Kenneth Fisher, chief government officer of Fisher Investments, speaks on the Forbes World CEO Convention in Sydney, Australia, on Tuesday, Sept. 2

Kenneth Fisher, chief government officer of Fisher Investments, speaks on the Forbes World CEO Convention in Sydney, Australia, on Tuesday, Sept. 28, 2010.

Gillianne Tedder | Bloomberg | Getty Photographs

It stays to be seen how lengthy different purchasers will keep on with billionaire cash supervisor Ken Fisher within the wake of off-color and sexist feedback he lately made at an investing convention.

Near $1 billion in public pension belongings have left Camas, Washington-based Fisher Investments to this point, together with the Boston Retirement System with $248 million in belongings and $600 million the State of Michigan says it is withdrawing.

Philadelphia’s board of pensions additionally stated it will transfer the $54 million it has with Fisher.

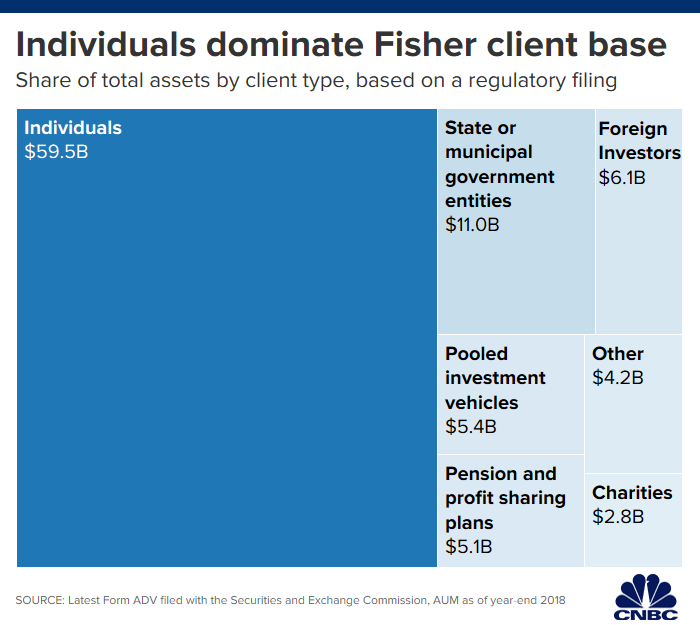

Whereas government-run pension funds make up a comparatively small quantity of the general belongings managed at Fisher Investments, $10.9 billion from 36 entities, based on the agency’s regulatory submitting with the Securities and Change Fee, how they reply could also be a bellwether for different purchasers of the agency, business specialists say.

In all, Fisher had $94 billion in belongings beneath administration as of Dec. 31, 2018, based on their SEC submitting. That determine reached $112 billion as of Sept. 30, 2019, based on the agency.

The velocity with which pensions moved belongings from the cash supervisor stunned even attorneys who concentrate on retirement…