Bitcoin and different cryptocurrencies might finally change into a part of the beneficial portfolio for on a regular basis traders, Ark Make invest

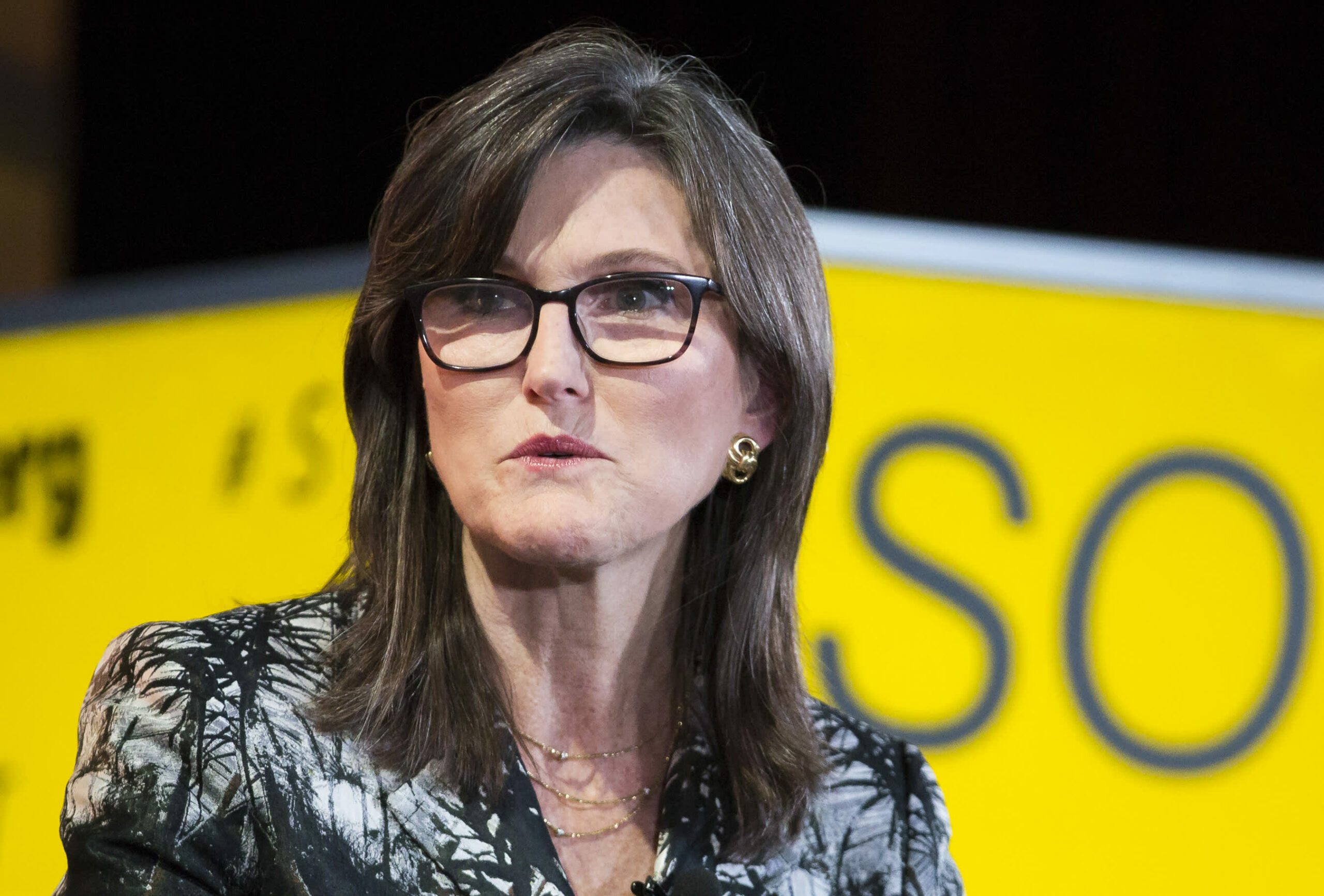

Bitcoin and different cryptocurrencies might finally change into a part of the beneficial portfolio for on a regular basis traders, Ark Make investments’s Cathie Wooden stated Monday.

Wooden, whose star as an investor rose dramatically final 12 months because of the sturdy efficiency of her flagship Ark Innovation ETF, stated on CNBC’s “Closing Bell” that she believes risky cryptocurrencies will finally resemble bonds.

“We expect because it turns into a greater accepted new asset class … We do suppose it can behave, truly, I might say extra just like the mounted revenue markets, imagine it or not,” Wooden stated.

Bitcoin has had a dramatic run to new highs after buying and selling beneath $10,000 per coin as just lately as September. The asset rose to just about $58,000 on Feb. 21, based on Coin Metrics, earlier than cooling off barely. It was buying and selling at about $51,700 on Monday.

Although typically referred to as “digital gold,” bitcoin doesn’t commerce in tandem with valuable metals and its excessive stage of volatility is extra harking back to property which are considered larger danger. Wooden stated that, for the time being, bitcoin’s worth was most correlated with actual property costs.

Nonetheless, Wooden stated that she thinks bitcoin might stabilize over time and change into part of the beneficial portfolio for the typical investor, which is 60% in shares and 40% in mounted revenue, particularly given the excessive worth of bonds relative to historical past.

“If you consider bonds from this stage, this concept of a 60-40 balanced portfolio is a bit problematic,” Wooden stated. “We have been by means of a 40-year bull market in bonds. We’d not be stunned to see this new asset class change into part of these percentages. Possibly 60 fairness, 20, 20,” Wooden stated.

Tesla, which has lengthy been certainly one of Ark’s largest positions, transformed a part of its stability sheet money into bitcoin earlier this 12 months. Different corporations have additionally more and more adopted cryptocurrency, both by supporting funds and transfers or truly shopping for the property.

The flagship Ark fund has tumbled within the opening months of 2021, with the rotation into worth hurting a few of Wooden’s largest holdings. The investor stated on Monday that she remains to be assured in her technique and in Tesla regardless of the latest losses.