Covid-related development charges are spiking. And it is not simply the virus. Just a few months in the past, The Wall Avenue Journal reported that

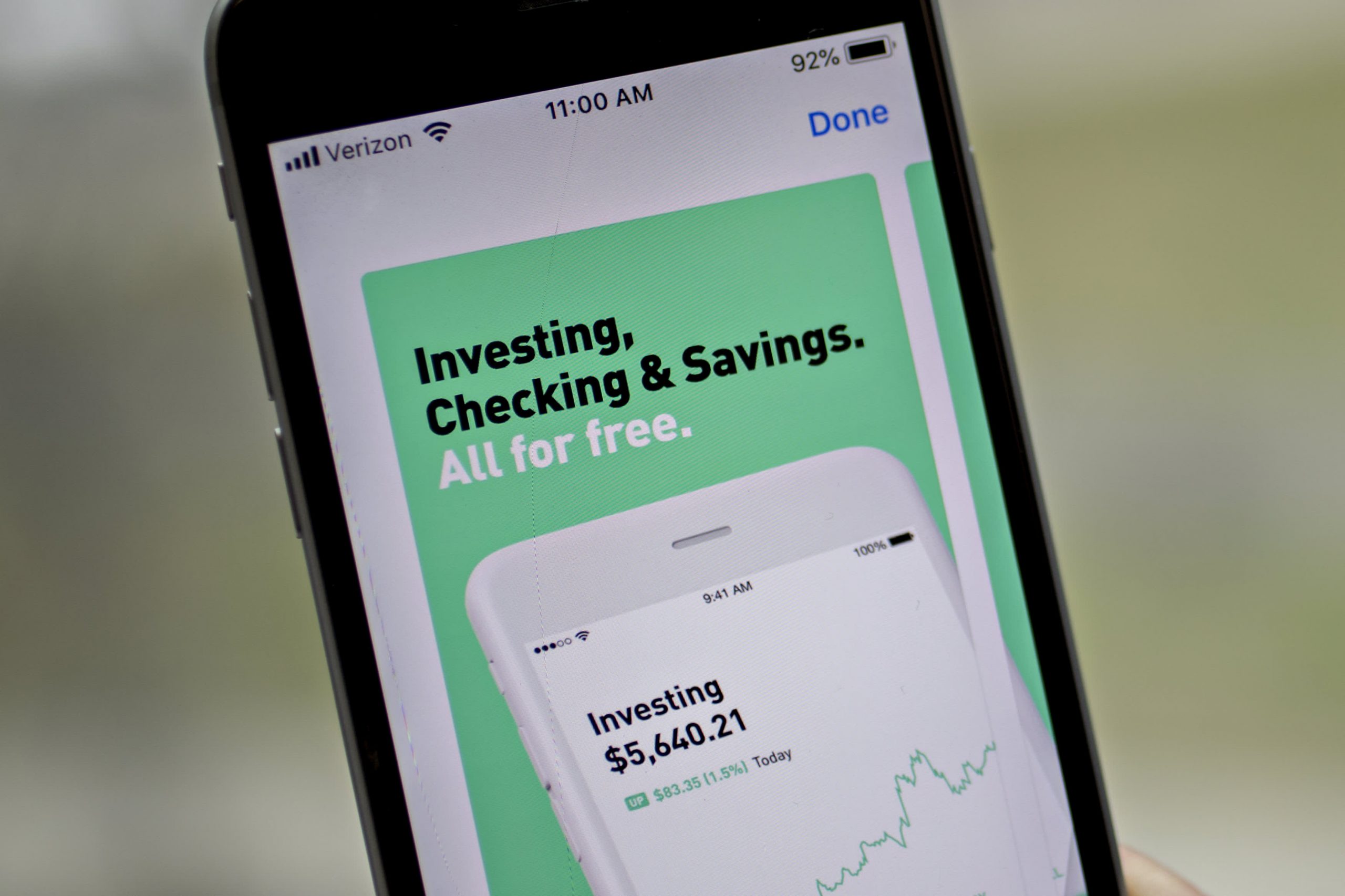

Covid-related development charges are spiking. And it is not simply the virus. Just a few months in the past, The Wall Avenue Journal reported that retail-investing volumes had climbed 30% on a year-over-year within the first half of 2020 to almost 20% of all trades. One younger consumer commented that “everybody and his uncle is buying and selling their accounts continually.”

It makes good sense. With so many individuals at residence and so few obtainable actions or distractions, buying and selling shares in an up-market, at zero commissions, has turn out to be the game of selection for hundreds of thousands of People. In keeping with an government at a really giant monetary service firm, which provides a cell buying and selling platform, third-quarter common each day quantity practically doubled over 2019 and the variety of new accounts skyrocketed.

Realizing the identification of inventory house owners has by no means been simple, however that effort is now muddied by the rise in wholesale or high-frequency buying and selling corporations corresponding to Citadel, who execute as much as 50% of whole each day quantity, each institutional and retail. In keeping with a number of business sources, particular person buying and selling has surged within the second half of 2020, to 25-30% of all shares.

Skilled traders, like my colleagues and me, get pleasure from an keen crowd of consumers within the shares we personal, serving to to push costs increased. What we hate, after all, is a stampede out of our giant holdings, flattening our good points and wreaking havoc. The query is whether or not the presence of this huge herd of mobile-app, quick-triggered market gamers ought to change how we make investments.

Figuring out the proper response entails analyzing a number of points of the retail investor image. Is that this a passing fancy or are they right here to remain? Definitely, the expertise (in your hand) and the value (zero) will proceed to be incentives. Nevertheless, the outcome (the market has rewarded most members since April) and the chance value (nothing else to do) will change. The market does, sometimes, go down, generally for longer than a month (I swear, that is true), and we all know there’ll finally be events, baseball video games, and concert events, to say nothing of actual job places.

In 2000, when the dot-com bubble burst, the resolve of retail traders was shaken however not shattered. That occurred on 9/11, and people fled the market till 2003. Ought to there be a few consecutive shocks to international markets of that magnitude, the retail investor may go into hibernation, however, in any other case, they appear right here to remain.

What are the shares people are inclined to commerce? The Robinhood 100 Most Common inventory record provides us a good suggestion. The record incorporates well-known development shares, together with Amazon, Alphabet, Microsoft, Nintendo, and Nike; comparatively new corporations which have burst into public consciousness on account of Covid-19 and present occasions, corresponding to Peloton, Virgin Galactic, and Catalyst Pharmaceutical; and small cap names I’ve by no means seen, that by some means seize the dealer world’s fancy by the Social Media-sphere, corresponding to Aphria and New Residential.

If the retail dealer is flooding in, and probably out, of the shares held by professionals, it is price understanding their relative significance. There may be a whole lot of obtainable details about the composition of an organization’s holders. For instance, we personal health-care tools maker Thermo Fisher in our 35-stock portfolio. Market information from FactSet, reveals that 91% of Thermo shares are owned by corporations outlined as “establishments” and eight.8% are held inside the “unknown” class, which generally alerts people. One other of our holdings, Mettler-Toledo, an instrumentation firm, has a tiny 1.4% “different” possession. Under 20% possession, the affect of day merchants would appear of restricted concern to institutional shareholders.

On the excessive reverse could be Novavax, a biotech firm that was vaulted into public consciousness by its foray into the Covid-19 vaccine panorama. The inventory was promoting at $Four in January and now trades at $139, with a Section three research ongoing in the UK.

Almost half of Novavax’s shares are doubtless held by retail house owners, FactSet information reveals. The entire market worth is about $8.9 billion, so institutional traders making an attempt to construct a Novavax place might be constrained by liquidity after which face a tidal wave of retail promoting on unhealthy information. Not surprisingly, Tesla’s unknown house owners account for 37.5% of the corporate, however greater than half of the floating shares, since Elon Musk holds 20% of the $538 billion company.

If we assume that retail shareholders usually tend to react positively or negatively to sentiment and information flashes than skilled traders, then it follows that shares with excessive “different” possession would exhibit higher common volatility. With sufficient time and information, we will analyze the correlation between a inventory’s Robinhood or different app’s rating and its value motion, beta, and different metrics.

Skilled traders want to pay attention to the “froth” probably embedded in essentially the most energetic retail names, which may evaporate when those self same consumers fall out of affection, like we noticed with Nikola. Nevertheless, we should always keep in mind a few essential issues.

First, shares finally transfer up and down based mostly on the potential and achievement of earnings, whatever the teams buying and selling shares on any given day. Second, the disruption in 2020 has been so dramatic, together with all the realm of retail buying and selling, that we shouldn’t be shocked by what emerges on this entrance within the post-vaccine world.

Karen Firestone is Chairman, CEO and co-founder of Aureus Asset Administration, an funding agency devoted to offering modern asset administration to households, people and establishments.