Vigoride switch car deploying a satellite tv for pc in orbit.MomentusArea firm Momentus will later this week go

An artist’s rendering of a Momentus Vigoride switch car deploying a satellite tv for pc in orbit.

Momentus

Area firm Momentus will later this week go public on the Nasdaq, a month after settling Securities and Trade Fee fees that it misled traders.

Steady Street Acquisition Corp, a particular objective acquisition firm or SPAC, on Wednesday introduced its merger with Momentus was accredited by shareholders. Whereas solely a little bit over half of Steady Street’s shareholders voted for the merger, 97% voted for the deal to undergo.

Shares of Steady Street will convert to inventory in Momentus on Friday, with the ticker image of the corporate altering from “SRAC” to “MNTS.”

Steady Street’s inventory fell 2.6% in buying and selling on Wednesday to shut at $10.20 a share. Steady Street famous that public stockholders filed to redeem about 20% of the agency’s excellent shares – an unusually excessive quantity for an organization that’s going public, as redemptions are sometimes within the low single-digit percentages or much less after a SPAC merger closes.

A SPAC raises cash from traders by an preliminary public providing after which makes use of the money to amass a non-public firm and take it public.

Steady Street’s inventory is down almost 43% to this point this 12 months, embattled by Momentus’ delayed missions and the pressured departure of Momentus’ founder and former CEO Mikhail Kokorich. The corporate additionally had its valuation lower in half from $1.1 billion to $567 million. Lastly, Steady Street additionally confronted SEC fees that it falsified the outcomes from a prototype spacecraft take a look at in July 2019.

SEC chair Gary Gensler emphasised that its case in opposition to Momentus and Steady Street “illustrates dangers inherent to SPAC transactions, as those that stand to earn vital income from a SPAC merger could conduct insufficient due diligence and mislead traders.”

“The truth that Momentus lied to Steady Street doesn’t absolve Steady Street of its failure to undertake satisfactory due diligence to guard shareholders,” Gensler added in an announcement.

Steady Street and Momentus agreed to settle the fees and penalties of over $eight million in complete. Former CEO Kokorich, who reportedly left the nation, has not settled with the SEC.

Turn into a wiser investor with CNBC Professional.

Get inventory picks, analyst calls, unique interviews and entry to CNBC TV.

Signal as much as begin a free trial at present.