Nick Schommer, Janus HendersonSupply: Janus Henderson(This story is a part of the Weekend Temporary version of the Night Temporary e-newsletter. To

Nick Schommer, Janus Henderson

Supply: Janus Henderson

(This story is a part of the Weekend Temporary version of the Night Temporary e-newsletter. To enroll in CNBC’s Night Temporary, .)

Being a contrarian could make somebody seem to be a genius or idiotic. For Nick Schommer, it has been the previous this 12 months.

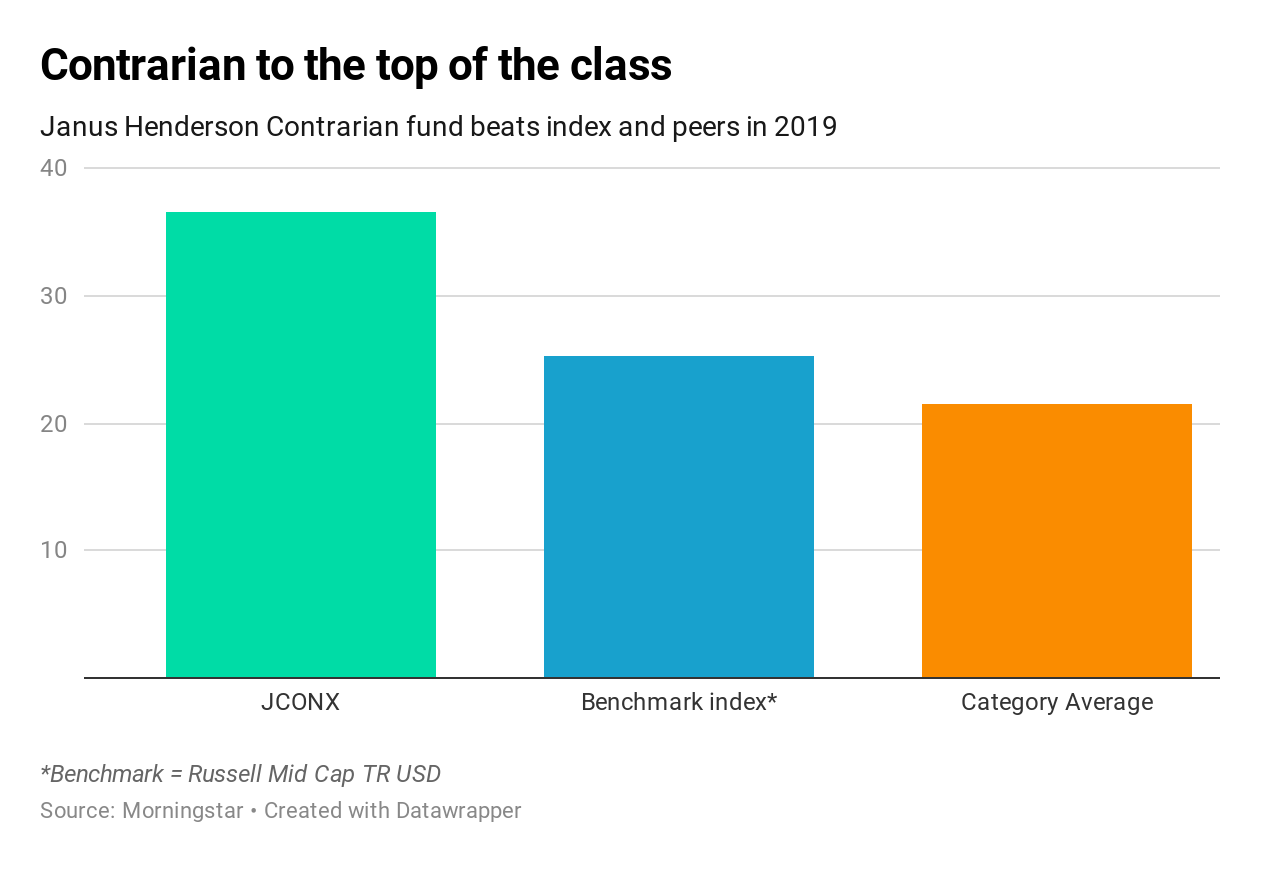

Schommer manages the Janus Henderson Contrarian I (JCONX) fund, which has practically $three billion in property and has been on hearth in 2019. The fund is up practically 37% 12 months up to now and ranks within the prime percentile amongst its friends, Morningstar knowledge exhibits. It is efficiency outpaces the U.S. Fund Mid-Cap Mix class common by greater than 15 share factors.

This staggering outperformance is a byproduct of enormous bets on shares equivalent to Crown Holdings, an organization that makes aluminum cans. Schommer additionally added Disney to the portfolio when the inventory was buying and selling close to its 2019 lows. He additionally has positions different robust performers equivalent to Liberty Media Formula One and PagSeguro Digital, a Brazilian funds firm.

“We’re trying to put money into sturdy companies that are buying and selling at a big low cost to what we predict their truthful worth is,” stated Schommer. “We wish that intrinsic worth as a enterprise to develop over time and we wish administration groups which might be aligned with us as shareholders.”

Schommer says he tries to seek out corporations with “misunderstood enterprise fashions” to…