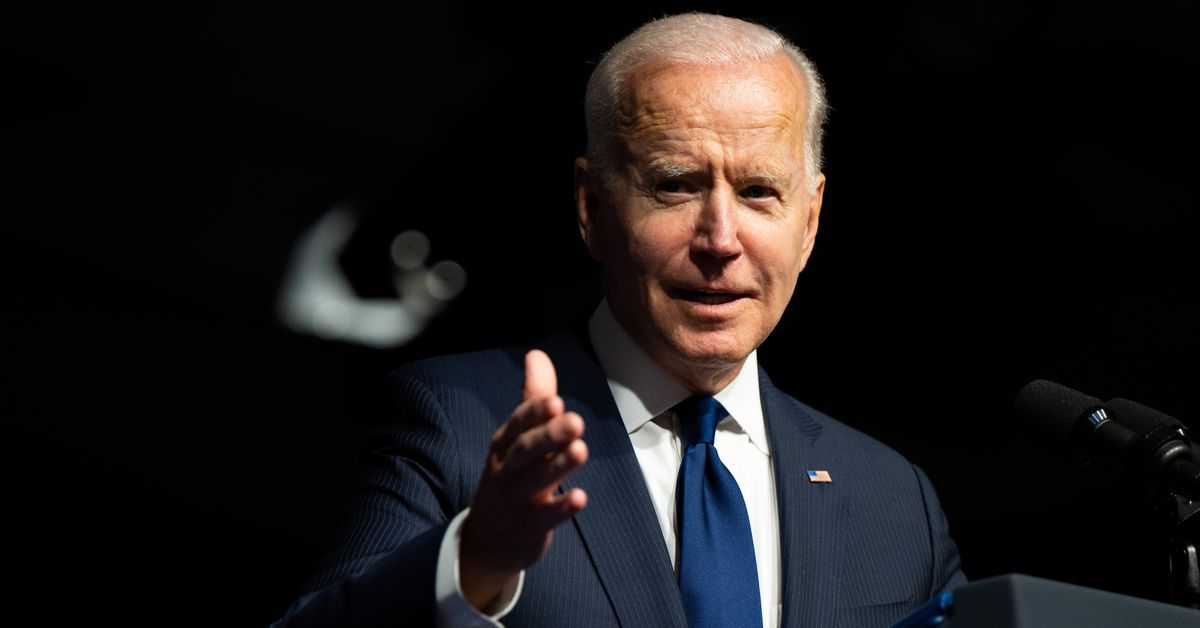

President Joe Biden might quickly discover out that elevating taxes on billionaires is extra sophisticated than it appears. The brand new presi

President Joe Biden might quickly discover out that elevating taxes on billionaires is extra sophisticated than it appears.

The brand new president needs the wealthy to pay way more in taxes, in an effort to finance a $1.eight trillion plan to put money into issues like baby care, training, and tax cuts for the poor that are supposed to scale back inequality.

However standing within the different nook of the ring is a classy wealth administration and accounting business that is able to combat, desirous to mood each aggressive proposal and exploit each loophole to please their purchasers who pay them massive bucks to defend each greenback.

Over the subsequent few months — and over the subsequent few years, if Biden’s plan manages to move in some kind or one other — these forces will collide. Passing the tax invoice is simply step one. The execution could possibly be more durable. Irrespective of Democrats’ intentions, they might discover that their plan lets tech billionaires off the hook.

And so the wealth administration business is brimming with a cocksure optimism that they’ll outsmart the paperwork.

“The rich will discover methods round it,” predicted one wealth supervisor. “There’s too some ways — completely acceptable methods — to defer, reduce, and even keep away from taxes.”

What wealth managers and pro-tax activists share is a perception that the Biden proposal poses extra of a menace to millionaires than it does to billionaires — as a result of billionaires usually might be extra affected person in relation to coping with taxes, selecting the precise second that they wish to pay them. Millionaires must work more durable to seek out intelligent workarounds.

The Biden plan would enhance the federal fee for people making over $450,000 a 12 months to nearly 40 %. It could enhance the ultra-rich’s capital positive factors tax fee — the tax fee paid by rich entrepreneurs once they promote an organization or rich buyers once they promote a inventory — to a sum of over 40 %. The White Home would finish the so-called “Angel of Loss of life” loophole that permits the rich to successfully keep away from capital positive factors tax altogether by not assessing the tax if the asset is handed alongside to an inheritor. And crucially, Biden plans to extend the enforcement firepower of the IRS, a transfer that the administration thinks might elevate over a 3rd of the $1.eight trillion in income focused by the tax overhaul.

And it’s true that these proposals have despatched a minimum of a few of the ultra-rich screaming for the brake pedal, greater than half a dozen wealth managers and accountants for a few of Silicon Valley’s wealthiest households instructed Recode.

Over the previous few weeks, various rich executives and buyers — together with those that made their fortunes within the tech business — have fired off emails and marched into conferences with their cash managers in a state of panic. Would they actually should pay a capital positive factors tax that might imply greater than half of their yearly earnings go to both the federal or California authorities? Would their kids actually be unable to entry the intergenerational wealth that the household’s patriarchs and matriarchs labored so exhausting to construct?

Sure, there are “mini freakouts in each consumer assembly we’ve,” stated one wealth supervisor for Silicon Valley’s wealthy.

To arrange for a world by which Biden’s plans would possibly turn into actuality, rich folks throughout the Bay Space are speeding to have their groups draw up authorized paperwork to attempt to put together for Biden’s plan probably passing. One supply relayed that tax legal professionals he works with have already put out phrase that they won’t take any extra purchasers after September as a result of they’re anticipating a lot last-minute 2021 enterprise. One other stated he’s seen increasingly more purchasers speaking about transferring to tax-friendly Puerto Rico within the aftermath of the Biden proposal.

However there’s a litany of causes that the tax specialists aren’t as involved as their purchasers are. And it’s not simply because activists and wealth managers anticipate the Biden plan to be considerably watered down if and when it will definitely passes Congress.

There’s the plain — that the hike within the upper-most tax bracket issues little as a result of the 0.01 % don’t make their fortunes via a wage; they make it by founding or investing in corporations. There’s the sorta apparent — that the rise within the capital positive factors fee might be circumvented if the rich keep away from “realizing” the acquire at a time when that increased fee is in place. After which there’s the even much less apparent — that mega–billionaires can fairly efficiently go to nice lengths to keep away from ever paying a capital positive factors tax by utilizing loans, charitable contributions, and a byzantine system of trusts to maintain their fortunes from Uncle Sam.

To Gabriel Zucman, an influential progressive economist who research tax funds from billionaires, the Biden plan has a “severe limitation.”

“In the event you’re Jeff Bezos or Elon Musk or the tech billionaires, it’s very simple to carry onto [your] shares and on the similar time to borrow cash to purchase stuff — houses, personal jets, or any kind of consumption,” Zucman stated. “The opposite factor within the Biden plan is to have taxation of capital positive factors at loss of life. However clearly most of those tech billionaires are fairly younger, which implies that they may nonetheless pay little or no tax as a fraction of the wealth for a few years and maybe even a number of a long time.”

Basically, the tech titans will resist promoting shares in a 12 months when the Biden capital positive factors hike is in impact (not that lively executives do a lot of that promoting to start with, out of worry of spooking the inventory market). And that even when Biden succeeds along with his plan to ax the supply that permits billionaires to ever keep away from paying capital positive factors tax by bequeathing the asset to an inheritor — a privilege referred to as the “step-up” foundation, or the aforementioned Angel of Loss of life loophole — Silicon Valley’s ultra-rich might should pay extra, however not till a long time from now once they die.

The irony is that Zucman, the tutorial brains behind liberals’ requires a wealth tax, largely agrees with the wealth protection business on one key level: That the ultra-rich will be capable of efficiently fend off a few of the Biden plan’s most intrusive proposals, probably defanging the administration’s plan to boost lots of of billions in tax income. The distinction is that to Zucman, that’s why Biden must go even bolder. To wealth managers, that’s possibly why Biden shouldn’t even attempt.

“No matter the place purchasers fall on the political spectrum, none of them are excited to pay extra taxes,” stated one wealth supervisor. “I by no means met a consumer, no matter their political affiliation, that isn’t enthusiastic about correct property planning.”

Billionaires and even regular-old millionaires rent these monetary aides to protect their property. Beating the Tax Man is why they’re paid. And so the business in Silicon Valley is already strategizing about what precisely it should do.

In relation to the capital positive factors tax, anticipate Silicon Valley titans to hurry to lock of their positive factors at this 12 months’s decrease fee (assuming the ultimate tax plan doesn’t apply retroactively, a provision that can be vigorously fought.) That implies that a rash of startups might look to promote towards the tip of the 12 months. Or that buyers who really feel they should promote inventory at some point might achieve this this 12 months fairly than subsequent. Analysis on earlier capital positive factors hikes reveals that there’s usually a spike in realizations within the 12 months earlier than a brand new tax takes impact, in keeping with Chye-Ching Huang, a tax coverage knowledgeable at NYU.

Others might not promote in any respect, hoping {that a} new administration or a brand new Congress might reverse the cuts altogether. And within the meantime, billionaires might take out extra loans utilizing their inventory holdings as collateral — a standard apply for tech titans, as Zucman identified.

Wealth managers concede that evading capital positive factors tax at loss of life can be troublesome with out the Angel of Loss of life loophole. However they nonetheless have a couple of tips up their sleeves. They are saying their purchasers of their wills will direct increasingly more of their appreciated fortunes to charity fairly than to the US Treasury. (“Charity is a approach of sustaining household wealth, not depleting it,” one wealth supervisor remarked.) They’ll — and in latest months, have already got — ramp up their property planning, which is the engineering of a posh net of trusts and firms that the wealthy construct to move cash on to their heirs, a part of an try to die whereas technically proudly owning nothing of their identify.

“In the event you’ve carried out a superb job, you die with nothing,” remarked one aide to Silicon Valley’s ultra-rich. “In idea, the step-up doesn’t matter since you’ve already given all of your property to your children, and so who cares? You spend your final greenback the day earlier than you die.”

And even when avoiding the supply is unattainable, the tax invoice — and the tax income, to progressives’ chagrin — gained’t come due till the billionaire dies. So for younger tech billionaires, it is a downside for the distant future. Who is aware of what America’s tax coverage will appear to be then? And for progressives, which means much less cash as we speak to unravel as we speak’s issues.

Then there’s additionally the extra basic sense that the home all the time wins, so to talk. Wealth advisers are already buying and selling concepts forwards and backwards for brand spanking new, underutilized tax hacks, as an illustration, that could possibly be pursued extra aggressively. It’s exhausting to foretell exactly which loopholes will emerge in a brand new federal tax invoice, however it’s exceptional that each tax activists and wealth advisers share this view that the tax avoidance business will stay sturdy.

Biden’s plan seeks to fight that by spending $80 billion to beef up the investigative and enforcement capabilities of the IRS. However there’s ample skepticism that the Biden plan will elevate the $700 billion in income that it seeks — partly as a result of the ultra-rich are so good on the cat-and-mouse recreation.

What’s shaping up in Silicon Valley is a battle not simply of legal guidelines and lobbying, however of wits and wiggle room. Tax activists concede that the wealth managers might have the higher hand within the brief run, however hope that they may reduce into the fortunes over the long term.

That cash, says Huang, would enable America to “make everlasting investments in kids and households — that aren’t the heirs to multibillion-dollar households.”