WASHINGTON — High Home Democrats are making ready to unveil laws that may ship as much as $3,600 per little one to hundreds of thousands of People

WASHINGTON — High Home Democrats are making ready to unveil laws that may ship as much as $3,600 per little one to hundreds of thousands of People, as lawmakers intention to vary the tax code to focus on little one poverty charges as a part of President Biden’s sweeping $1.9 trillion stimulus package deal.

The proposal would broaden the kid tax credit score to offer $3,600 per little one youthful than 6 and $3,000 per little one as much as 17 over the course of a 12 months, phasing out the funds for People who make greater than $75,000 and {couples} who make greater than $150,000. The draft 22-page provision, reported earlier by The Washington Publish and obtained by The New York Occasions, is anticipated to be formally launched on Monday as lawmakers race to fill out the contours of Mr. Biden’s stimulus plan.

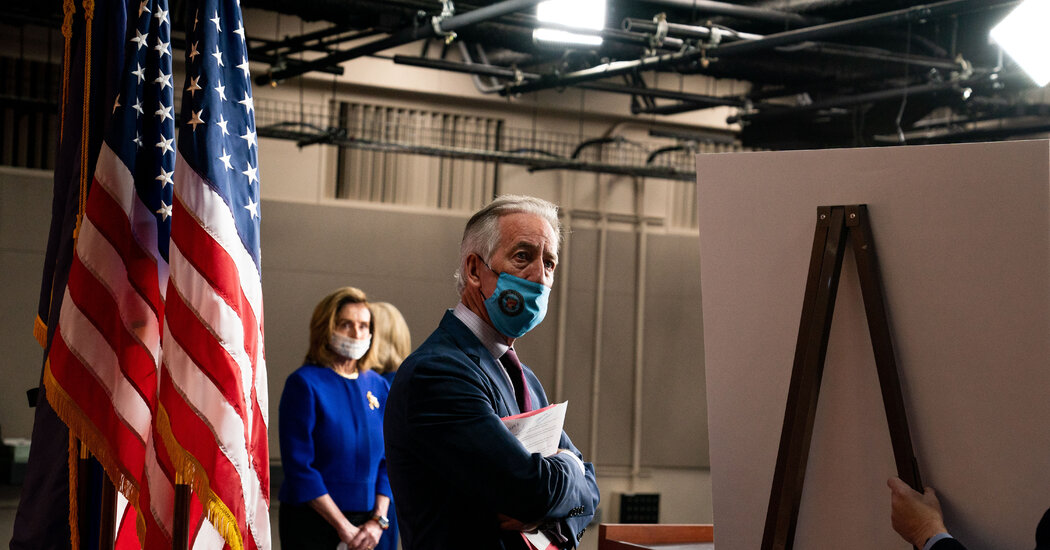

“The pandemic is driving households deeper and deeper into poverty, and it’s devastating,” mentioned Consultant Richard E. Neal of Massachusetts, the chairman of the Methods and Means Committee and one of many champions of the availability. “This cash goes to be the distinction in a roof over somebody’s head or meals on their desk. That is how the tax code is meant to work for individuals who want it most.”

The credit can be break up into month-to-month funds from the Inside Income Service starting in July, based mostly on an individual’s or household’s revenue in 2020. Though the proposed credit score is just for a 12 months, some Democrats mentioned they might battle to make it everlasting, a sweeping transfer that would reshape efforts to battle little one poverty in America.

The one-year credit score seems more likely to garner sufficient help to be included within the stimulus package deal, however it’s going to additionally must clear a collection of robust parliamentary hurdles due to the procedural maneuvers Democrats are utilizing to muscle the stimulus package deal by way of, doubtlessly with out Republican help.

With Home Democratic management aiming to have the stimulus laws authorised on the chamber flooring by the tip of the month, Congress moved final week to fast-track Mr. Biden’s stimulus plan at the same time as particulars of the laws are nonetheless being labored out. Buoyed by help from Democrats in each chambers and a lackluster January jobs report, Mr. Biden has warned that he plans to maneuver forward together with his plan whether or not or not Republicans help it.

Republicans, who’ve accused Mr. Biden of abandoning guarantees of bipartisanship and raised issues in regards to the nation’s debt, have largely balked at his plan due to its measurement and scope after Congress authorised trillions of {dollars} in financial aid in 2020.

However the little one tax credit score might present a possibility for some bipartisan help, since Senator Mitt Romney, Republican of Utah, launched the same measure that may ship funds of as much as $1,250 per thirty days to households with youngsters. Mr. Romney’s proposal, supposed to encourage People to have extra youngsters whereas decreasing little one poverty charges, would distribute funds by way of the Social Safety Administration and offset prices by eliminating different authorities security web spending.

“If you happen to’re President Biden, and also you’re severe about having a bipartisan — working along with individuals on the opposite facet, bringing individuals collectively in unity, he has the chance to do it,” Senator Patrick J. Toomey, Republican of Pennsylvania, mentioned on CNN’s “State of the Union.” (Mr. Toomey has mentioned he wouldn’t help Mr. Biden’s proposal due to the worth tag.)

Janet L. Yellen, the Treasury secretary, warned on Sunday that the US labor market was stalling and in a “deep gap” that would take years to emerge from if lawmakers didn’t rapidly go the stimulus package deal.

Ms. Yellen rebutted issues that large spending would result in inflation and mentioned the economic system would face the sort of lengthy, gradual restoration that it skilled after the 2008 monetary disaster if lawmakers did too little.

“A very powerful threat is that we go away employees and communities scarred by the pandemic and the financial toll that it’s taken,” Ms. Yellen mentioned on CNN. “We have now to verify this doesn’t take a everlasting toll on their lives.”

Ms. Yellen mentioned that passing the stimulus package deal might permit the economic system to succeed in full employment by subsequent 12 months. Failing to take action, she mentioned, might go away the jobless charge elevated for years to return.

The availability increasing the kid tax credit score is among the many legislative proposals supposed to handle the inequities exacerbated by the pandemic and assist households climate the nation’s faltering economic system. Researchers at Columbia College discovered that Mr. Biden’s total stimulus proposal might reduce little one poverty in half in 2021 due to the enlargement of the kid credit score, in addition to different modifications to tax credit and expansions of unemployment and meals help advantages.

“The second is right here to make dramatic cuts in little one poverty that would enhance the lives and the way forward for hundreds of thousands of kids,” Consultant Rosa DeLauro, Democrat of Connecticut and the chairwoman of the Home Appropriations Committee, mentioned on Sunday. She mentioned she would push to make the credit score everlasting.

Chris Cameron and Jim Tankersley contributed reporting.