Till pretty lately, pupil debt cancellation was thought of to be a fringe concept that, whereas fashionable among the many Occupy Wall Road cro

Till pretty lately, pupil debt cancellation was thought of to be a fringe concept that, whereas fashionable among the many Occupy Wall Road crowd and on the left, was a mainstream nonstarter. That’s begun to alter.

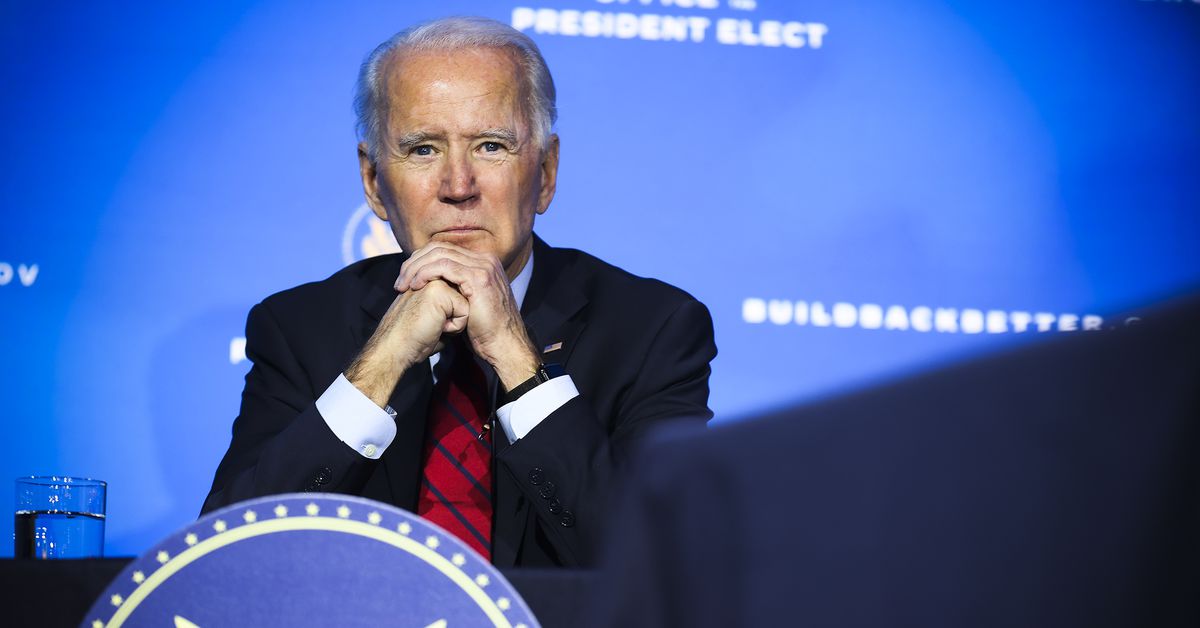

The Covid-19 pandemic and ensuing financial downturn have pushed the problem even additional to the forefront. The CARES Act after which President Donald Trump put a pause on federal pupil mortgage funds in the course of the pandemic that expires on the finish of January. However with the coronavirus disaster worse than ever, there’s a rising refrain of activists, politicians, and voters calling for pupil debt cancellation as a type of financial stimulus. That refrain is pushing Democrats and, specifically, President-elect Joe Biden to go huge on pupil debt, utilizing federal motion to wipe out some and even all of what debtors owe.

“What’s engaging about pupil debt cancellation on this second is that along with righting a coverage unsuitable — which is the choice to make the price of school a person burden after I would say it’s a public good — is that it may possibly assist stimulate the economic system at a second after we want financial stimulus. And it has important racial fairness implications as effectively,” mentioned Suzanne Kahn, director of schooling, jobs, and energy on the Roosevelt Institute and an advocate for full federal pupil debt cancellation. It’s additionally one thing Biden might attempt to do independently of Congress, which is engaging since stimulus talks have stalled out.

Biden’s marketing campaign backed laws forgiving the primary $10,000 in federal pupil mortgage debt, however some Democrats and progressives are pushing for him to cancel extra pupil debt by way of govt motion — and never simply $10,000, however $50,000 and even all of it.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22160554/GettyImages_1230034708.jpg)

Past direct cancellation, there’s loads Biden can do to make preexisting pupil debt applications work higher and assist extra individuals.

“There’s a super alternative by way of govt motion for President-elect Biden to enhance the lives of tens of millions of People,” mentioned Seth Frotman, govt director of the Scholar Borrower Safety Middle and former pupil debt ombudsman on the CFPB.

The dialog round pupil debt in america stretches far past questions of schooling, legislation, and economics. It additionally entails thorny discussions round racial justice, politics, and equity. Advocates argue that debt cancellation will carry a spread of advantages — stimulating the economic system, selling racial justice, and righting the unsuitable of pushing tens of millions of People into life-hindering debt.

However because the Biden administration plans its first steps, a debate is raging about whether or not mortgage forgiveness is basically the easiest way to get the economic system shifting and get reduction to individuals who want it. Some critics warn it might be a politically expensive push that doesn’t clear up the underlying issues with increased schooling within the US.

Why this, why now

Broad-based pupil debt cancellation isn’t a brand new concept, nevertheless it being mentioned in institution political circles is.

45 million People now owe a complete of about $1.6 trillion in pupil loans, and one in 10 loans are in delinquency or default. The Federal Reserve estimates the everyday month-to-month cost to be between $200 and $299. Analysis suggests individuals are delaying shopping for properties, having children, and altering jobs partly due to pupil mortgage debt, which implies it might grow to be a drag on the general economic system. The burden is particularly heavy on Black debtors, who usually carry extra debt and wrestle extra to pay it off.

“This isn’t some area of interest drawback,” mentioned Bharat Ramamurti, a member of the Congressional Oversight Fee that oversees the CARES Act funds and former adviser to Sen. Elizabeth Warren. “Scholar mortgage debt impacts lots of people — it’s principally a fifth of all adults.”

Scholar debt was a significant theme throughout Occupy Wall Road, a widespread protest motion that emerged in response to the worldwide monetary disaster in 2011. Within the years following Occupy, activists continued to give attention to the problem and push it into the dialog: In 2012, they organized 1T Day to mark pupil debt surpassing $1 trillion, they usually subsequently launched Strike Debt and fundraisers to assist cancel pupil debt. Scholar debt strikes started to pop up throughout the nation, the place debtors stopped paying their loans in protest of the state of affairs, and organizers helped propel rules to guard pupil debtors in opposition to deceptive and predatory practices.

As pupil debt, which is tough to get discharged in chapter, has grow to be an more and more prevalent concern, so have proposals concerning methods to tackle it. Within the 2020 Democratic presidential main, Bernie Sanders ran on canceling all pupil debt, and Elizabeth Warren proposed canceling money owed of as much as $50,000.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22155788/GettyImages_133142882.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22155795/GettyImages_1163778082.jpg)

Many Democrats and progressives are calling for Biden to cancel some or all debt by way of govt motion, specifically, a “settlement and compromise” provision that they argue would permit for debt to be canceled by way of govt authority.

“The legislation is fairly clear that the secretary of schooling has the authority to compromise — that’s the time period — which implies successfully cancel any particular person debt of as much as $1 million,” mentioned Ramamurti, who helped devise the plan Warren ran on.

Now Warren and Senate Minority Chief Chuck Schumer are urging the incoming administration to cancel as much as $50,000 in pupil mortgage debt.

However as the concept has grown extra fashionable, so has the resistance. On the proper, detractors say it’s a pointless authorities give-out. Within the center, they warn it’s not a great way to stimulate the economic system. And on the left, there are considerations it’s a regressive coverage that can assist individuals who don’t want it. Some critics have panned the concept as a “Brahmin bailout” that will assist out the higher class (those that went to school) and do little, if something, for everybody else, and a few individuals have warned that such a bailout might show a messaging catastrophe for Democrats.

“Regardless of the way it’s designed, student-debt forgiveness may be very poorly focused,” Bloomberg’s editorial board warned in November. “Even when reduction might be higher centered on the poor, extreme drawbacks stay. For one, the overwhelming majority of People who don’t have pupil debt would rightly really feel omitted. Many by no means had the chance to get the next schooling; others postpone monetary targets (reminiscent of saving for retirement) to pay it down. Additionally, it will do little to enhance the rapid money movement of the various debtors who — as a result of they’re in default or in income-based reimbursement plans — are making small or no month-to-month funds.”

A ballot carried out by Vox and Knowledge for Progress discovered {that a} majority of probably voters help forgiving pupil mortgage debt as much as $50,000, particularly whether it is tied to nationwide or group service or comes with a $125,000 earnings threshold. Solely about one in 4 probably voters, nevertheless, help forgiving all pupil debt. And the concept is far more fashionable amongst these with debt than these with out it.

Different polls have additionally discovered that canceling some pupil debt is a reasonably fashionable concept, although not the preferred concept on this planet. And it’s fairly effectively appreciated amongst members of the Democratic base — Black voters and middle-class professionals — who helped hand Biden the election.

If Democrats do go forward with pupil debt forgiveness by way of govt actions, they might pair it with one thing that will profit non-college-educated individuals, reminiscent of requiring federal contractors to pay a $15 minimal wage. That will profit tens of millions of staff.

How a lot can Biden do on pupil debt?

The Trump administration has prolonged the federal mortgage cost pause by way of January 31, and Biden might proceed to increase it. Nonetheless, leaving individuals in limbo month-to-month just isn’t ultimate.

There are different steps Biden might take in need of full debt cancellation, together with enhancing applications to alleviate debt for college students defrauded by predatory colleges or who signed up for applications that permit them repay loans based mostly on their earnings, mortgage forgiveness for individuals who go into public service, and debt reduction for pupil veterans and college students with disabilities, amongst others.

However the huge dialog has shifted as to if Biden ought to set college students free from their debt — and if that’s the case, how a lot.

The burden of pupil debt in America isn’t equally shared. In 2019, households with graduate levels owed 56 % of schooling debt, despite the fact that solely 14 % of adults over the age of 25 have graduate levels, and the three % of households with doctorates or skilled levels held 20 % of all debt. In the meantime, a lot of these struggling most with pupil debt are those that by no means completed their levels.

Biden has backed laws that will cancel $10,000 in debt, however until Democrats take management of the Senate and make a giant effort to push that by way of, that’s not prone to grow to be legislation.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22155801/GettyImages_1151695913.jpg)

When it comes to what advocates need Biden himself to do, the extra conservative quantity rests across the $10,000 vary, which is the quantity the president-elect had initially thrown his weight behind legislatively. Capping forgiveness at $10,000 might get rid of debt for greater than 15 million debtors and scale back by half the debt of 9 million extra.

Adam Looney, a nonresident fellow on the Brookings Establishment and govt director of the Marriner S. Eccles Institute on the College of Utah, famous in a Washington Put up op-ed that it will particularly assist “debtors with smaller balances, who, paradoxically, are likely to wrestle most, accounting for 60 % of all defaults.”

Debtors who owe the least are sometimes those who wrestle most to pay their loans, partly as a result of a lot of them are individuals who dropped out of faculty and aren’t getting the advantage of a school diploma of their careers.

From the $10,000, the size goes up. Schumer and Warren are pushing Biden to forgive $50,000. On the most formidable finish of the spectrum, some activists, organizers, and politicians need to cancel all federal pupil mortgage debt for everybody.

Ramamurti informed me he sees it as “purely a matter of political will,” and as soon as the mechanisms are in place, there’s room for adjustment on forgiveness quantities and thresholds.

“The great factor about this coverage is you may tweak it, relying on what your targets are,” he mentioned.

When reached for remark, the Biden transition crew pointed to his marketing campaign schooling plan and famous his help for the $10,000 forgiveness laws. It didn’t reply when requested whether or not he was contemplating the Schumer-Warren proposal.

The financial argument for canceling pupil debt

On the coronary heart of the argument for canceling pupil debt, particularly within the midst of the pandemic, is that it will be good for tens of millions of individuals and, due to this fact, the economic system. How good is the place the disagreement resides — and since mass pupil debt forgiveness isn’t one thing we’ve seen up to now, the info on what might occur is comparatively restricted.

One 2019 working paper from Harvard Enterprise Faculty checked out what occurred when college students in default had their discharged due to a lawsuit. They discovered that debtors decreased their total indebtedness by 1 / 4 and had been additionally much less prone to default on different accounts. That’s good for them and for the entities they owe cash to.

“We truly discover that these people are likely to decrease their complete liabilities over time by repaying, as an example, bank card debt, so their total monetary well being improves,” mentioned Marco Di Maggio, an affiliate professor of enterprise administration at Harvard and one of many paper’s authors.

Individuals additionally demonstrated extra mobility — they moved states, modified jobs, and took extra dangers that usually translated to increased incomes.

Di Maggio’s analysis centered on individuals who had been in default and weren’t making funds in any respect. But when it had been broader federal debt forgiveness that features debtors who’re paying, he thinks the influence might be a lot higher.

“In case you give the identical sort of forgiveness to individuals that aren’t in that state of affairs, one impact that we don’t seize is that your month-to-month cost goes down,” he mentioned. The $300 individuals had been placing towards mortgage funds each month might then be spent elsewhere.

Some critics have argued that pupil mortgage forgiveness might be fairly regressive, particularly at increased quantities, as a result of it will imply canceling money owed for high-earning households. And there’s disagreement amongst economists about simply how efficient stimulus forgiveness could be. The Committee for a Accountable Federal Price range, a gaggle that advocates for fiscal accountability, estimates that pupil mortgage forgiveness would have comparatively small near-term multiplier results, that means the influence on the economic system could be restricted (and that’s assuming it’s tax-free — extra on that later).

“We discovered that it’s all actually poorly focused stimulus,” mentioned Marc Goldwein, senior coverage director at CRFB. “It will increase the economic system, however by our estimates, for each $1 of mortgage forgiveness … it will increase the economic system by someplace between eight and 23 cents, which is a really poor multiplier.”

Different analysts disagree. Di Maggio estimates the multiplier to be not less than $1 on each $1 — that means that spending on forgiveness would straight increase the economic system. A 2018 examine from the Levy Economics Institute of Bard Faculty projected that debt cancellation might increase GDP by tens of billions of {dollars} a yr and scale back unemployment.

Biden’s urge for food for mortgage forgiveness may even rely on how keen Congress is to do different stimulus.

“I might anticipate that pupil mortgage cancellation by govt motion is extra probably the extent to which the Republicans are blocking progress on a stimulus bundle by way of Congress,” mentioned Bob Shireman, the director of upper schooling excellence and a senior fellow on the Century Basis. “It’s positively not probably the most efficient methods to stimulate the economic system, but when it is likely one of the issues obtainable to the administration, then it is likely to be one thing they do.”

However financial stimulus just isn’t the one argument for wiping out debt.

The justice argument for canceling pupil debt

Black debtors are disproportionately burdened with debt. From 2000 to 2018, the median pupil debt for younger white debtors with a bachelor’s diploma about doubled from $12,000 to $23,000. For Black debtors, it quadrupled, from $7,000 to $30,000, despite the fact that white households are likely to have extra cumulative debt than Black households total.

A examine from Brandeis College discovered that 20 years after beginning school, a typical Black borrower nonetheless owes 95 % of their debt, whereas the everyday white pupil has paid off 94 % of their debt. Throughout socioeconomic ranges, Black debtors wind up worse off than their white counterparts.

“Black college students borrow extra typically, they borrow extra, they usually have a tougher time repaying their friends,” mentioned Tiffany Jones, senior director of upper schooling coverage on the Training Belief. “That’s true all the way in which up the earnings ladder.”

Forgiveness is a racial justice coverage. A current Roosevelt Institute working paper discovered that whereas white debtors stand to realize probably the most in absolute {dollars} from cancellation, “the relative good points for Black debtors are a lot bigger and the higher proportion of Black debtors signifies that Black wealth total would expertise far more development in consequence.” They didn’t, nevertheless, discover that it will meaningfully tackle the racial wealth hole.

Darrick Hamilton, a professor of economics and concrete coverage and founding director of the Institute for the Examine of Race, Stratification, and Political Financial system on the New Faculty, mentioned the wealth hole isn’t fully the purpose.

“In case you’re actually attempting to shut the racial wealth hole, the principle part, from an accounting standpoint, is property, not debt,” he mentioned. “Debt is problematic as a result of it’s nearly like sharecropping — that’s hyperbole — nevertheless it places individuals in a debt entice the place they aren’t permitted pathways for social mobility as a result of they’re constrained by a financier and the efforts of their labor go to repay the curiosity on finance.”

Advocates say the racial justice argument applies on the high and backside of the earnings spectrum, for Black debtors who’re well-off and people who will not be, and that slim concentrating on isn’t vital. “People are feeling like offering reduction to a gaggle which are excessive earners might be not the proper factor to do, forgetting and erasing that amongst excessive earners there are Black and brown individuals who could be impacted,” Jones mentioned.

However pupil mortgage forgiveness is also a restorative justice concern in that it will assist proper previous wrongs. Greater schooling has lengthy been held up because the gateway to a livable wage, and college students have been inspired to enter debt to go to high school, construct their résumés, and advance.

Now tens of millions of younger People live by way of their second recession on the outset of their careers, they usually’re saddled with debt they had been informed was a good suggestion. Forgiveness might be “stimulus to a era that’s been notably scarred,” Hamilton mentioned.

Frederick Wherry, a professor of sociology at Princeton College and director of the Dignity and Debt Community, emphasised that if pupil debt is canceled, “it’s additionally a good suggestion to cancel it in a method that’s not denigrating for the debtors” — making it simple to entry as an alternative of creating individuals really feel unhealthy about leaping by way of hoops to reap the profit.

“For individuals who are already drowning and you’re saying you need to do a stimulus, do a stimulus,” Wherry mentioned. “Nobody says something when wealthy individuals get a tax break.”

One looming query: Taxes

One main coverage and political concern that hangs over the forgiveness dialogue is taxes. Debt cancellation is usually counted as taxable earnings. So if somebody has $50,000 in pupil loans forgiven, that will imply $50,000 could be counted as gross earnings for the yr it was forgiven on high of different earnings.

Beneath right this moment’s tax charges, that will be taxed probably someplace between 22 and 37 %. In different phrases, main pupil debt cancellation might include an infinite tax invoice for debtors.

Those that have studied the problem say there are workarounds. John Brooks, a legislation professor on the Georgetown College Regulation Middle who has studied pupil debt taxes, informed me that there are a selection of authorized arguments that will permit the secretary of schooling, the treasury division, and the IRS to make forgiveness tax-free. Forgiveness might get a “normal welfare” exclusion, or qualify as catastrophe reduction, or get a scholarship exclusion, amongst different choices.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22160570/GettyImages_1230031495.jpg)

“Scholar debt is simply actually, actually bizarre, and it simply doesn’t match into the classes and the methods we take into consideration other forms of debt,” he mentioned. “It’s a type of authorities funding for increased schooling, and it’s designed to supply as many individuals attainable with a method to recover from a point of affordability issues that’s limiting their capacity to enroll in increased schooling.”

Jessica Thompson, affiliate vp on the Institute for Faculty Entry & Success (TICAS), mentioned the case that there’s a preexisting authorized method round taxes on cancellation is “positively extra in query” than forgiveness proponents would really like, although there’s an argument to be made. “You may make your case, however ultimately, you’ve acquired to fulfill each single hurdle that might be thrown at you,” she mentioned. “Treasury and the IRS are usually conservative and cautious about how they interpret their authority to behave.”

It’s price emphasizing that the tax concern isn’t restricted to the present govt motion forgiveness query — the idea for individuals repaying loans by way of applications that ultimately forgive any remaining stability is that they’ll owe taxes, too. So this drawback goes to indicate up whether or not there’s mass cancellation or not.

The second to cancel debt is likely to be now. It additionally doesn’t clear up the larger drawback.

The dialog america is having proper now round pupil debt cancellation isn’t a brand new one — it’s the results of years of activism, organizing, and considering amongst individuals who suppose it’s a very good, simply, and proper concept.

However that is additionally indicative of the second: Thousands and thousands of People are hurting and in determined want of assist amid the Covid-19 pandemic, particularly as a lot of the federal stimulus already supplied has run out or is about to. Debt forgiveness could also be an outlet for the Biden administration to be inventive and nimble in addressing the disaster.

“Any debt reduction is best than what’s occurring proper now,” Jones mentioned.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22155812/AP_20148687995511.jpg)

However wiping out debt is simply a part of the equation in relation to the price of increased schooling in america. Even in the event you cancel all current debt, you will have college students at school or about to go to high school who’re going to wind up caught in the identical loop.

“Each breath that you simply hear somebody speaking about debt cancellation, we must be speaking concerning the urgency of people who find themselves at school proper now and individuals who needs to be at school proper now,” Thompson mentioned.

That interprets to points reminiscent of making school extra inexpensive, retaining college students away from predatory establishments, and fostering levels and coaching which are well worth the cash. The problem on these fronts is that Biden can’t do a lot on his personal.

“We want a Congress that’s keen to have that dialog,” the Century Basis’s Shireman mentioned. “We can’t tackle the broader affordability questions, the broader affordability drawback, with out Congress and the administration working collectively.”

Is widespread pupil debt cancellation the optimum path towards stimulus? Cheap minds can disagree, however in all probability not. But when there’s ever a time to attempt it, the second might be now.