WASHINGTON — The Biden administration and prime Democrats in Congress started detailing plans for vital adjustments to how the USA and different na

WASHINGTON — The Biden administration and prime Democrats in Congress started detailing plans for vital adjustments to how the USA and different nations tax multinational firms as they search for methods to boost revenues and finance President Biden’s $2 trillion infrastructure proposal.

On Monday, Treasury Secretary Janet L. Yellen threw her help behind a world effort to create a world minimal tax that may apply to multinational firms, no matter the place they find their headquarters. Such a world tax, she stated, might assist stop a “race to the underside” by which nations lower their tax charges as a way to entice firms to maneuver headquarters and earnings throughout borders.

“Collectively, we are able to use a world minimal tax to ensure the worldwide financial system thrives primarily based on a extra stage taking part in subject within the taxation of multinational firms,” she stated. The hassle is geared toward “ensuring that governments have steady tax programs that elevate enough income to spend money on important public items and reply to crises, and that each one residents pretty share the burden of financing authorities.”

On the identical time, Democrats in Congress launched their very own proposal so as to add enamel to the de facto minimal tax that the USA already imposes on earnings earned overseas — one that may apply to American multinational firms no matter what the remainder of the world does. The proposal might elevate as a lot as $1 trillion over the subsequent 15 years from massive firms by requiring that they pay increased taxes on earnings they earn abroad, in response to analyses of comparable plans.

Ms. Yellen’s help for a world minimal tax might assist catalyze an settlement being labored out by the Group for Financial Cooperation and Improvement, which seeks to scale back firms’ follow of reserving earnings in low-tax “haven” nations to keep away from increased tax payments elsewhere. Negotiators are discussing a variety of prospects for such a plan, however they haven’t settled on a number of essential particulars, together with the speed of the minimal tax.

The deal with elevating taxes for giant firms comes because the Biden administration begins its push to promote a $2 trillion infrastructure plan and finance it with increased taxes. Mr. Biden’s proposal consists of elevating the U.S. company tax price to 28 p.c from 21 p.c and a wide range of adjustments to worldwide tax regulation, all meant to pressure firms to pay extra to the Treasury after a plunge in company tax revenues spurred by President Donald J. Trump’s signature 2017 tax cuts.

Democrats and White Home officers say that their aim is to make sure firms pay their justifiable share and that they don’t transfer jobs and earnings overseas to keep away from paying taxes in the USA.

However some tax specialists, together with massive enterprise lobbying teams, say the proposals might hobble American firms on the worldwide stage by forcing them to pay considerably increased tax charges than their rivals pay. That may very well be true even when world negotiators finally conform to a worldwide minimal tax — as a result of that tax price might nonetheless be decrease than what firms pay in the USA.

If the Democratic plans succeed and Ms. Yellen and her world counterparts attain settlement, “there may very well be a cogent worldwide tax system” with some efficient incentives for investments in the USA, stated Danielle Rolfes, a former worldwide tax counsel for the Treasury Division within the Obama administration who’s now a pacesetter of KPMG’s worldwide tax follow in Washington.

However, she stated, “I might be involved, if the charges get too excessive, that the U.S. might need competitiveness points.”

Senator Patrick J. Toomey, Republican of Pennsylvania, stated Ms. Yellen’s name for a world minimal tax was an admission that Mr. Biden’s plan to boost the company tax price to 28 p.c would make American firms much less aggressive.

“For this reason Secretary Yellen is imploring different developed nations to punish their staff and companies with their very own tax will increase,” Mr. Toomey stated in an announcement. “‘Race to the underside’ is the way in which the Biden administration describes competitors amongst developed nations to get to a tax code that draws funding and maximizes development.”

Mr. Biden dismissed that view on Monday, saying American firms might afford to pay the next tax price given many paid no taxes over the previous a number of years.

At this time in Enterprise

“You’ve 51 or 52 firms of the Fortune 500 that haven’t paid a single penny in taxes for 3 years,” he stated. “Come on, man. Let’s get actual.”

At concern is how governments ought to tax earnings that multinational firms earn throughout borders. Giant corporations more and more function in a number of nations: Amazon sells to customers in Europe, for instance, and Morgan Stanley presents monetary providers in China.

With operations unfold throughout a number of nations, many firms search to scale back their tax payments by finding operations — or just reserving earnings — in low-tax jurisdictions like Bermuda or Eire. When Republicans handed their sweeping tax regulation in 2017, supporters stated it could assist to curb that follow and encourage home funding, each by decreasing the company tax price in the USA and by organising a brand new system for taxing earnings earned overseas, together with a measure that was meant to be like a minimal tax for all world earnings.

However Democrats say the regulation and the administration’s use of the tax did the other, giving firms new incentives to find factories and earnings overseas. Each the plan Mr. Biden sketched out final week and a brand new proposal launched by three Democratic senators on Monday would search to reverse these incentives, taxing offshore earnings extra aggressively and providing new focused advantages for firms that spend money on analysis and manufacturing at residence.

The proposal would enhance the speed of the 2017 minimal tax and alter how it’s utilized to earnings that firms earn in varied nations abroad, successfully forcing many firms to pay the tax on extra of their earnings, whereas providing new focused tax aid linked to home investments.

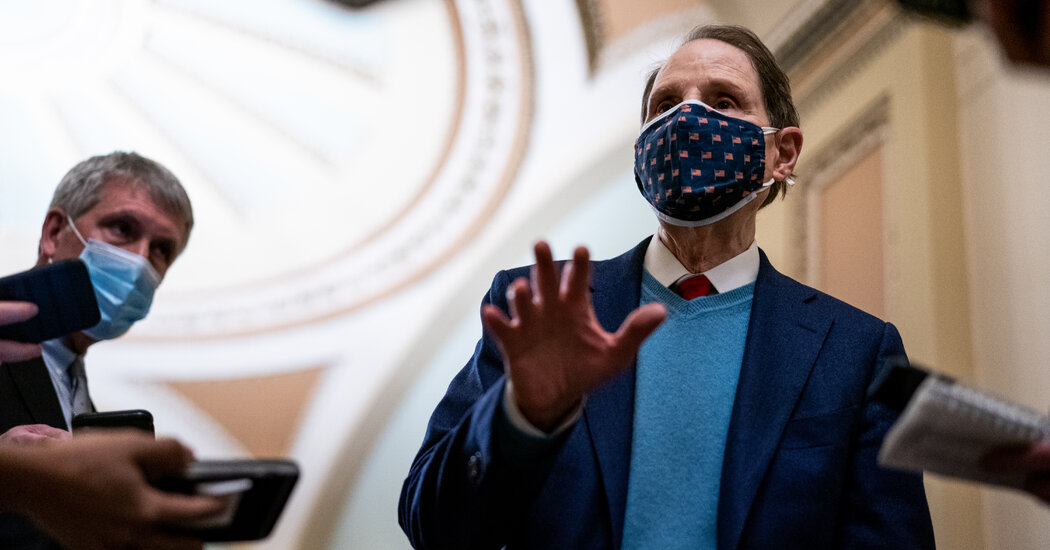

The Senate plan comes from Senator Ron Wyden, Democrat of Oregon, who’s in command of writing tax laws as chairman of the Finance Committee, and two Democratic colleagues: Senator Sherrod Brown of Ohio and Senator Mark Warner of Virginia.

The presence of Mr. Brown, one of the progressive Democrats on tax points within the Senate, and the extra centrist Mr. Warner as authors suggests the Wyden plan might entice widespread help in a Democratic caucus that most certainly can not afford to lose a single vote for Mr. Biden’s infrastructure plan.

Adam Looney, a former Treasury Division tax official within the Obama administration who’s now the manager director of the Marriner S. Eccles Institute for Economics and Quantitative Evaluation on the College of Utah, praised the senators’ proposal. “The plan retains the now-familiar worldwide tax regime,” he stated, “however proposes to reform a number of lopsided tax breaks that present wealthy advantages for worldwide firms with out a lot in the way in which of funding or jobs within the U.S.”

However Republicans, the main enterprise lobbying group and a few tax specialists panned the proposal and defended the Trump system as one which labored.

The 2017 regulation “labored to enhance a system that nobody felt was working and struck a steadiness between the necessity for firms to have the ability to compete within the world financial system whereas defending the U.S. tax base,” stated Caroline Harris, the vp of tax coverage on the U.S. Chamber of Commerce. “At this time’s proposal to extend worldwide taxes threatens to maneuver us to a system even worse than the place we began, to the detriment of financial development, competitiveness and job creation.”

Tax specialists expressed comparable considerations about imposing the form of world minimal tax Ms. Yellen is looking for and about what that may imply for American firms.

“It’s administratively unattainable to execute and it requires all nations on the earth to carry fingers,” stated Peter Barnes, a lawyer on the tax agency Caplin and Drysdale who was beforehand a senior worldwide tax counsel for Common Electrical. “Until they’ll get 90 p.c of the world’s nations to undertake it, nations will view exempting themselves from the system as a good way to create a probably vital aggressive benefit.”

Different specialists stated the timing of the 2 efforts might pose challenges for American companies, significantly if Mr. Biden succeeded this 12 months at overhauling the USA system of worldwide taxation, however world negotiations take years to translate into the precise imposition of recent minimal taxes elsewhere.

Any change to worldwide taxation is much from assured. The Senate proposal launched on Monday is probably going simply the primary of a number of plans to boost company tax income — all of which face a tough highway to passage given Democrats’ slim margins in each chambers. And whereas world negotiations for a minimal tax are underway, an settlement, if reached, might take years to place in place.