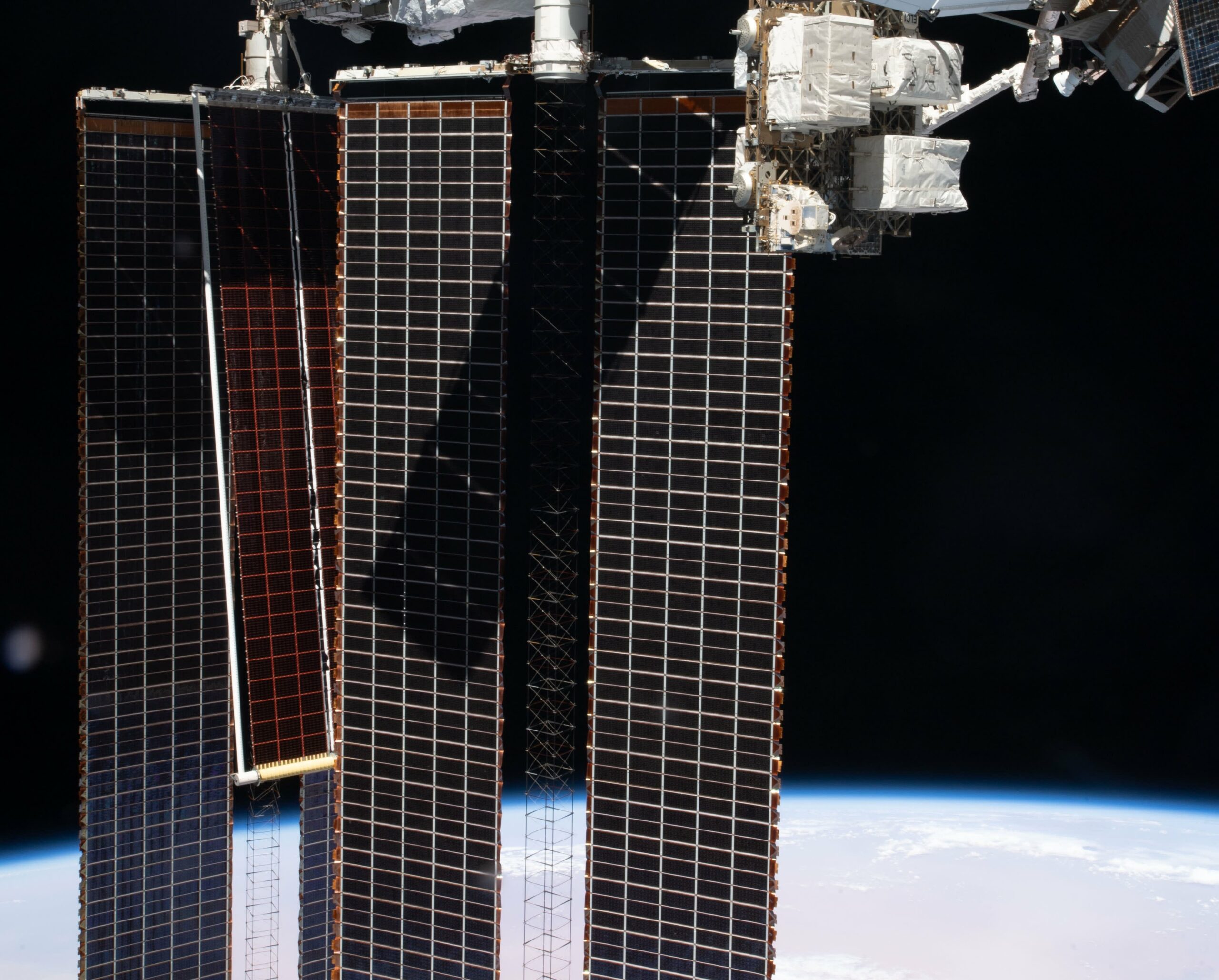

The brand new ISS Roll-Out Photo voltaic Array (iROSA) is deployed protecting a portion of the principle photo voltaic array on the Worldwide House

The brand new ISS Roll-Out Photo voltaic Array (iROSA) is deployed protecting a portion of the principle photo voltaic array on the Worldwide House Station

NASA’s Johnson House Heart

House infrastructure conglomerate Redwire started buying and selling on the New York Inventory Trade on Friday, becoming a member of a flurry of house corporations closing SPAC mergers and going public.

“We’re actually making an effort to get the message out above the broader SPAC noise that we’re a income constructive, money circulate constructive, very financially conservative and quickly rising firm,” Redwire chairman and CEO Peter Cannito advised CNBC.

Redwire, fashioned final 12 months by non-public fairness agency AE Industrial Companions, merged with particular function acquisition firm Genesis Park, and now trades underneath the ticker “RDW.”

Shares of Redwire surged as a lot as 20% in buying and selling from its earlier shut of $10.50.

Redwire is the sixth house firm this 12 months to shut a SPAC deal and go public – following AST & Science, Astra, Spire World, Momentus, and Rocket Lab. A number of more room corporations are anticipated to go public earlier than the top of the 12 months, with offers in progress by BlackSky, Satellogic, and Planet.

Cannito emphasised that merging with a SPAC “was only a handy mechanism for going public” for Redwire, coming with the good thing about including as a lot as $170 million in money from the deal. The merger valued Redwire at $675 million in fairness.

Redwire, which spent a lot of the previous 12 months buying and integrating seven house corporations into one, plans to make use of that money to proceed “artistic M&A” in addition to make “some inside investments” alongside the way in which, Cannito stated.

“We’ve a very thrilling pipeline of alternatives that we’re proper now,” Cannito stated.

He additionally emphasised that Redwire is “uniquely positioned from an funding perspective,” since it is a pure-play house inventory producing greater than $100 million in income a 12 months and money circulate constructive. Cannito referenced the ARKX House ETF, created by Cathie Wooden’s Ark Make investments, as debuting with out many “choices that might go into it.”

“We give traders on the market a possibility … to put money into the way forward for house with the corporate that has a conservative monetary place and, subsequently, endurance to be in it for the long term,” Cannito stated.

Partnerships and offers throughout the business

Redwire chief working officer Andrew Rush reveals former NASA administrator Jim Bridenstine a spacecraft mannequin of subsidiary Made In House.

Redwire House

Redwire’s imaginative and prescient is of supplying the “individuals dwelling and dealing in house” with the instruments and manufacturing wanted to develop the financial system in orbit and past, Cannito stated.

Redwire has 5 strategic focus areas: House commercialization, digitally engineered spacecraft, on-orbit providers and manufacturing, superior sensors and parts, and house area consciousness.

The corporate handed a lot of milestones since saying its intent to merge and go public.

The corporate’s iROSA photo voltaic arrays had been delivered by SpaceX to the Worldwide House Station. Additionally, Redwire despatched a brand new 3D-printer to house to show manufacturing with lunar floor materials, gained a Virgin Orbit contract to ship digital engineering options, signed an settlement with Sierra House for in-space providers, and introduced Firefly Aerospace as a lunar lander mission companion.

General, Redwire is offering {hardware} and providers for house infrastructure, which it estimates is at present a $15 billion market.

Change into a wiser investor with CNBC Professional.

Get inventory picks, analyst calls, unique interviews and entry to CNBC TV.

Signal as much as begin a free trial at present.

www.cnbc.com