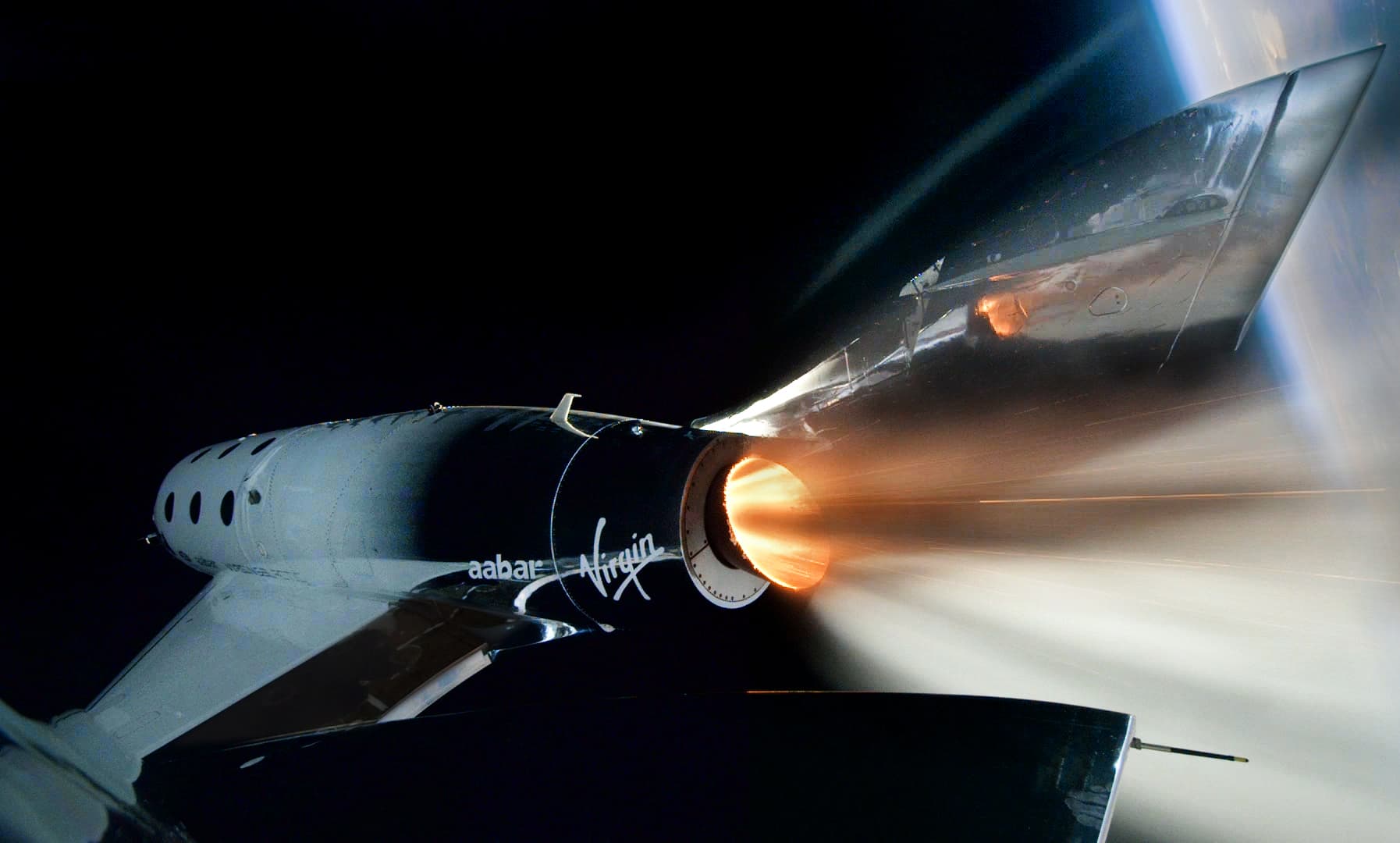

Virgin Galactic's spacecraft Unity reaches house for the primary time.Supply: Virgin GalacticArk Make investments, which operates the biggest activ

Virgin Galactic’s spacecraft Unity reaches house for the primary time.

Supply: Virgin Galactic

Ark Make investments, which operates the biggest actively managed exchange-traded fund, plans so as to add a “Area Exploration ETF” below the ticker ARKX, based on a securities submitting on Wednesday.

Whereas the ETF’s constituents have but to be introduced, shares of house firms Virgin Galactic and Maxar Applied sciences every jumped greater than 8% in after hours buying and selling.

Ark Make investments is coming off a wildly profitable 2020, with its flagship ARK Innovation fund returning greater than 170% final 12 months and progress in property below administration to $17 billion. The fund’s largest holding is electrical automobile maker Tesla, which accounts for greater than 10% of its weighting.

Ark founder and CEO Cathie Wooden advised CNBC final month that traders ought to “get on the correct aspect of change and keep on the correct aspect of change as a result of it has hit escape velocity within the aftermath of the coronavirus.” Wooden, a long-time Tesla bull, has a $7,000 a share worth goal for the corporate to hit by the top of 2024.

The Area Exploration ETF would concentrate on firms which are “main, enabling, or benefitting from technologically enabled merchandise and/or providers that happen past the floor of the Earth,” the submitting mentioned.

The house trade grew steadily in 2020 regardless of delays because of the COVID-19 pandemic, with funding bouncing again after a short lull. Investor curiosity in house firms has continued at heightened ranges, regardless of just a few publicly-traded firms.

However extra space firms plan to enter public markets within the 12 months forward, with each conventional IPOs and SPAC offers anticipated in 2021.

Ark divided the trade into 4 classes: orbital aerospace, suborbital aerospace, enabling applied sciences, and aerospace beneficiary.

“Area exploration is feasible because of the convergence of quite a lot of themes, and a Area Exploration Firm might not at present derive any income, and there’s no assurance that such firm will derive any income from progressive applied sciences sooner or later,” Ark’s submitting mentioned.

Ark additional defined the 4 classes of firms that can be within the Area Exploration ETF:

“Orbital Aerospace Firms are firms that launch, make, service, or function platforms within the orbital house, together with satellites and launch automobiles. Suborbital Aerospace Firms are firms that launch, make, service, or function platforms within the suborbital house, together with drones, air taxis and electrical aviation automobiles. Enabling Applied sciences Firms are firms that create the applied sciences required for profitable value-add aerospace operations, together with synthetic intelligence, robotics, 3D printing, supplies and vitality storage. Aerospace Beneficiary Firms are firms that stand to profit from aerospace actions, together with agriculture, web entry, international positioning system (GPS), building and imaging.”

– CNBC’s Maggie Fitzgerald contributed to this report.

Subscribe to CNBC PRO for unique insights and evaluation, and dwell enterprise day programming from all over the world.