On the afternoon of Feb. 24, President Trump declared on Twitter that the coronavirus was “very a lot underneath management” in the USA, one in all

On the afternoon of Feb. 24, President Trump declared on Twitter that the coronavirus was “very a lot underneath management” in the USA, one in all quite a few rosy statements that he and his advisers made on the time in regards to the worsening epidemic. He even added an commentary for traders: “Inventory market beginning to look superb to me!”

However hours earlier, senior members of the president’s financial workforce, privately addressing board members of the conservative Hoover Establishment, have been much less assured. Tomas J. Philipson, a senior financial adviser to the president, advised the group he couldn’t but estimate the consequences of the virus on the American financial system. To some within the group, the implication was that an outbreak might show worse than Mr. Philipson and different Trump administration advisers have been signaling in public on the time.

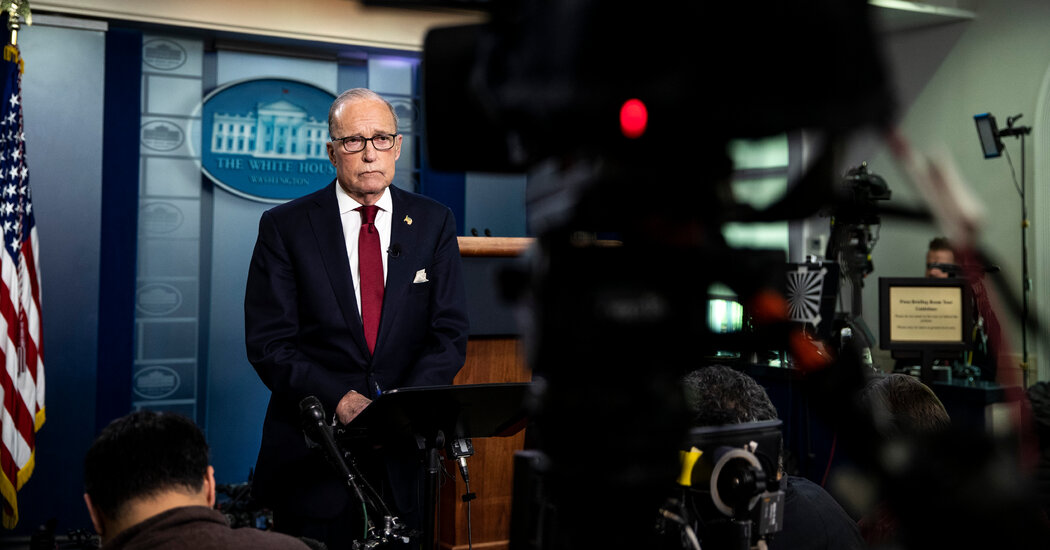

The following day, board members — a lot of them Republican donors — bought one other style of presidency uncertainty from Larry Kudlow, the director of the Nationwide Financial Council. Hours after he had boasted on CNBC that the virus was contained in the USA and “it’s fairly near hermetic,” Mr. Kudlow delivered a extra ambiguous non-public message. He asserted that the virus was “contained within the U.S., so far, however now we simply don’t know,” in keeping with a doc describing the periods obtained by The New York Instances.

The doc, written by a hedge fund marketing consultant who attended the three-day gathering of Hoover’s board, was stark. “What struck me,” the marketing consultant wrote, was that just about each official he heard from raised the virus “as some extent of concern, completely unprovoked.”

The marketing consultant’s evaluation rapidly unfold by way of components of the funding world. U.S. shares have been already spiraling due to a warning from a federal public well being official that the virus was prone to unfold, however merchants noticed the speedy significance: The president’s aides gave the impression to be giving rich celebration donors an early warning of a probably impactful contagion at a time when Mr. Trump was publicly insisting that the menace was nonexistent.

Interviews with eight individuals who both acquired copies of the memo or have been briefed on elements of it because it unfold amongst traders in New York and elsewhere present a glimpse of how elite merchants had entry to data from the administration that helped them achieve monetary benefit throughout a chaotic three days when world markets have been teetering.

The memo was sometimes breathless and inchoate. It seems to have overstated the gravity of some administration officers’ warnings to the group and included dire projections from the Facilities for Illness Management and Prevention, with out clear attribution, that don’t seem to have come from the gathering. The Instances is publishing solely the passages from the memo whose accuracy it has independently confirmed.

However the memo’s overarching message — {that a} devastating virus outbreak in the USA was more and more prone to happen, and that authorities officers have been extra conscious of the menace than they have been letting on publicly — proved correct.

To most of the traders who acquired or heard in regards to the memo, it was the primary important signal of skepticism amongst Trump administration officers about their means to comprise the virus. It additionally supplied a touch of the fallout that was to come back, mentioned one main investor who was briefed on it: the upending of each day life for the complete nation.

“Brief all the pieces,” was the response of the investor, utilizing the Wall Avenue time period for betting on the concept that the inventory costs of corporations would quickly fall.

That investor, and a second who was briefed on the Hoover conferences, mentioned that elements of the readout from Washington knowledgeable their buying and selling that week, in a single case including to present brief positions in a means that amplified his earnings. Different traders, upon studying or listening to in regards to the memo, stocked up on bathroom paper and different family necessities.

The memo was written by William Callanan, a hedge fund veteran and member of the Hoover board. A analysis establishment at Stanford College that research the financial system, nationwide safety and different points, Hoover has been directed since September by Condoleezza Rice, the secretary of state underneath President George W. Bush. Its board contains the media mogul Rupert Murdoch and the enterprise capitalist Mary Meeker, neither of whom attended the conferences in February, which have been a collection of casual, off-the-record discussions with Trump administration officers and Republican lawmakers.

Mr. Callanan described the Hoover briefings in a prolonged electronic mail he wrote to David Tepper, the founding father of the well-known hedge fund Appaloosa Administration, and one in all his senior lieutenants in regards to the stage of concern amongst American officers over the unfold of the virus domestically. Within the electronic mail, he additionally touched on how ill-prepared well being companies gave the impression to be to fight a pandemic.

Inside Appaloosa, the e-mail circulated amongst staff, who in flip briefed no less than two exterior traders on the extra worrisome components of Mr. Callanan’s electronic mail, in keeping with individuals who acquired these briefings.

These traders in flip handed the knowledge to their very own contacts, finally delivering elements of the readout to no less than seven traders in no less than 4 money-management corporations across the nation inside 24 hours. By late afternoon on Feb. 26, the day the e-mail bounced from Appaloosa to different buying and selling corporations, U.S. inventory markets had fallen near 300 factors from their excessive the earlier week.

Mr. Tepper, who can also be the proprietor of the N.F.L. workforce the Carolina Panthers, was one of many first distinguished cash managers to sign concern over Covid-19 in the USA.

Throughout an interview at a Tremendous Bowl occasion in Miami on Feb. 1, Mr. Tepper described the virus as a potential “sport changer,” saying that traders wanted to be “cautious” till extra was identified about its attain. Many traders regarded his remarks, broadcast on CNBC on Feb. 3, as bearish — purpose to both promote funding positions or brief the general market.

Three weeks later, Mr. Callanan’s readout appeared to validate Mr. Tepper’s warning.

“I simply left D.C. and needed to answer to your query ASAP,” Mr. Callanan wrote to Mr. Tepper and one in all his senior lieutenants in an electronic mail on Feb. 25. “Should you can preserve the feedback beneath confidential, I might be grateful.”

From there, Mr. Callanan reported that quite a few Trump administration officers — Mr. Kudlow, Secretary of State Mike Pompeo and economists on the Council of Financial Advisers, who had given the presentation on the White Home on Feb. 24 — expressed a better diploma of alarm in regards to the coronavirus than the administration was saying publicly. He additionally mentioned he had a gathering with a Democratic senator, though it’s unclear which lawmaker he met.

At about the identical time, Mr. Callanan additionally knowledgeable no less than one in all his shoppers, a rich non-public investor, of the extra notable elements of the Hoover briefing, together with that Mr. Kudlow signaled extra concern over the impact of the virus in the USA to the Hoover group than he had earlier on CNBC.

In an announcement, Mr. Callanan mentioned his electronic mail to Mr. Tepper contained “private {and professional} views primarily based on intensive analysis and publicly accessible data,” displaying his “concern on the worldwide pandemic that was rising.” The e-mail was shared with others with out his information or consent, he mentioned, including {that a} copy of it supplied to him by The Instances to reply questions on it was “materially totally different” from its unique kind. He declined to elucidate how.

He famous that the e-mail was a mix of his observations from a go to to Washington and his personal evaluation, and that the C.D.C. outbreak projections have been drawn from estimates already circulating within the public area. The request for confidentiality, he added, was essential as a result of the e-mail’s recipients weren’t sure to consumer restrictions supposed to guard his mental property.

Mr. Tepper initially denied receiving Mr. Callanan’s message, then acknowledged in a later interview that he almost certainly acquired the e-mail however that it was not memorable.

“We have been within the data move on Covid at that time,” Mr. Tepper mentioned of late February. “As a result of we have been so public about this warning, folks have been calling us presently.” He mentioned that Appaloosa already had its bearish place in place on Feb. 23, when the Hoover gathering started.

By then, some high Trump administration officers have been already predicting an impending catastrophe. On Feb. 23, Peter Navarro, one of many president’s financial advisers, distributed a memorandum predicting that the virus might have an effect on as many as 100 million Individuals and kill as much as 2 million of them.

He warned that the nation was unprepared for a pandemic, arguing that an emergency funding request to Congress for private protecting tools and different measures to mitigate the unfold of the virus have been wanted.

In a e-book printed final month, the journalist Bob Woodward revealed that Mr. Trump advised him on Feb. 7 that the novel coronavirus “goes by way of the air” and is “extra lethal than even your strenuous flus” — the alternative of what the president was saying publicly.

On Feb. 24, the White Home requested lawmakers for $2.5 billion in extra funding. That afternoon, the Hoover group traveled to the White Home grounds for a panel dialogue with members of the Council of Financial Advisers. That speak struck some viewers members as worrying for the financial system, in keeping with Mr. Callanan’s memo and interviews with three individuals who have been there. Of specific observe, one of many folks mentioned, was the reluctance of Mr. Philipson, the council’s appearing chair, to estimate the potential impact of the virus on American financial progress for the yr, provided that the scenario was nonetheless unfolding.

Mr. Philipson confirmed that he had conveyed a message to that impact, although he couldn’t recall specifics. That morning, he had advised the Nationwide Affiliation for Enterprise Economics in a public gathering that the Trump administration was taking a “wait-and-see strategy” to the virus and famous that manufacturing shutdowns in China have been prone to have an effect on the American financial system. He mentioned that the potential financial results, nevertheless, had “been exaggerated.”

At noon on Feb. 25, a high official from the C.D.C. gave the primary public glimpse of inside authorities assessments in regards to the potential unfold of the virus, and it was bracing.

“It’s not a lot a query of if this can occur anymore, however relatively extra a query of precisely when this can occur,” Dr. Nancy Messonnier advised reporters.

Shortly after, Mr. Kudlow made his “hermetic” feedback on CNBC, including that the virus wouldn’t be “an financial tragedy.” Two hours after that, nevertheless, his Hoover presentation struck Mr. Callanan as backpedaling.

Mr. Kudlow “revised his assertion in regards to the virus being contained,” Mr. Callanan wrote to Mr. Tepper, saying “we simply don’t know” whether or not it was on the time — whilst Mr. Kudlow continued to downplay its penalties to the non-public viewers. Mr. Kudlow “did add that he has really helpful to the president a interval of ‘tariff tranquillity,’ as markets don’t want extra uncertainty now.”

Mr. Kudlow confirmed making each assertions on the Hoover assembly, including that in his thoughts, they have been primarily the identical as his remarks on CNBC. “There was by no means any intent on my half to misinform,” he mentioned, noting that the variety of recognized Covid-19 instances in the USA on the time was not more than 20, and that he had anticipated journey restrictions to restrict additional unfold.

The nationwide case depend on the time was 17, in keeping with a Instances database; as well as, greater than three dozen American cruise ship passengers had confirmed infections.

The Hoover Establishment has shut relations with the Trump administration, and the White Home has pulled from its ranks to fill high positions. Joshua D. Rauh, one of many White Home economists addressing the Hoover crowd on Feb. 24, has returned to the establishment, the place he labored beforehand. Kevin Hassett, who moderated the panel and has served because the chairman of the White Home Council of Financial Advisers, is now a Hoover Establishment fellow.

Dr. Scott W. Atlas, a Hoover fellow and Stanford professor identified for his unorthodox positions on encouraging “herd immunity,” was named to Mr. Trump’s coronavirus process pressure in August.

Mr. Callanan spoke to Dr. Atlas one-on-one on the Hoover gathering in February, mentioned an individual who attended the conferences. In response to Mr. Callanan’s message to Appaloosa, a Hoover well being care fellow and former official of Stanford’s medical college knowledgeable him that San Francisco’s choice to declare a state of emergency when hundreds of individuals have been self-quarantining within the Bay Space was an indication that the federal government there foresaw a severe disaster. The particular person on the conferences recognized Dr. Atlas as Mr. Callanan’s supply.

Dr. Atlas didn’t reply to requests for remark.

The federal government is investigating monetary transactions made in early February — earlier than the market spiraled — by Senator Richard Burr, Republican of North Carolina, who was compelled to step apart because the chairman of the Senate Intelligence Committee in Could over the inquiry.

Mr. Burr bought inventory after he acquired authorities briefings in regards to the looming well being and financial disaster from the pandemic. The senator has denied wrongdoing.

However authorized specialists say the briefings by administration officers are a really totally different scenario, and it isn’t obvious that any of the communications in regards to the Hoover briefings violated securities legal guidelines. The Justice Division and the Securities and Change Fee would have a number of hurdles to clear earlier than establishing that Appaloosa or different funds that acquired insights from Mr. Callanan, both straight or by way of intermediaries, acted improperly.

Kitty Bennett contributed analysis.