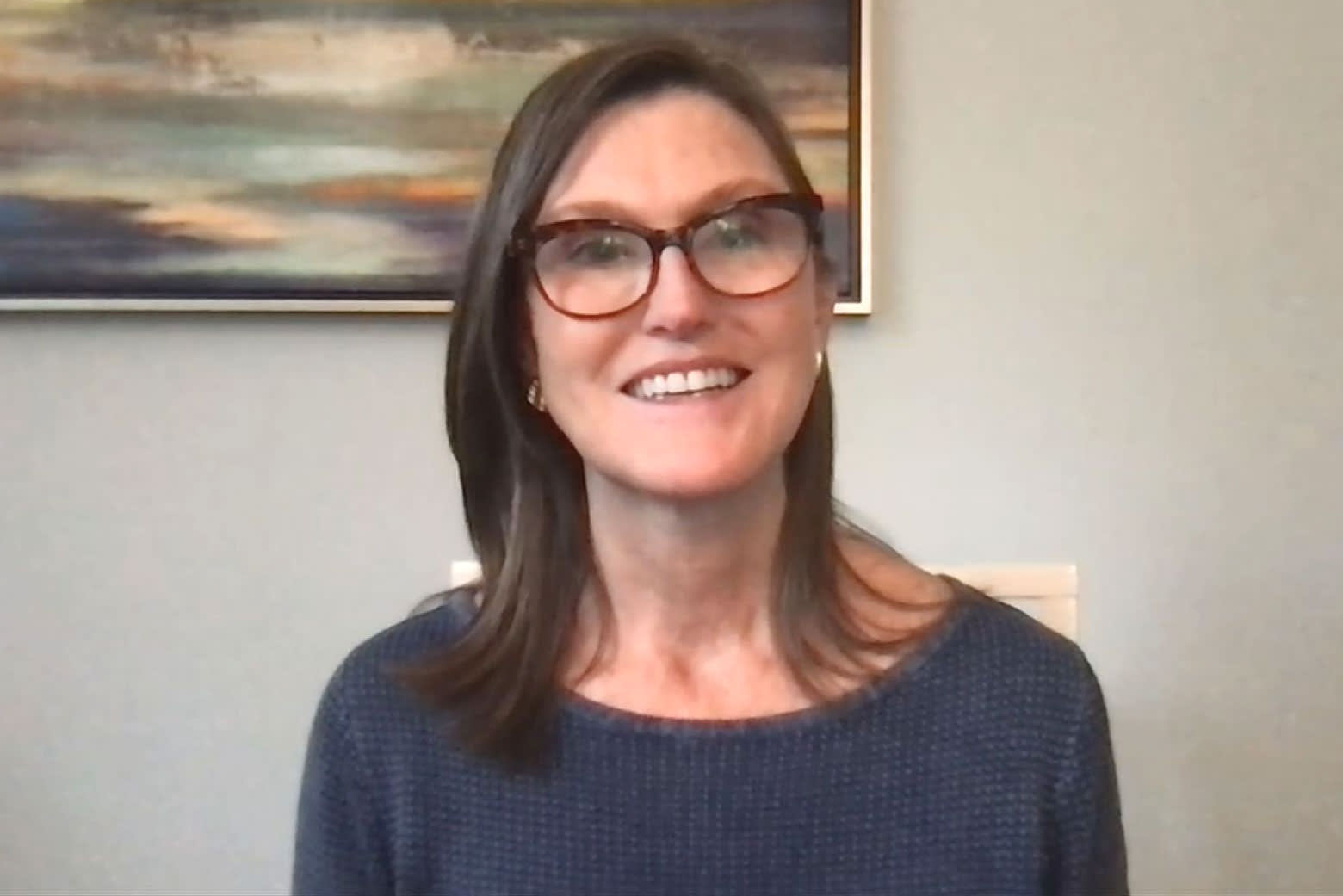

Cathie Wooden's Ark Make investments is making a bitcoin exchange-traded fund, in response to a submitting with the Securities and Change Fee.Woode

Cathie Wooden’s Ark Make investments is making a bitcoin exchange-traded fund, in response to a submitting with the Securities and Change Fee.

Wooden — a longtime bitcoin bull — has been shopping for up proxies for the digital asset in names equivalent to Coinbase and Grayscale Bitcoin Belief. Now, the innovation investor is searching for to personal the precise asset itself.

The ETF’s funding goal is to trace the efficiency of bitcoin, in response to the SEC submitting. The fund would commerce beneath the ticker image “ARKB,” if accepted by the SEC. Ark Make investments is working in partnership with 21Shares to launch the ETF.

Bitcoin has hovered round $34,000 for the previous couple of weeks because it struggles to reclaim its Might highs. Many within the buying and selling group have saved a watchful eye to see if it will maintain at $30,000 because it continued its decline. Some nonetheless say it may drop as little as $20,000 earlier than rebounding.

Nevertheless, the digital asset has practically been reduce in half since its all-time excessive of about $63,000 in April. China’s bitcoin crackdown, Tesla CEO Elon Musk’s choice to cease accepting bitcoin for its electrical automobiles, and extreme danger taking by crypto merchants have all contributed to current worth swings.

Ark Make investments acknowledged the volatility related to the digital asset within the “danger elements” part of the submitting.

“The market worth of bitcoin just isn’t associated to any particular firm, authorities or asset. The valuation of bitcoin relies on future expectations for the worth of the Bitcoin community, the variety of bitcoin transactions, and the general utilization of bitcoin as an asset. Which means a big quantity of the worth of bitcoin is speculative, which may result in elevated volatility. Traders may expertise important good points, losses and/or volatility within the Belief’s holdings, relying on the valuation of bitcoin,” the S1 submitting acknowledged.

The SEC final week once more postponed a call to approve the primary bitcoin ETF. The most recent motion comes as SEC Chairman Gary Gensler has referred to as for extra regulation of cryptocurrency exchanges and higher investor protections.

To this point, there have been eight different bitcoin ETFs filed with the SEC.

Coinbase, the world’s largest cryptocurrency change, is a high 10 holding in Wooden’s flagship fund Ark Innovation. Grayscale Bitcoin Belief is a high 10 holding in Ark Subsequent Era Web ETF.

Wooden has mentioned she sees a future the place bitcoin is a part of a balanced funding portfolio. Ark Make investments estimates that if 1% of the company money of each firm within the S&P 500 had been transformed into bitcoin, then the asset’s worth would balloon by greater than $40,000 from its present ranges. If the money stage elevated to 10% from every firm within the broader inventory index, bitcoin’s worth would enhance by greater than $400,000, the agency mentioned.

With Gensler — a longtime financier who taught a digital forex class on the Massachusetts Institute of Expertise — being nominated to steer the Securities and Change Fee, the watchdog may heat to crypto through the Biden administration, Wooden informed CNBC earlier this 12 months.

Wooden’s disruptive innovation funds have not too long ago turned a nook after months of underperformance amid a rotation into worth shares. Shares of Ark Innovation are up greater than 16% in June.

— CNBC’s Tanaya Macheel and Yun Li contributed to this report.