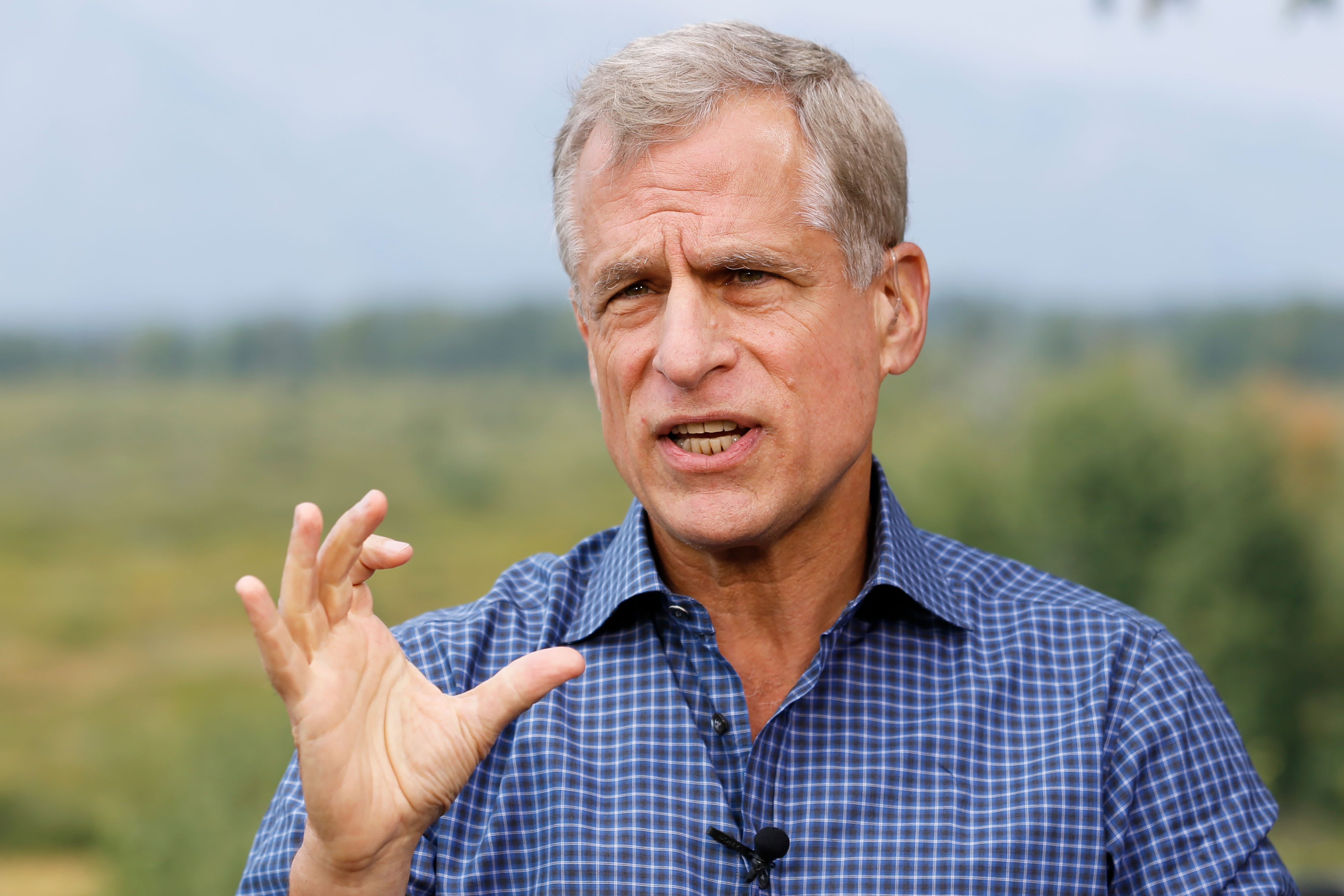

Dallas Federal Reserve President Robert Kaplan is frightened about surging ranges of company debt and laid out a state of affairs the place it migh

Dallas Federal Reserve President Robert Kaplan is frightened about surging ranges of company debt and laid out a state of affairs the place it might all of a sudden turn out to be a giant drawback for the financial system.

“The factor I’m frightened about is in case you get two or three BBB credit score downgrades to BB or B, that would result in a fast widening in credit score spreads, which might then result in a fast tightening in monetary situations,” Kaplan stated in a Tuesday interview with CNBC’s Steve Liesman.

“We’re received a document stage of company and to be particular BBB debt has tripled during the last 10 years,” he stated on “Squawk Box.” “Leveraged loans in addition to BB and B debt have grown dramatically.”

Complete company debt has swelled from about $5 trillion in 2007 because the Nice Recession was simply starting to $9.5 trillion midway via 2019, quietly surging 90%, based on Securities Trade and Monetary Markets Affiliation information.

Buyers have pointed to traditionally low rates of interest each as the explanation for the excessive ranges of debt and justification for not panicking about its dimension simply but. The Fed has minimize the in a single day lending price 3 times in 2019, most lately at its October assembly when it decreased the federal funds price to a spread between 1.5% and 1.75%.

However a sudden slide from low funding grade resembling BBB-rated debt to junk high quality might set off concern over the credit score…