Merchants and monetary professionals work on the ground of the New York Inventory Change.Drew Angerer | Getty Pictures Information | Getty Pictures

Merchants and monetary professionals work on the ground of the New York Inventory Change.

Drew Angerer | Getty Pictures Information | Getty Pictures

Traders could also be simply too snug choosing particular person shares, and ignoring the macro dangers that might derail the rally and broadly hit the entire market’s names.

Citigroup strategists, in a be aware, stated they’re involved inventory pickers have change into overly assured. They stated the correlation between the highest 50 shares by market cap has dropped under 10%. That implies that fund managers have change into laser centered on particular person inventory tales and will not be too frightened about different looming dangers.

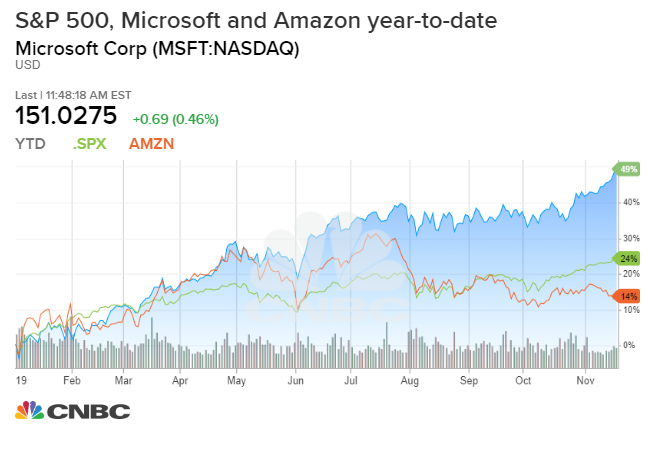

Take Microsoft, as an illustration. It’s the darling of hedge funds and mutual funds alike, and it has gained greater than 48% 12 months to this point, in contrast with the S&P 500’s 26%. Other favorites are not so correlated to Microsoft, and even the S&P 500. Alphabet is properly behind Microsoft’s good points and is up about 30%, whereas widespread title Amazon is up solely 16.4%.

“There’s nothing inherently improper with being a inventory picker however there’s motive to fret when nearly everybody thinks they’re good at selecting the profitable equities when previous proof suggests in any other case,” wrote the strategists, led by Citigroup’s chief U.S. fairness strategist, Tobias Levkovich.

Then again, when correlations are very excessive, that’s related to broad sell-offs…