Tasos Katopodis | Bloomberg | Getty Photos(By comparability, the 37% high particular person price applies to earnings exceeding: $523,600 for singl

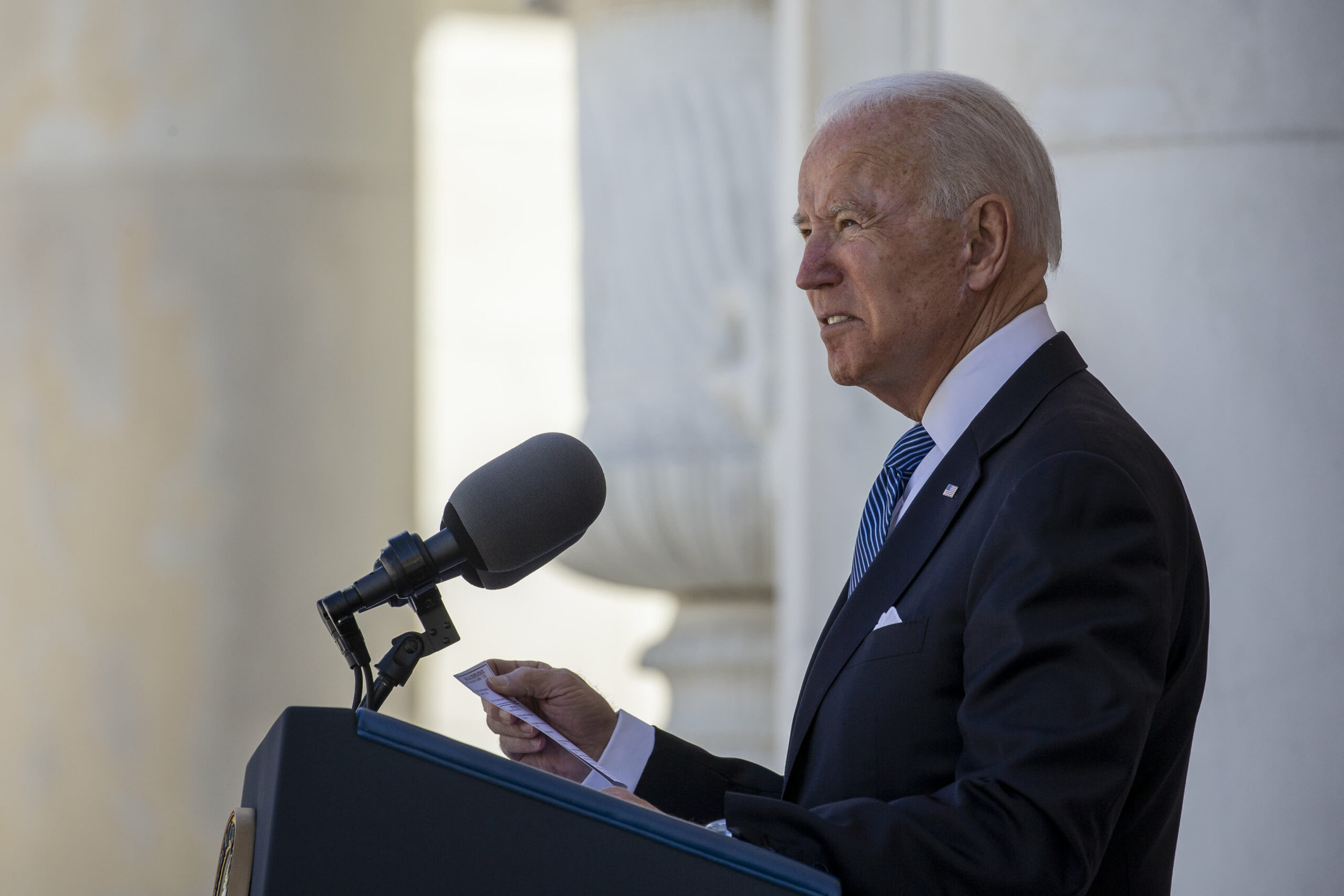

Tasos Katopodis | Bloomberg | Getty Photos

(By comparability, the 37% high particular person price applies to earnings exceeding: $523,600 for single filers and heads of family, $628,300 for married joint filers, and $314,150 for married separate filers.)

The 39.6% high price would kick in throughout the 2022 tax yr, in response to the proposal. (Which means it could apply to tax returns filed in 2023.) Congress would nonetheless have to go laws enacting the coverage, which is not assured.

Biden’s proposal is one among a number of measures aimed toward elevating taxes on households incomes greater than $400,000 a yr.

The tax income would assist finance initiatives within the American Households Plan to develop the social security web, together with funding for 4 extra years of free education, closely backed little one take care of middle-class households, federal paid household go away and expanded little one tax credit.

Mountain climbing the highest price to 39.6% would increase an estimated $132 billion over 5 years, in response to the Treasury Division.

The highest price is slated to extend even when Congress does not go Biden’s proposal. The Tax Cuts and Jobs Act’s particular person tax reductions will lapse after 2025 because of how Congress structured the regulation.

Biden’s proposed earnings thresholds for the 39.6% price correspond to the pre-TCJA thresholds, listed for inflation, in response to a Treasury official.