Cathie Wooden's flagship fund Ark Innovation hit its lowest level of the yr on Monday amid additional promoting in innovation shares.Ark Innovation

Cathie Wooden’s flagship fund Ark Innovation hit its lowest level of the yr on Monday amid additional promoting in innovation shares.

Ark Innovation’s drop of as a lot as 5% on Monday dragged the “disruptive innovation” ETF beneath its March low, a stage that many buyers are watching as a barometer for the bigger tech sector.

Ark Innovation is now practically 35% off its most up-to-date excessive: $159.70 on Feb. 16.

Wooden’s core ETF is now down practically 13% this month and greater than 15% year-to-date.

A few of Ark Innovation’s prime holdings took massive hits on Monday because the Nasdaq Composite dropped as a lot as 1.5%. Tesla fell 4% and Teladoc Well being dropped 4.6%. Sq. and Roku fell practically 6% and three%, respectively. DraftKings declined greater than 3% and Zillow misplaced over 2%.

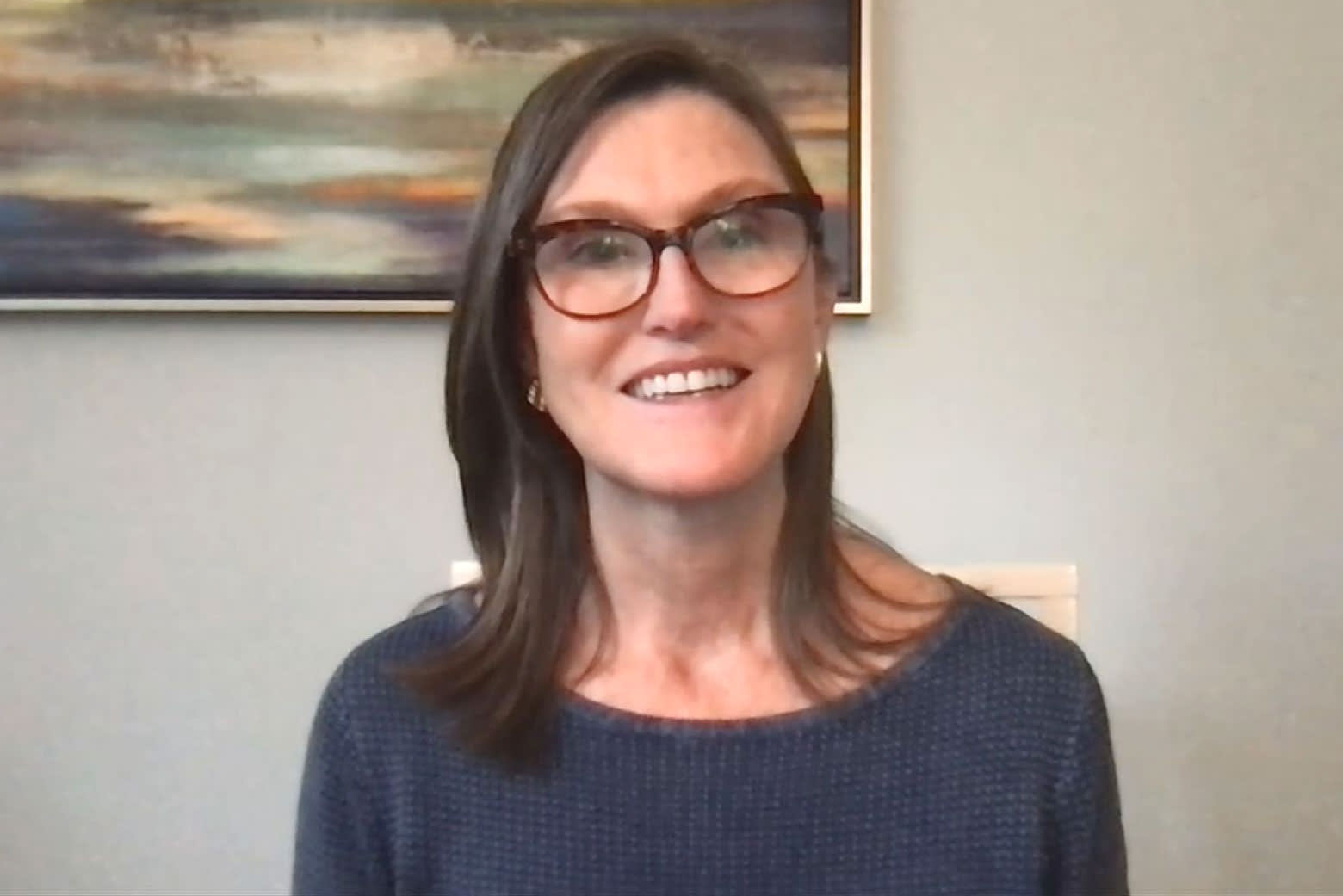

Wooden advised CNBC on Friday that she loves the set-up for her ETFs following the newest sell-off in expertise shares. She mentioned she envisions her methods posting a compound annual price of return between 25% and 30%.

“I really like this set-up,” Wooden mentioned Friday on CNBC’s “Closing Bell.” “The worst factor that would have occurred to us is to have the market narrowly give attention to simply our ilk of inventory — the innovation house.”

Nevertheless, greater than $1.1 billion of fund flows have left Ark Innovation this month. Ark Make investments — together with its 5 core ETFs — has misplaced about practically $2 billion in investor {dollars} in Might, in response to FactSet.

200-day shifting common lengthy gone

Ark Innovation broke beneath its 200-day shifting common, a key technical stage watched by merchants that’s primarily the common of the previous 200 closing costs.

“The problem with ARKK and different speculative development ETFs is that short-term rallies have been aggressively pale for 3 months now,” Frank Cappelleri, Instinet govt director, advised CNBC. “The ETF should do extra than simply bounce for a couple of days to persuade merchants in any other case.”

“In different phrases, merely getting again above the 200-day shifting common will not imply a lot with out upside comply with by. That continues to be the largest concern,” Cappelleri added.