In the early days of streaming, Netflix and Hulu promised an on-demand viewing experience with an ever-growing library of movies and TV shows, present

In the early days of streaming, Netflix and Hulu promised an on-demand viewing experience with an ever-growing library of movies and TV shows, presenting an alternative to the traditional cable bundle.

Today, consumers are cutting the cable cord, but also juggling streaming services, creating a fragmented and confusing experience — and perhaps generating a need for a streaming bundle.

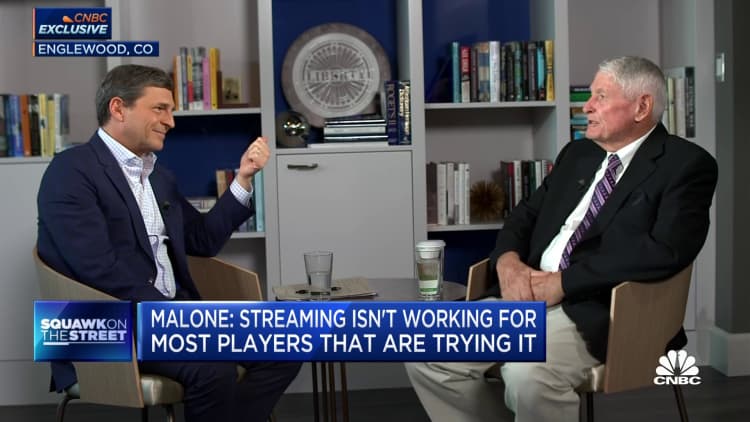

“It could certainly happen if one was focused on one type of demographic and the other, another type of demographic,” Liberty Media Chairman John Malone told CNBC’s David Faber in an interview that aired Thursday. “A Disney+ together with Max might be a pretty decent combination. You might also see sports-related or focused bundles.”

Malone, known in the industry as the “cable cowboy,” is on the board of Warner Bros. Discovery, the parent company of Max. He has previously talked about a future of streaming bundles. But the idea has taken on more urgency of late as media companies try to reach profitability with their direct-to-consumer offerings.

Sports streaming, as Malone noted, is a major piece of the puzzle. Streaming platforms such as YouTube TV, NBCUniversal’s Peacock and Amazon Prime have made the jump and paid the price to stream big-name sports, such as NFL Football. But, exclusive deals keep certain games walled off from those who don’t subscribe to the right streaming service.

For example, Amazon secured exclusive rights to NFL’s “Thursday Night Football” in 2021 for $1 billion a year until 2033. Last year, YouTube TV secured rights for NFL Sunday Ticket for $2 billion annually. Those who don’t subscribe to one or both of these services could be out of luck when trying to view games streamed under these exclusive deals.

“Broadcast continues to survive, but is under real pressure as Big Tech competes for sports,” Malone told CNBC. “The anomaly is that network neutrality creates this world in which Amazon can go buy ‘Thursday Night Football’ for multiples of what the industry has been paying — essentially choking the networks and forcing the distribution companies to spend a lot of money on expanding capacity rapidly.”

This month, Disney announced its plans to buy Comcast’s remaining one-third stake in Hulu. And next month, Disney will launch a combined app that will bundle Disney+ and Hulu content. Disney already offers a three-way bundle plan of Hulu, Disney+ and ESPN+, which Disney owns.

The company expects to roll out its direct-to-consumer ESPN offering, essentially the full channel available as a streaming option, in 2025, according to Disney CEO Bob Iger. “We obviously are planning to take ESPN out on a direct-to-consumer basis,” Iger told CNBC’s Julia Boorstin on Wednesday. “We feel great about that.”

Malone also touched on the potential for more cable-streaming bundles, reflecting the resolution of Disney’s spat with Spectrum parent Charter Communications. The companies’ agreement included ad-supported Disney+ and ESPN+ plans in some Spectrum offerings.

“The streaming version with ads will be part of the cable bundle,” Malone, a former Charter board member, told CNBC. “You could buy the stream of ESPN if you want, but why would you pay for it twice? I would much rather see the cable companies be distributors of streaming in bundles and packages, because the two are kind of tied to the hip.”

Warner Bros. Discovery declined to comment. Disney didn’t immediately respond to CNBC’s request for comment.

Disclosure: NBCUniversal is the parent company of CNBC.

www.cnbc.com

COMMENTS