A bipartisan deal is President-elect Joe Biden’s solely hope to get the sort of monumental Covid-19 reduction invoice and the dream of an “FDR-s

A bipartisan deal is President-elect Joe Biden’s solely hope to get the sort of monumental Covid-19 reduction invoice and the dream of an “FDR-size presidency” that he desires. However bipartisanship doesn’t imply Democrats ought to return to the deficit-slashing, grand-bargaining strategy that failed beneath President Barack Obama. There’s a greater choice.

The election outcomes are on the right track to arrange a divided authorities, with a Democratic president, a skinny Democratic majority within the Home, and a skinny Republican majority within the Senate, or, greatest case for Democrats, a single-vote Senate majority.

Republicans would favor a small reduction invoice if they supply any in any respect, with principled skepticism about authorities spending now aligning with a cynical lack of curiosity in seeing Biden preside over an financial growth.

And even when one thing will get accomplished on reduction, the bitter fiscal coverage fights gained’t finish there. As one veteran of Obama-era battles tells me, it’ll be “trench warfare on appropriations and debt restrict” beginning with the expiration of presidency funding this December and persevering with to August’s statutory debt ceiling.

Below the circumstances, Democrats may understandably be tempted to show to the hoary Obama-era trope of deficit-reduction negotiating. In any case, when Donald Trump grew to become president, one of many Republican Social gathering’s key coverage targets was to chop long-term Medicare spending. With Trump in workplace, that precedence went away, however the want didn’t.

Mitch McConnell merely pivoted to the speculation that after Republicans had been accomplished slicing taxes, entitlement reform must be accomplished on a bipartisan foundation, seemingly concluding from the Trump expertise {that a} one-party strategy to those points is much less viable than he and Paul Ryan thought within the Obama period.

Biden, in the meantime, was a severe deficit hawk for many of his Senate profession, and several other of his present high advisers, together with Bruce Reed and Jeff Zients, had been deeply concerned in Obama-era deficit discount drives.

These may add as much as a state of affairs the place Republicans insist on spending cuts in authorities funding offers whereas Democrats argue that deficit discount ought to function tax will increase too with a purpose to be balanced and truthful. This may exacerbate celebration tensions on the Democratic aspect, make it basically not possible for a Biden administration to resolve any large issues, and really probably founder on the fundamental actuality that Republicans are fanatically against taxing the wealthy.

There’s a substitute for “eat your peas” politics — a push for a special sort of bipartisan deal during which, somewhat than giving up on progressive spending priorities, Biden tries to safe help for them by giving in to large, GOP-friendly tax cuts.

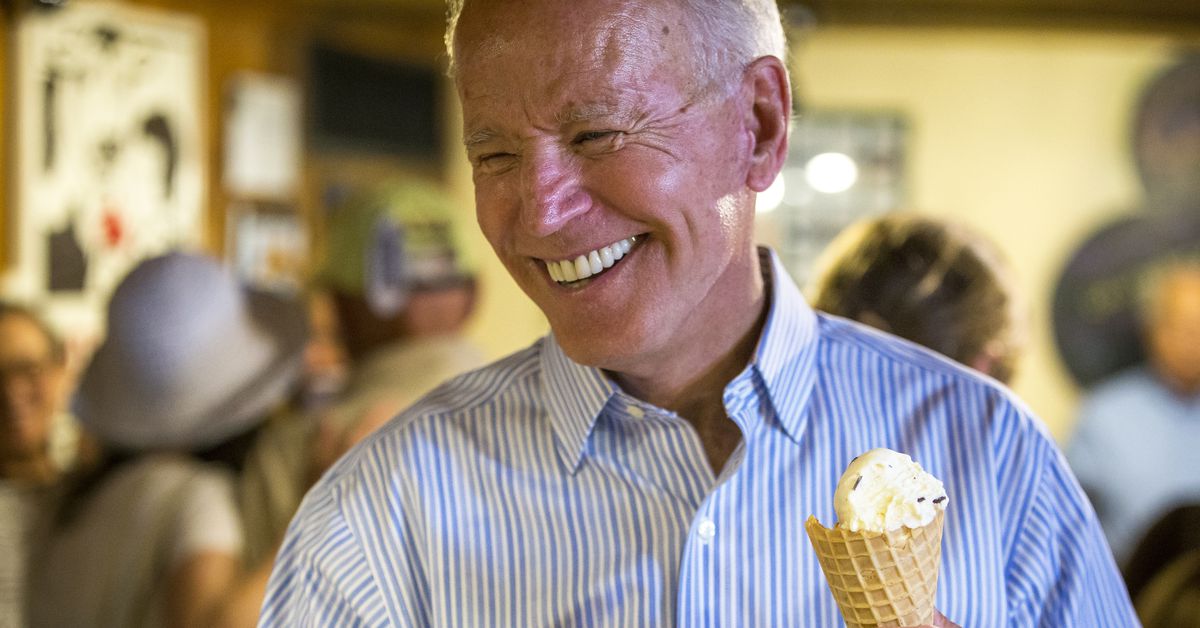

The Democratic financial coverage wonks I’ve floated this by are skeptical, however largely as a result of they insist Republicans would by no means go for it. The Republicans are extra optimistic — although they concede it’s dicey. Name it an ice cream celebration, the alternative of consuming your peas. Definitely it would fail. However given the financial fundamentals, it’s value a shot.

The nation can afford ice cream for everybody

Democrats, with good cause, usually don’t imagine that enormous tax cuts for wealthy persons are a good suggestion. They’ve additionally struggled for the previous 20 years to clarify precisely why they’re a dangerous thought. However left-wing Democrats hate inequality whereas extra reasonable ones are suspicious of deficits.

Manner again in a 2006 speech, for instance, then-Sen. Barack Obama complained about George W. Bush’s insurance policies that “over the previous 5 years, our federal debt has elevated by $3.5 trillion to $8.6 trillion. That’s ‘trillion’ with a ‘T,’” he reminded us, saying “that’s cash that we’ve borrowed from the Social Safety belief fund, borrowed from China and Japan, borrowed from American taxpayers.”

Looking back, it’s really outstanding how a lot cash was spent throughout Bush’s first time period with so little to indicate for it. Two rounds of tax cuts plus two wars — one with few successes and excessive human prices and the opposite a catastrophic failure — didn’t ship a lot of a return on the $5 trillion invested.

However the deficits themselves had been nice — discovering folks to lend the American authorities cash was simple, and didn’t give China or Japan or anybody else energy over us.

The rate of interest buyers charged on the federal debt was not particularly excessive on the time Obama complained, and it’s solely fallen since then throughout the monetary disaster, stimulus, failed efforts at grant cut price, Trump tax cuts, pandemic, and extra stimulus.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22023128/Screen_Shot_2020_11_08_at_8.55.51_PM.png)

St. Louis Federal Reserve

Specifically, debt service funds as a share of GDP have plummeted because the 1980s and 1990s and are presently falling somewhat than rising.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22023136/Screen_Shot_2020_11_08_at_8.59.22_PM.png)

St. Louis Fed

The upshot is that the sensible restrict on the federal government’s means to ship fiscal stimulus is political, not financial. Nancy Pelosi and Home Democrats initially proposed the $3.four trillion HEROES Act, which was way more than Republicans had been prepared to spend (some Democratic economists additionally quietly inform me it was legitimately greater than wanted). They then lowered their bid to a $2.2 trillion bundle, whereas Mnuchin countered with a $1.Eight trillion proposal. McConnell’s final provide was at $650 billion, and his place will most likely develop into stingier given the election.

Realistically, even the smallest of those reduction packages would assist the nation. And even the most important of them is reasonably priced. However whereas Republicans clearly aren’t going to comply with an enormous spending enhance simply to be good, they could do it in change for an enormous tax lower.

Republicans by no means completed their tax lower ice cream

Again in 2001 and 2003, George W. Bush wished to enact tax cuts, and he wished to do it utilizing the funds reconciliation course of to keep away from a Democratic filibuster. However to qualify for reconciliation remedy, a legislation can’t increase the long-term funds deficit. So Republicans wrote a invoice to chop taxes for 9 years after which have them return to Clinton-era ranges in 2011.

Their pondering was that they might then marketing campaign on extending the tax cuts later.

And they also did, however that didn’t cease Barack Obama from profitable in 2008 and threatening to dam their extension. Then within the lame-duck session after the 2010 midterms, Obama agreed to increase the tax cuts for 2 extra years in change for Republicans doing a bit extra fiscal stimulus. After Obama gained once more in 2012, there was one other standoff, and one other deal — extending many of the Bush tax cuts however elevating taxes on households incomes over $450,000 and once more getting a bit extra stimulus.

Then in 2017, Republicans pulled one other model of the identical transfer — pairing an unpopular everlasting lower in company taxes with short-term cuts in particular person earnings taxes, figuring they might run on extending them throughout the 2024 marketing campaign.

However now Biden might be president, Democrats nonetheless management the Home, incumbent presidents normally get reelected, and the percentages of those cuts largely being reversed (a couple of provisions, such because the elevated generosity of the kid tax credit score, have bipartisan help) are respectable. In an “ice cream for everybody” state of affairs, as an alternative of offsetting his spending concepts by rolling again the Trump tax cuts, Biden may contemplate doing the alternative: swapping his spending concepts for the GOP’s tax concepts.

Now, make no mistake, completely extending these tax cuts is an costly proposition — costing over $1 trillion, in line with the Tax Coverage Heart — and it’s very regressive, delivering a lot bigger advantages to folks within the high 20 % of the earnings spectrum than to these in want.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22024465/extend_tcja_distribution.png)

Tax Coverage Heart

However whereas this isn’t by any means a good thought, it’s additionally removed from clear that it could be dangerous. Present rates of interest are very low, and they’re prone to keep low for a while. The Federal Reserve just lately adopted a brand new framework it calls Common Inflation Concentrating on (AIT), which critics, like David Reifschneider and David Wilcox of the Peterson Institute for Worldwide Finance, warned pre-Covid can be a “weak software to cope with recession.”

Below the outdated framework, the Fed’s promise when inflation slipped under the two % goal charge was to revive it to 2 % as shortly as attainable. Below the brand new framework, the Fed guarantees to make up for previous undershooting by permitting inflation to overshoot 2 % earlier than it raises charges. That’s a weak software as a result of it solely very not directly evokes anybody within the personal sector to go spend more cash. However what AIT does is hand a really highly effective software to Congress within the type of a assure {that a} strongly stimulated financial system gained’t be offset by fast rate of interest hikes.

An much more costly thought, at the least within the brief time period, can be everlasting extension of a Tax Cuts and Jobs Act provision permitting companies to right away write off the complete value of their capital investments.

The short-term value of that is very excessive since you’re shedding an enormous chunk of company tax income. However the longer-term value is significantly decrease as a result of, as Kyle Pomerleau and Scott Greenberg of the Tax Basis level out, these investments do get written off over time beneath the present tax code anyway. Over an infinite time horizon, the income is basically the identical, although in any finite span of time you increase much less with fast expensing. The mixture of excessive short-term prices and modest long-term ones may make one thing like this a perfect part of an ice cream celebration.

Can Democrats recover from their love of focusing on?

I floated the ice cream celebration idea previous three Democratic economists who had been concerned in Obama-era funds negotiations on both the White Home or congressional aspect, they usually all stated Republicans wouldn’t go for it (given the résumé-swapping going across the transition interval, no one desires to be quoted on the report about something controversial).

These usually are not austerity followers or entitlement reform fans; they only suppose bargaining is more likely to be small-ball stuff just like the 2015 tax extender deal somewhat than an enormous multitrillion-dollar bundle.

Alternatively, two Republicans concerned in tax coverage stated they had been intrigued personally, although they had been additionally pretty skeptical of the politics.

One subject is just that Democrats have historically been leery of this sort of factor. In 2008, Democratic specialists adopted the slogan that fiscal stimulus must be “well timed, focused, and short-term” — i.e., centered on fast transfers of money into the palms of the folks probably to spend it.

The 2009 American Restoration and Reinvestment Act was based mostly on these rules, and the $600-a-week bonus unemployment insurance coverage program within the CARES Act was maybe their final expression. The cash began flowing quick (well timed). It went to individuals who had pressing monetary wants (focused). After which it went away (short-term). Usually the Democratic wonks have to synthesize this view with Democratic Social gathering elected officers’ want to recreate their understanding of an FDR-style public works drive. However each the wonks and the hacks are united of their opposition to the conservative view that long-term funding tax cuts are a good suggestion.

As Samantha Jacoby and Kathleen Bryant wrote of full expensing proposals for the Heart on Finances and Coverage Priorities in June, “These assets can be much better spent on simpler fiscal stimulus instruments.” The implicit mannequin is that there’s some mounted sum of stimulus, and it’s necessary for the stimulus to be nicely focused so that you get probably the most bang on your buck.

The ice cream celebration mind-set: The quantity of stimulus obtainable is restricted by what congressional Republicans are prepared to do, so it doesn’t matter if their concepts are dangerous — it solely issues if they’re prepared to pair their concepts along with your concepts.

However are they?

Can Congress do greater than electioneering?

The basic subject is that electoral politics is zero-sum in a manner that policymaking is just not.

At present, america is having fun with very low rates of interest, which makes it extraordinarily reasonably priced to enact pricey measures. Below the circumstances, the chance is clearly obtainable for a win-win deal during which everybody will get to do one thing large that they’re enthusiastic about. The events don’t have to agree about what taste of ice cream to eat; they only have to agree that everybody will get some ice cream. Cheap folks can disagree about which taste can be serving to the financial system, however it’s fairly clear that one would the truth is assist the financial system.

However that will get us to electoral politics, which is zero-sum. Just one individual can win any given election. And it’s not apparent that Republicans would wish to see plenty of profitable policymaking occur within the Biden years.

Contemplate that early in Trump’s time period, it was widespread for Democrats to fret that the White Home would possibly unveil a very affordable infrastructure proposal. If that occurred, they’d haven’t any selection however to agree after which Trump may develop into a preferred and profitable chief.

Instinctively, Democrats will utterly reject any analogy between the specter of a preferred and profitable Trump (an authoritarian proto-fascist of their view) and a preferred and profitable Biden (a kindly outdated reasonable of their view).

However Republicans might take a special view of issues. This, nonetheless, is why placing everlasting tax cuts on the desk in a deal may very well be so potent. That may be a extremely large coverage win for Republicans. Sufficiently big that Democrats will discover it genuinely painful, however by the identical token large enough that Republicans may discover it genuinely tempting.

Perhaps they gained’t go for it. However extra probably, Democrats gained’t even try and broach the topic — preferring to stay to focused measures, accept much less if vital, and doubtlessly fall again to “eat your peas” efforts to cut back somewhat than enhance the long-term deficit. However the most effective path to a profitable Biden administration is the ice cream celebration, and if there’s one factor we learn about Joe Biden, it’s that he likes ice cream.