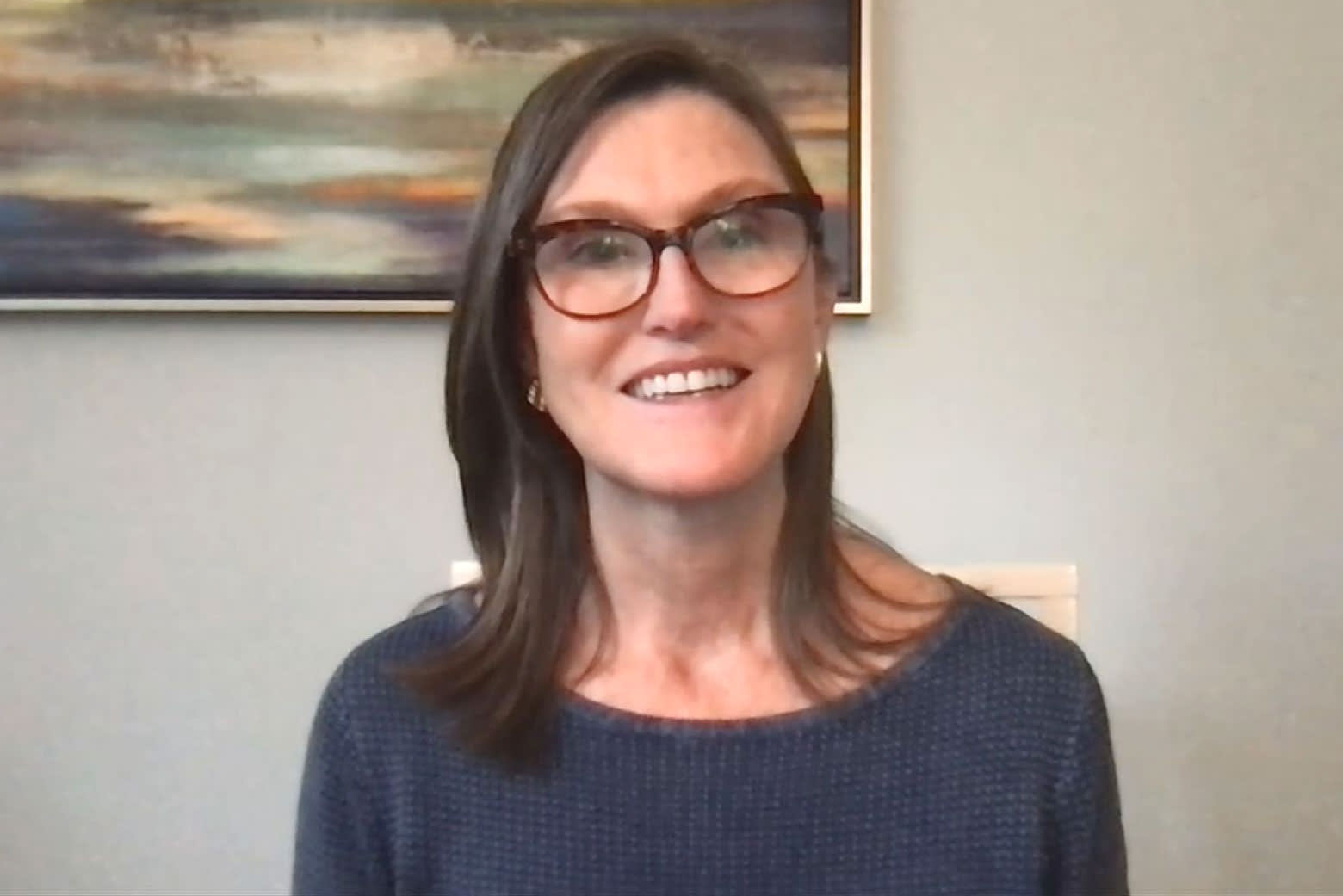

Cathie Wooden referred to as out Michael Burry on social media after 'The Massive Quick' investor positioned a wager towards her flagship ARK Innov

Cathie Wooden referred to as out Michael Burry on social media after ‘The Massive Quick’ investor positioned a wager towards her flagship ARK Innovation exchange-traded fund.

“To his credit score, Michael Burry made a terrific name primarily based on fundamentals and acknowledged the calamity brewing within the housing/mortgage market. I don’t imagine that he understands the basics which can be creating explosive development and funding alternatives within the innovation house,” Wooden tweeted on Tuesday morning.

On Monday, regulatory filings noticed by CNBC Professional confirmed Burry wager towards Woods’ ARK Innovation ETF utilizing choices. Burry’s Scion Asset Administration purchased 2,355 put contracts towards the red-hot tech ETF throughout the second quarter and held them by means of the top of the interval. Buyers revenue from places when the underlying securities fall in costs. It isn’t clear whether or not Burry’s place is worthwhile or whether or not he nonetheless holds the quick wager.

Burry was one of many first buyers to name and revenue from the subprime mortgage disaster. He was depicted in Michael Lewis’ e book “The Massive Quick” and the next Oscar-winning film of the identical identify.

Wooden made a reputation for herself after a banner 2020 the place ARK Innovation returned practically 150% because the fund had large holdings in shares like Zoom and Teladoc, which thrived throughout the pandemic.The ETF ballooned with buyers hoping to get a bit of the “disruptive innovation” names that Wooden touts on her fashionable YouTube channel. The fund’s belongings below administration at the moment are round $22.5 billion, based on FactSet.

The new-handed investor will get a lot of her consideration from a youthful demographic that she mentioned appreciates the place innovation has on this planet at the moment. Merchants on Reddit chat rooms seek advice from Wooden as “Cathie BAE” and “Queen Cathie” and submit photographs of Wooden on a t-shirt that claims “In Cathie We Belief.”

Nonetheless, a few of Wooden’s high holdings are controversial attributable to their lofty valuations with many making little or no income.

Shares of Wooden’s flagship fund, ARK Innovation, hit a backside in Might as buyers rotated into worth shares within the first half of 2021 and out of tech shares; nonetheless, the ETF ended the second quarter up 9%. Shares of ARK Innovation are nonetheless down 6% year-to-date.

Burry’s submitting by means of the top of final quarter additionally exhibits he elevated his Tesla put place throughout the interval. Wooden is a long-time Tesla bull. The electrical carmaker is the No. 1 holding in ARK Innovation, accounting for greater than 10% of the whole ETF.

Check out the remainder of Wooden’s twitter thread right here.

“In our view, the seeds for the innovation explosion that @ARKInvest is devoted to researching have been planted throughout the 20 years ending with the tech and telecom bust. Having gestated for greater than 20 years, these applied sciences ought to remodel the world throughout the subsequent 10 years,” Wooden’s twitter thread continued.

“If we’re appropriate, GDP and income development will diminish till the alternatives in nascent applied sciences start to maneuver macro needles. On this setting, innovation primarily based methods ought to distinguish themselves,” Wooden mentioned.

“The deflation in commodity costs is cyclical however is including to the secular forces brought on by technologically enabled disruptive innovation (“good deflation”) and inventive destruction (“dangerous deflation”),” Wooden’s tweet mentioned.

“Since mid Might plenty of commodity costs have been breaking down: lumber -65-70%, copper -10-15%, oil -10%. An surprising improve within the greenback is also damaging for commodity costs. Now the Mannheim used automobile index – a number one index for brand spanking new automobile gross sales – is slipping,” mentioned Wooden.

“Most bears appear to imagine that inflation will proceed to speed up, shortening funding time horizons and destroying valuations. Regardless of what we imagine has been a supply-chain associated/quick time period burst in inflation, each equities and bonds have appreciated since March,” Wooden concluded.

Wooden is likely one of the few buyers going towards the grain on the subject of inflation. Whereas many market members are involved about rising costs, the founding father of ARK Make investments expects deflation amid a breakdown in commodity costs, gridlock on tax coverage in Washington and innovation tendencies taking off.

Scion Asset Administration did not instantly reply to CNBC’s request for remark.

— with reporting from CNBC’s Yun Li.