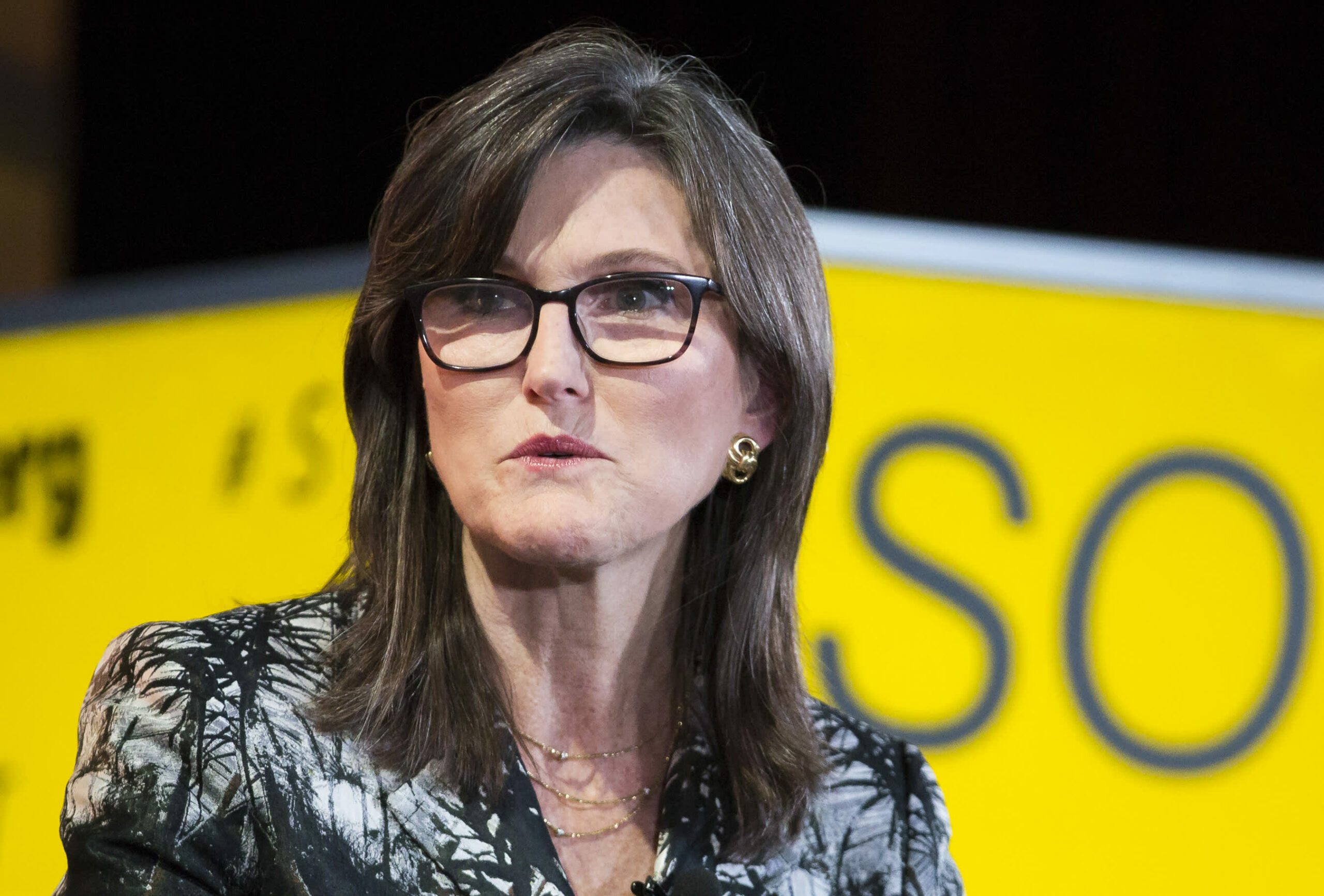

CNBC's Jim Cramer stated Tuesday he was skeptical concerning the newest exchange-traded fund launched by Cathie Wooden's Ark Make investments."One

CNBC’s Jim Cramer stated Tuesday he was skeptical concerning the newest exchange-traded fund launched by Cathie Wooden’s Ark Make investments.

“One have a look at the newly launched ARK House Exploration ETF tells you the whole lot you have to learn about how managers cannot resist creating new funds, even when there isn’t any cause for them to exist,” Cramer stated on “Mad Cash.”

The ARK House Exploration ETF (ARKX) tracks publicly traded firms within the budding house trade. The fund, which started buying and selling Tuesday, sipped 1% to $20.30 in its first session.

Trimble, The 3D Printing ETF and unmanned programs supplier Kratos Protection and Safety Options are the fund’s three highest-weighted holdings. Protection contractors L3Harris and Lockheed Martin, in addition to airplane producer Boeing, are additionally a part of the fund as a consequence of their house publicity.

Whereas ARKX contains some pure house performs, Cramer was perplexed as to why names like Amazon, Alphabet and Netflix had been included within the fund alongside. Chinese language e-commerce performs JD.com, Alibaba and Tencent — in addition to tractor producer Deere — are additionally a part of the ETFs holdings.

“It is ridiculous, however there aren’t sufficient real space-related shares to make an honest ETF and the supervisor desires to gather that 0.75% expense ratio,” Cramer stated. “Possibly … do not launch an area ETF if you need to pad it out with Netflix and Deere.”

Ark Make investments didn’t instantly reply to CNBC’s request for remark.

Ark Make investments, which targets disruptive firms significantly ones in know-how, has picked up a variety of consideration for its different funds’ sturdy in the course of the Covid-19 pandemic. Nonetheless, that momentum has eased this 12 months in as many buyers have bought high-growth shares from the previous 12 months in favor of firms whose companies are anticipated to growth throughout an financial restoration.

In its ARKX prospectus, the corporate stated it plans to take a position not less than 80% of its belongings in home and overseas firms which can be linked or will profit from house journey or companies past the earth’s floor.

Disclosure: Cramer’s charitable belief owns shares of Alphabet, Amazon and Boeing.

Disclaimer

Questions for Cramer?

Name Cramer: 1-800-743-CNBC

Wish to take a deep dive into Cramer’s world? Hit him up!

Mad Cash Twitter – Jim Cramer Twitter – Fb – Instagram

Questions, feedback, recommendations for the “Mad Cash” web site? [email protected]