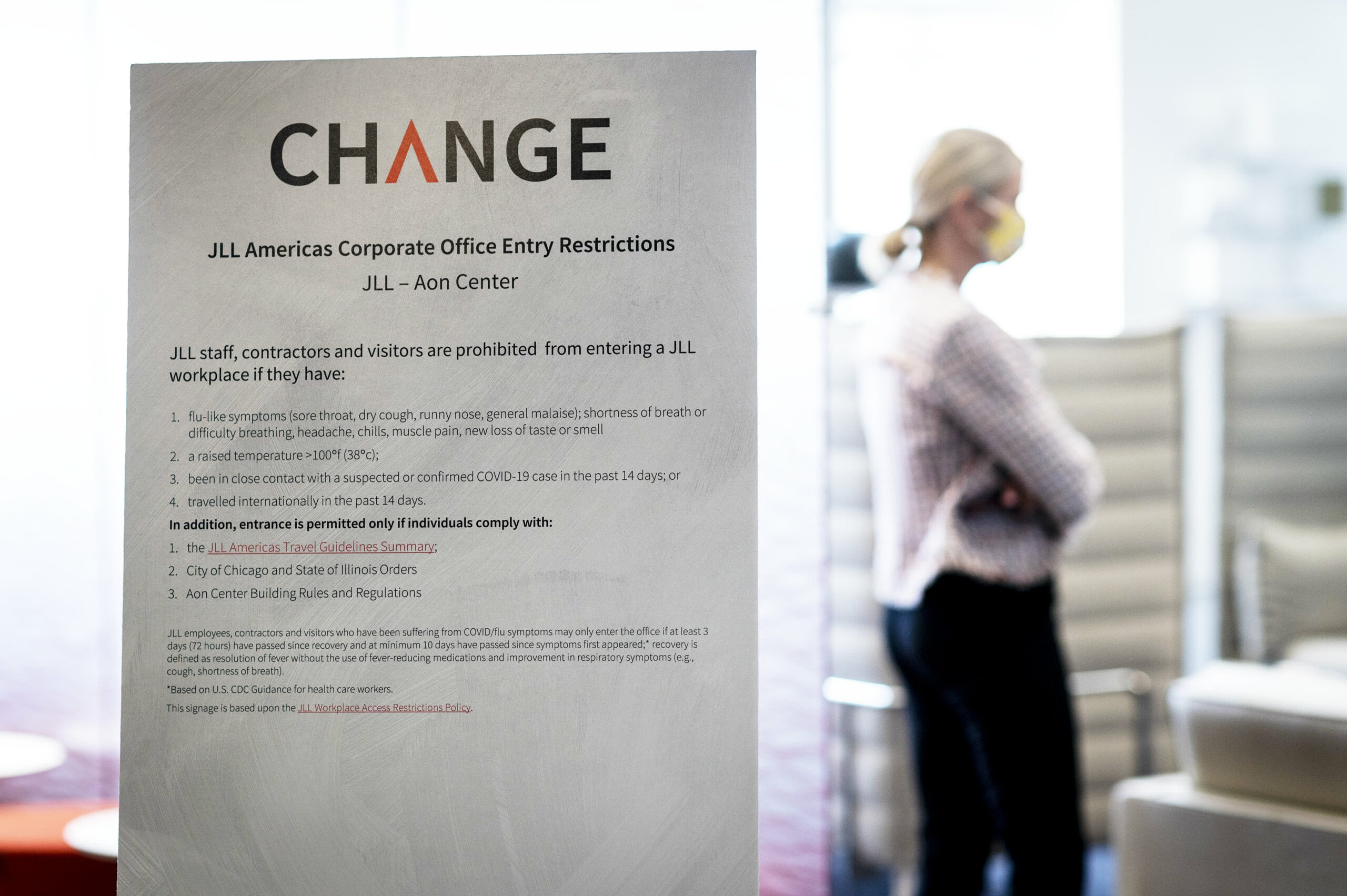

An indication particulars entry restrictions at a JLL workplace within the Aon Heart in Chicago, Illinois, U.S., on Thursday, June 24, 2020.Christo

An indication particulars entry restrictions at a JLL workplace within the Aon Heart in Chicago, Illinois, U.S., on Thursday, June 24, 2020.

Christopher Dilts | Bloomberg | Getty Photos

When earnings season kicked off in earnest in mid-July, few corporations fielded questions on or talked about the Covid delta variant.

That modified as new Covid-19 instances spiked and the Facilities for Illness Management and Prevention reversed its stance on masks for vaccinated individuals, in keeping with a CNBC evaluation of earnings name transcripts.

Between July 13 and Thursday, 142 corporations within the S&P 500 out of the 410 who’ve reported their quarterly earnings have talked about the delta variant by identify or answered a query about it on their earnings calls. Simply 15% of these mentions got here earlier than July 27 — the identical day that the CDC mentioned that absolutely vaccinated individuals ought to put on masks indoors in areas with excessive transmission charges. New Covid instances have been additionally steadily climbing upwards because the extremely contagious delta variant grew to become the dominant pressure of the virus within the U.S.

The U.S. is reporting a seven-day common of greater than 109,000 new instances as of Aug. 5, up practically 28% from one week in the past, in keeping with knowledge from Johns Hopkins College.

For probably the most half, executives mentioned their corporations aren’t seeing a cloth affect on their enterprise associated to the surge in new instances but.

Becton, Dickinson & Co., a medical know-how firm, was one of many few to report a change in client conduct, telling analysts that some U.S. states are seeing much less elective surgical procedures in latest weeks due to the variant. Throughout the week ended Aug. 1, 72% of intensive care unit beds within the U.S. have been occupied, in keeping with Johns Hopkins knowledge.

However some corporations with a extra international presence mentioned that exterior of the U.S., it is a completely different story.

“An uneven restoration to the pandemic and a delta variant surging in lots of international locations all over the world have proven us as soon as once more that the street to restoration can be a winding one,” Apple CEO Tim Prepare dinner mentioned on the corporate’s July 27 name.

Reserving Holdings, the dad or mum firm of Kayak and OpenTable, mentioned that July bookings shrank 22% in contrast with 2019 ranges, a steeper decline than June’s fall of 13%.

“Wanting inside Europe, we noticed reductions in room nights in July throughout a number of of our key international locations together with Germany, France and Italy,” Reserving CFO David Goulden mentioned on the corporate’s name on Wednesday.

Different corporations reported provide chain disruptions as Covid instances accelerated in Asia and Europe. For instance, railway operator Norfolk Southern mentioned that the delta variant is impacting its suppliers in Southeast Asia.

“We have got a few vegetation that supply elements from Southeast Asia and due to manufacturing points over there, they’ve needed to pull ahead deliberate manufacturing downtime later this yr,” Chief Advertising and marketing Officer Alan Shaw mentioned on the corporate’s July 28 name. “And in order that has had an affect on our manufacturing and our volumes proper now.”

The delta variant has additionally led some corporations to launch extra conservative forecasts, though most corporations mentioned that they didn’t anticipate one other spherical of lockdowns in the US.

Abiomed, a medical system maker, instructed analysts on its Thursday earnings name that the low finish of its full-year income forecast assumes “some continued unevenness” stemming from the variant, though the corporate raised the outlook.

Past Meat, which isn’t part of the S&P 500, mentioned that restaurant operators are being extra conservative about their meals orders due to the uncertainty attributable to the delta variant, in addition to labor challenges.

“And so for us, I feel the primary attribute of the third quarter, and our steerage is, is just lack of visibility,” CEO Ethan Brown mentioned Thursday.