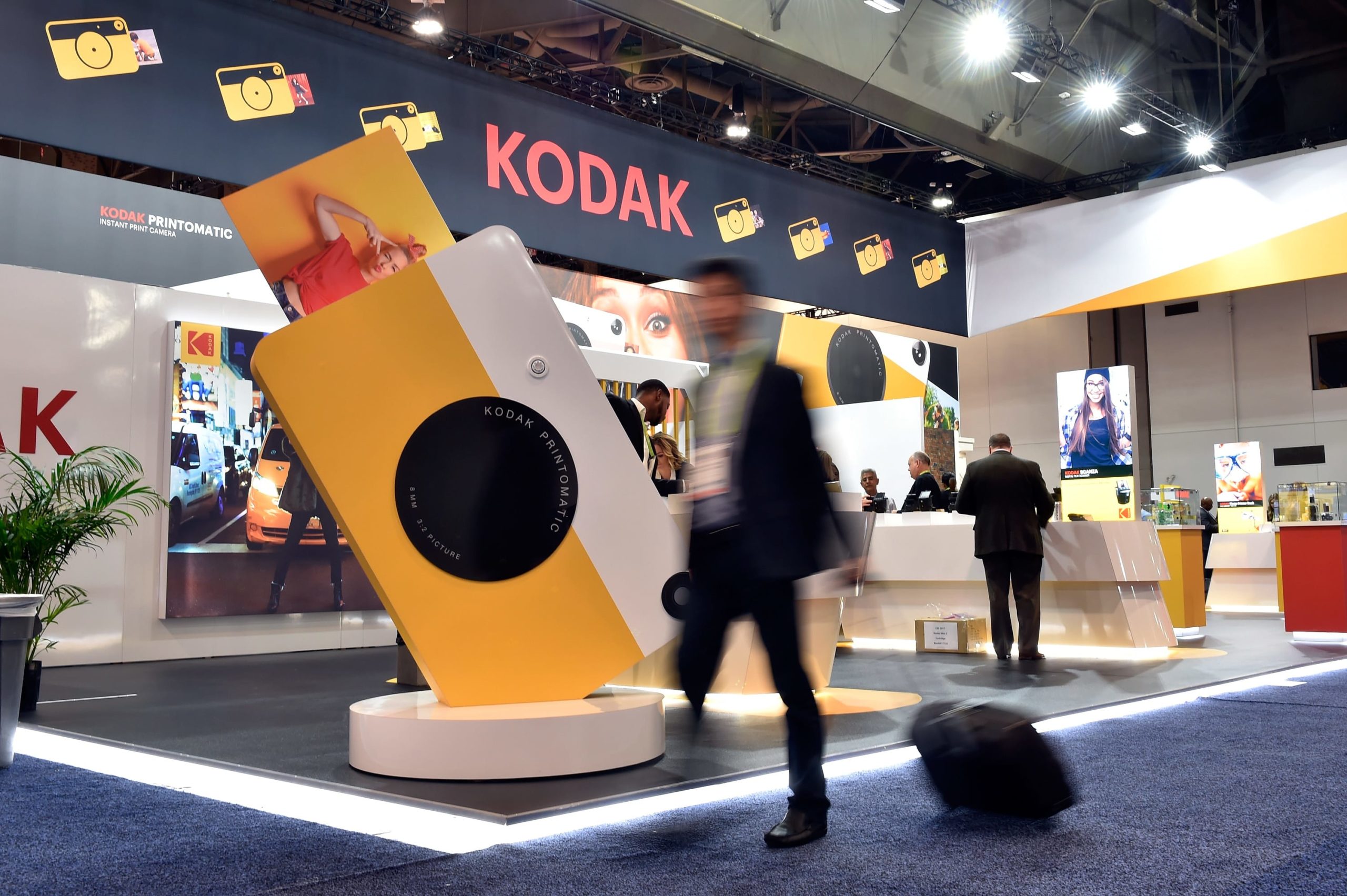

Utilizing a gradual shutter velocity an attendee is blurred as he walks by the Kodak sales space throughout CES 2018 on the Las Vegas Conference Mi

Utilizing a gradual shutter velocity an attendee is blurred as he walks by the Kodak sales space throughout CES 2018 on the Las Vegas Conference Middle on January 10, 2018 in Las Vegas, Nevada.

David Becker | Getty Pictures

Shares of Eastman Kodak plunged greater than 40% throughout premarket buying and selling on Monday after a federal company stated it was reviewing a beforehand introduced $765 million mortgage for the onetime images pioneer to supply drug elements.

“Latest allegations of wrongdoing elevate critical considerations. We is not going to proceed any additional until these allegations are cleared,” the U.S. Worldwide Improvement Finance Company stated in a tweet Friday.

The evaluation of funding comes because the Securities and Alternate Fee is reportedly investigating how the corporate disclosed the take care of the federal government, in keeping with a report from The Wall Road Journal. The probe can be reportedly reviewing inventory choices that have been granted to government chairman James Continenza forward of the announcement.

The inventory has been on a wild journey for the reason that funding was introduced on Tuesday, July 28. However buying and selling exercise picked up the day earlier than the official announcement, which raised some eyebrows on the Road.

The day earlier than the deal was introduced the inventory jumped 25%, and noticed 1,645,719 shares alternate fingers, far surpassing the typical every day buying and selling quantity of 236,479 for the 12 months prior, in keeping with knowledge from FactSet.

Because the information of the deal broke, Kodak, which had been buying and selling round $2.60, skyrocketed. Inside two days, the inventory was buying and selling at $60. Within the span of simply 24 hours, greater than 100,000 traders added the inventory to their account on Robinhood, an app in style with millennial traders, in keeping with knowledge from Robintrack. The inventory was so unstable the day after the announcement that it was halted 20 instances through the session.

Sen. Elizabeth Warren, D-Mass., has known as on the SEC to look into buying and selling that occurred earlier than the Trump administration’s public announcement of the take care of Kodak.

“There have been a number of cases of surprising buying and selling exercise previous to the announcement, elevating questions on whether or not a number of people might have engaged in insider buying and selling or within the unauthorized disclosure of fabric, nonpublic info concerning the forthcoming $765 million mortgage awarded underneath the Protection Manufacturing Act,” Warren wrote in an open letter.

Subscribe to CNBC PRO for unique insights and evaluation, and dwell enterprise day programming from world wide.