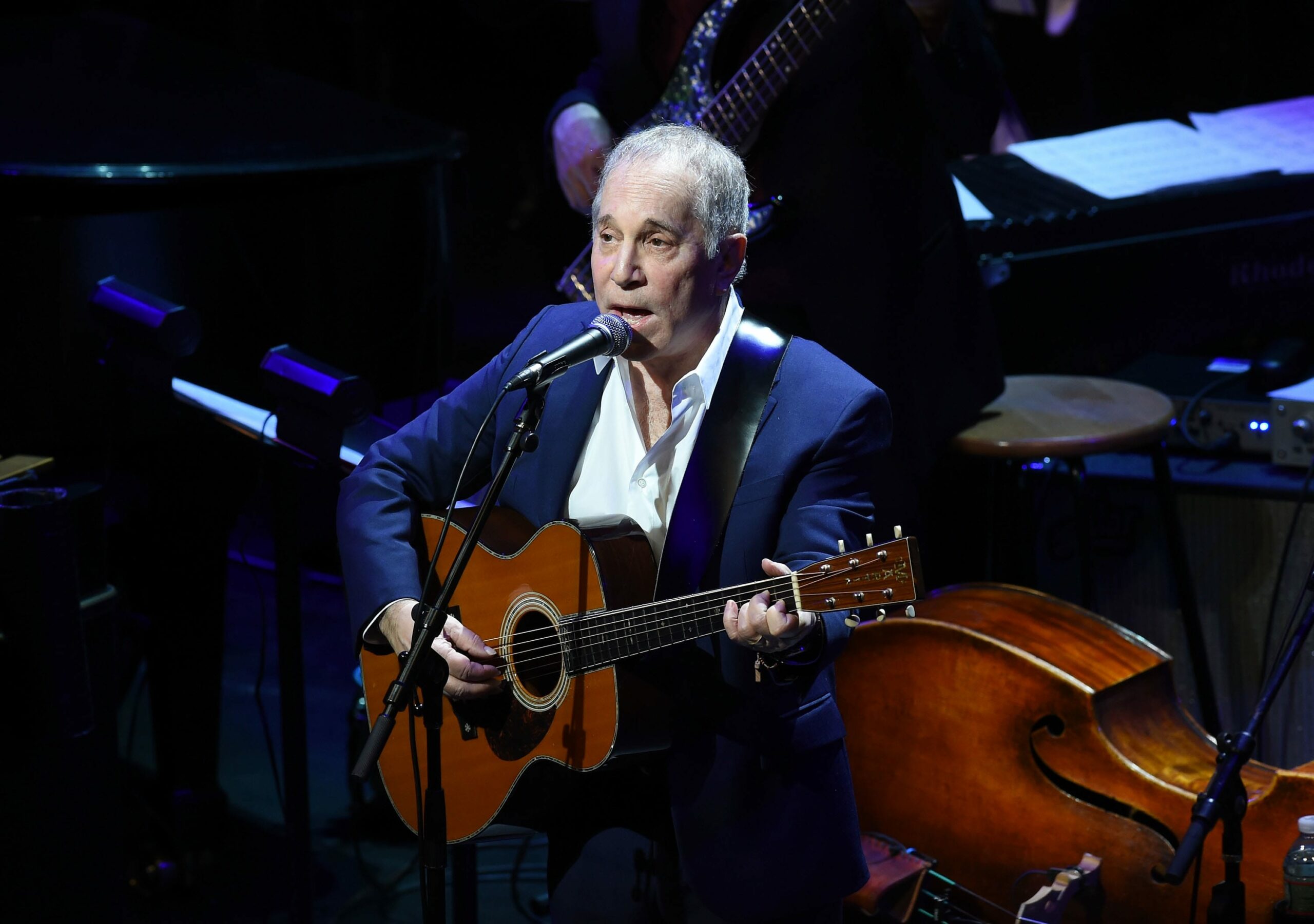

Paul Simon performs onstage throughout The Nearness Of You Profit Live performance at Frederick P. Rose Corridor, Jazz at Lincoln Heart on January

Paul Simon performs onstage throughout The Nearness Of You Profit Live performance at Frederick P. Rose Corridor, Jazz at Lincoln Heart on January 20, 2015 in New York Metropolis.

Ilya S. Savenok | Getty Photos Leisure | Getty Photos

From Bob Dylan plugging in his electrical guitar for the primary time to Tremendous Bowl commercials, there have all the time been moments in music historical past when essentially the most die-hard followers will accuse their idols of doing the unthinkable: promoting out. However proper now “‘promoting out” has a brand new connotation, and it’s a increase marketplace for each buyers and famous person recording artists.

A wave of boomer rock icons are promoting out of their music catalogs. The strikes, the newest of which was made by Paul Simon final week, level to a simple reality concerning the intersection of artwork and cash: Music has all the time been a enterprise, and one the place artistic genius deserved to be rewarded with riches. And it’s a enterprise that proper now could be seeing main modifications brought on by streaming, and additional disruptions brought on by the pandemic. The offers from Paul Simon, Bob Dylan, Neil Younger (in Younger’s case a 50% stake) and Stevie Nicks (80% of the rights to her songs), spotlight main traits within the leisure business, capital markets and wealth administration.

Music publishing corporations like Hipgnosis Songs Fund and Main Wave Music, and conglomerate gamers like BMG, Sony, Warner Music Group and Vivendi’s Common Music Group, are shopping for up premier music catalogs in massive offers fueled by file low rates of interest with the idea there might be extra profitable returns sooner or later from promoting the rights to these songs throughout leisure platforms.

Document low charges gas music offers

Larry Mestel, CEO of Main Wave Music, the corporate that simply acquired a majority stake within the catalog of two-time Rock and Roll Corridor of Fame inductee, Stevie Nicks, advised CNBC the financial setting that the Coronavirus pandemic has created has labored in favor of corporations seeking to buy massive property. These low rates of interest make it simpler to borrow cash, and excessive charges of return have created an ideal alternative for acquirers.

“You are speaking a few low rate of interest setting and you may obtain a 7% to 9% … after which improve that by means of advertising and marketing and generate mid-teen returns. That is a really engaging place for folks to place cash,” he stated.

Music catalogs even have confirmed to be recession-proof, and the pandemic has solely heightened the quantity of offers being made because the music business goes by means of an enormous disruption brought on by the shutdown of dwell venues and touring.

Streaming music’s rise

The offers additionally come at a time when streaming music — for all of its controversy and skepticism on the a part of the musicians themselves about getting a uncooked deal — has proved to be an financial juggernaut, at the least for the file corporations. In 2020, Goldman Sachs forecast that world music income would attain $142 billion by the top of the last decade, reflecting an 84% improve when in comparison with the 2019 degree of $77 billion and streaming seize 1.2 billion customers by 2030, 4 instances its 2019 degree, and primarily benefiting corporations like Sony, which purchased Simon’s catalog, and Common, which acquired Dylan’s songs.

World streaming music income hit an all-time excessive as share of the business final 12 months (83% in line with a current report) and it favors the superstars, too. Spotify has stated its mission is “giving 1,000,000 artistic artists the chance to dwell off their artwork,” however as a current New York Instances evaluation famous, Spotify’s information exhibits solely about 13,000 generated $50,000 or extra in funds final 12 months.

It is not simply streaming, although. The rights to greater acts catalogs, as soon as acquired, can be utilized in sync placements that license music throughout numerous types of media, together with movie, tv exhibits, ads, and video video games.

“From a writer’s perspective, this can be very precious to acquire the rights to a sure catalog that we are able to pitch for synch,” stated Rebecca Valice, copyright and licensing supervisor at PEN Music Group. “A catalog can do its personal pitching simply due to its legendary success.”

Valuing rock icons

The extra recognizable a catalog is, the extra precious it turns into for corporations to buy and use in films or tv. The perfect catalogs “pay for themselves” over time, she says, as synch helps recoup the cash acquirers spent “after which some as time goes on.”

“I do consider that the icons and legends are value greater than the opposite artists,” Mestel stated. Main Wave owns the catalogs of stars like Whitney Houston, Ray Charles, and Frankie Valli and the 4 Seasons.

Some well-known musicians of the boomer period have lashed out on the scenario the business has positioned them in, equivalent to David Crosby, who stated in a tweet in December, ” I’m promoting mine additionally … I can not work … and streaming stole my file cash … I’ve a household and a mortgage and I’ve to care for them so it is my solely choice … I am positive the others really feel the identical.”

He bought his whole catalog to Irving Azoff’s Iconic Artists Group in March, which had additionally lately acquired a controlling stake in The Seashore Boys’ mental property, together with a portion of the music catalog.

“Given our present lack of ability to work dwell, this deal is a blessing for me and my household and I do consider these are the most effective folks to do it with,” Crosby stated in an announcement saying the deal.

Boomer era estate-planning

For the musicians themselves, there’s a mega pattern at work: the estate-planning wants of America’s wealthiest era. Boomer musicians (and people born simply on the cusp of that era’s begin like Simon and Dylan in 1941), similar to their followers, are getting old. “Artists are getting older now to allow them to use money, they will property plan,” Mestel says.

In fact, the draw back will be lack of management over an artist’s most valuable asset: the artistic genius that made their careers.

“These getting old rock stars could wish to money out to supply for his or her estates … however you lose management of your model and your legacy, to some extent, relying on what protections you place in place as a part of the deal,” stated John Ozszajca, musician and founding father of Music Advertising and marketing Manifesto, an organization that teaches musicians the way to promote and market their music.

Crosby and Azoff have been buddies for a very long time, some extent Azoff made within the launch saying the deal.

It looks like anyone that has a relationship within the music enterprise that is aware of anyone is making an attempt to boost cash.

Larry Mestel

Main Wave Data CEO

Some followers aren’t too comfortable about listening to hits like Nicks’ “Fringe of Seventeen” or Dylan’s “Like a Rolling Stone” promoting vehicles and garments — although Dylan has completed a number of Tremendous Bowl commercials courting again a few years for GM and IBM, and his songs have been featured alone in others — however the choices to promote catalogues also can assist musicians keep away from posthumous authorized battles just like the estates of Tom Petty, Prince, and Aretha Franklin needed to endure.

BMG acquired the catalog pursuits of Nicks’ bandmate, Mick Fleetwood, of Fleetwood Mac early this 12 months and famous some stats in its announcement that present that as outdated as boomer acts could also be, they will get renewed life from viral streaming hits. The Fleetwood Mac music ‘Desires’ generated over 3.2 billion streams globally (throughout an eight-week interval September 24 to November 19, 2020) because of a video with a cranberry juice-loving fan, and launched a brand new era, extra accustomed to TikTok, to Fleetwood Mac. The band’s album “Rumours” reached No. 6 on Billboard’s Streaming Songs chart 43 years after its launch.

Dylan’s deal is the largest reported up to now, estimated at $300 million although no sale worth was formally disclosed and Common solely stated in a launch it was “essentially the most important music publishing settlement this century.”

Mestel believes the increase is not nearing an finish.

“It looks like anyone that has a relationship within the music enterprise that is aware of anyone is making an attempt to boost cash. However that does not imply that they will exit an determine property to promote and even know what they’re doing.”

BMG and personal fairness big KKR lately signed a deal to exit and make a serious musical rights acquisition, and as one govt advised Rolling Stone, “We’re not chasing hits from January 2021. We’re taking a look at repertoire that is proved itself about being a part of our lives.”

KKR has been in on massive music offers previously, and the pattern of shopping for rights shouldn’t be new, however the present increase is notable, and matches inside the asset class appreciation going down throughout so many components of the market as buyers search extra methods to place their cash to work. Whereas the boomer offers are the largest headlines, current acts are seeing massive paydays as effectively. Earlier this 12 months, KKR purchased a stake within the catalog of OneRepublic’s Ryan Tedder for a reportedly excessive sum.

Corporations like Main Wave are working with artists like Nicks to try to preserve them as a part of the deal, and make that deal even higher for them sooner or later, in line with Mestel, who says many did not perceive that they might enter right into a partnership, promote a bit of their catalog, and that piece doubtlessly turn into extra precious sooner or later than the 100% they owned earlier than.

“If all goes effectively, [artists] get essentially the most out of what they’re making an attempt to promote it for, and it is often a win-win situation for the client and the vendor,” Valice stated.