Merchants and monetary professionals work on the ground of the New York Inventory Trade (NYSE) on the opening bell on October 3, 2019 in New York M

Merchants and monetary professionals work on the ground of the New York Inventory Trade (NYSE) on the opening bell on October 3, 2019 in New York Metropolis.

Drew Angerer | Getty Photos

An uncommon development within the inventory market emerged lately as the newest signal that maybe greed is the driving pressure behind the rally and traders are ignoring some key dangers.

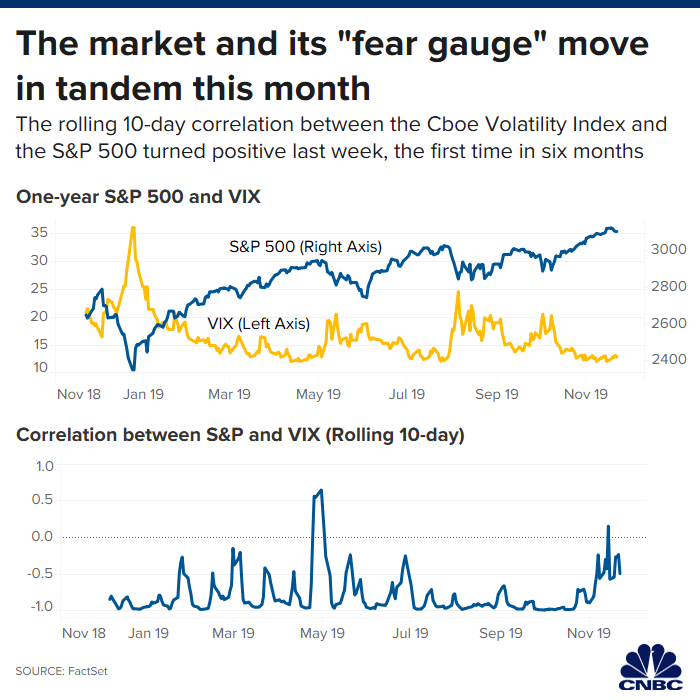

Wall Avenue’s “worry gauge” the Cboe Volatility Index, which generally trades inversely with inventory costs, began transferring in tandem at occasions with the S&P 500 earlier this month. The rolling 10-day correlation between the VIX and the S&P 500 turned constructive on Nov. 14, the primary time this has occurred in six months, based on FactSet.

“When this correlation, and like many others lately, get out of whack would indicate that one thing else is driving inventory costs,” Roberto Friedlander, head of power buying and selling at Seaport International, mentioned in a word on Thursday.

The so-called VIX is a measure of the inventory market’s 30-day anticipated volatility computed from the market costs of the decision and put choices on the S&P 500. When the market goes down, traders would need to buy insurance coverage, which drives up the costs of put choices and will increase the VIX. The VIX decreases when there’s much less demand for put choices because the market rises. That is why it tends to maneuver inversely to equities.

The worry gauge can be flirting…