Normal Motors introduced a halt in manufacturing at a number of North American vegetation and Ford introduced extra downtime at two vegetation, the

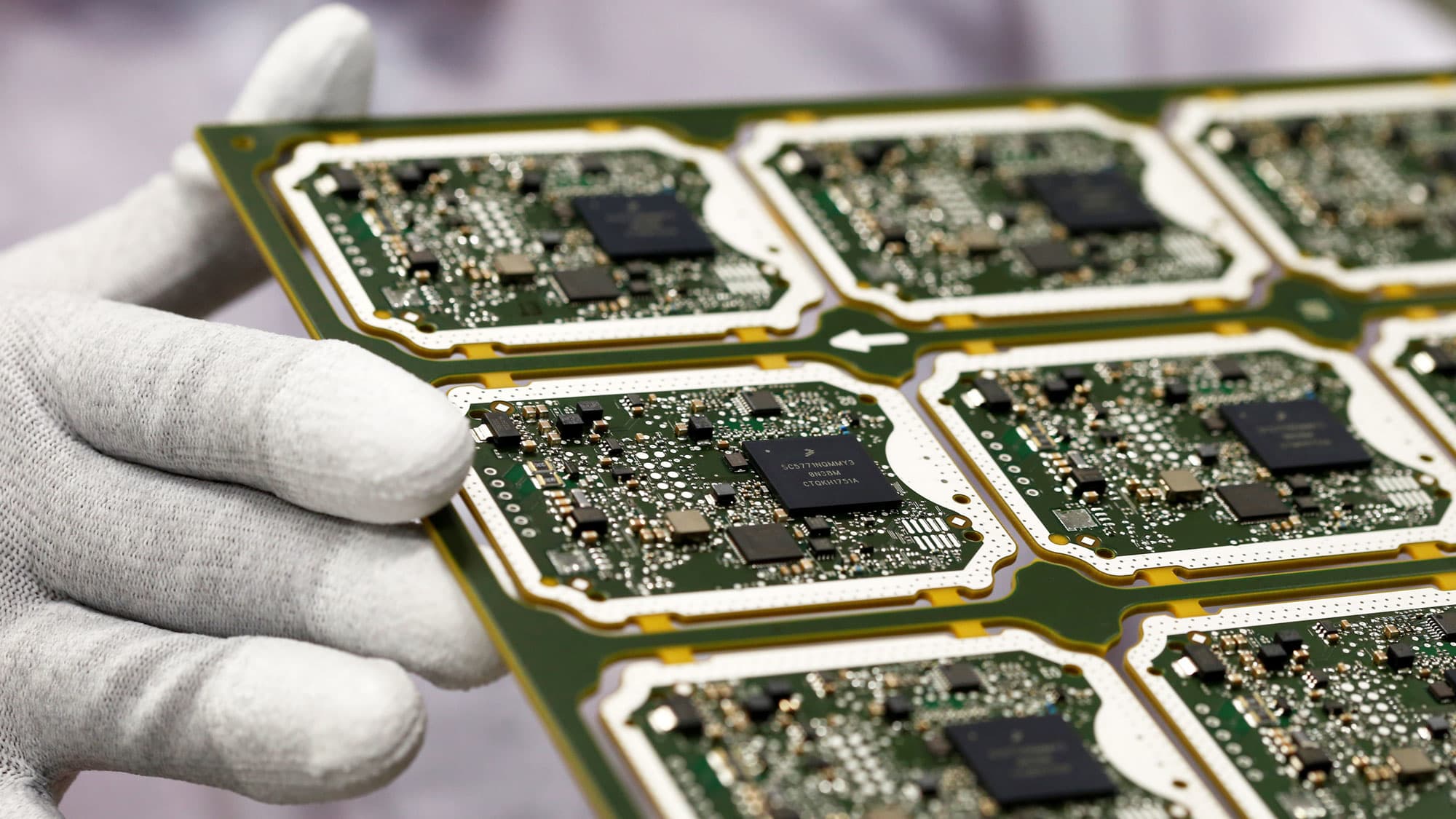

Normal Motors introduced a halt in manufacturing at a number of North American vegetation and Ford introduced extra downtime at two vegetation, the most recent disruptions to the auto provide chain due to a chip scarcity.

Shares for GM had been down 1% on Thursday, the day of its announcement. Ford closed down almost 2%.

Each shares have risen greater than 40% for the 12 months, regardless of the persevering with manufacturing points.

JC O’Hara, chief market technician of MKM Companions, recognized one technique to get publicity to the auto shares with out the headwind danger.

“Used automobile gross sales are by way of the roof so one play that I am very focused on right here is CarMax. They’re an enormous used automobile gross sales firm, and the positivity from used automobile gross sales is being mirrored within the chart,” O’Hara informed CNBC’s “Buying and selling Nation” on Thursday.

CarMax has rallied greater than 100% over the previous 12 months. Shares are up 36% simply this 12 months.

Gina Sanchez, chief market strategist at Lido Advisors and CEO of Chantico International, warned that the chip scarcity is “one thing that is in all probability not going away.”

With Ford and GM transferring into electrical autos, Sanchez famous, “the outlook for Ford is considerably higher than GM, primarily based on the concept they’re actually transferring into the electrical automobile area, however what’s attention-grabbing about that’s that electrical vehicles are going to require extra chips, not much less.”

“Suppliers simply didn’t stockpile sufficient chips as a result of auto demand plummeted throughout Covid, and so now they’re simply caught on the incorrect foot, and it is not really easy to only order up extra chips,” she stated in the identical interview. “That is going to take in all probability a number of months to work by way of, and it should dampen the restoration for the auto sector.”

Nonetheless, for long-term traders, O’Hara stated GM and Ford might current a extra secure alternative over extra unstable electrical automobile makers equivalent to Tesla.

“We have an opportunity to maneuver into decrease volatility names. GM and Ford, who are actually checked out as EV performs. I believe you’ll get a pullback and I believe that pullback is buyable,” stated O’Hara.

Disclaimer