The nation’s unemployment insurance coverage program, conceived through the Nice Melancholy, was meant to maintain jobless staff and their househol

The nation’s unemployment insurance coverage program, conceived through the Nice Melancholy, was meant to maintain jobless staff and their households from struggling drops in revenue that would tip them into poverty or pressure them to liquidate their property to afford meals, lease and different requirements.

Its objectives included permitting the unemployed to attend for a productive job to materialize, reasonably than take the primary one which appeared, and offering stability to the financial system in recessions, mitigating the anticipated drop in consumption when hundreds of thousands of staff misplaced their jobs.

The tussle in Congress final month over whether or not to increase emergency unemployment funds that had been on the cusp of expiring — probably pushing 12 million folks into some type of destitution, in line with the Century Basis, a liberal coverage analysis group — was a reminder that the system as designed has not been as much as its activity.

Unemployment insurance coverage is managed and funded by the states, inside unfastened federal pointers. However Washington has been repeatedly referred to as on to offer further reduction, together with emergency patches to unemployment insurance coverage after the Nice Recession hit in 2008. Certainly, it has intervened in response to each recession because the 1950s.

Whereas a federal backstop might make sense for occasions of financial upheaval, the repeated recourse to Capitol Hill underscores the shortcomings of a chronically underfunded, patchwork system that has not saved up with modifications within the office and places the unemployed on the mercy of the nation’s political winds.

Whereas the surge in unemployment brought on by the pandemic might supply a gap to overtake this system — a chance strengthened by Democrats’ takeover of the White Home and the Senate — any push for change should overcome highly effective incentives vying to additional shrink this system.

The system provides states incentives to reduce protection.

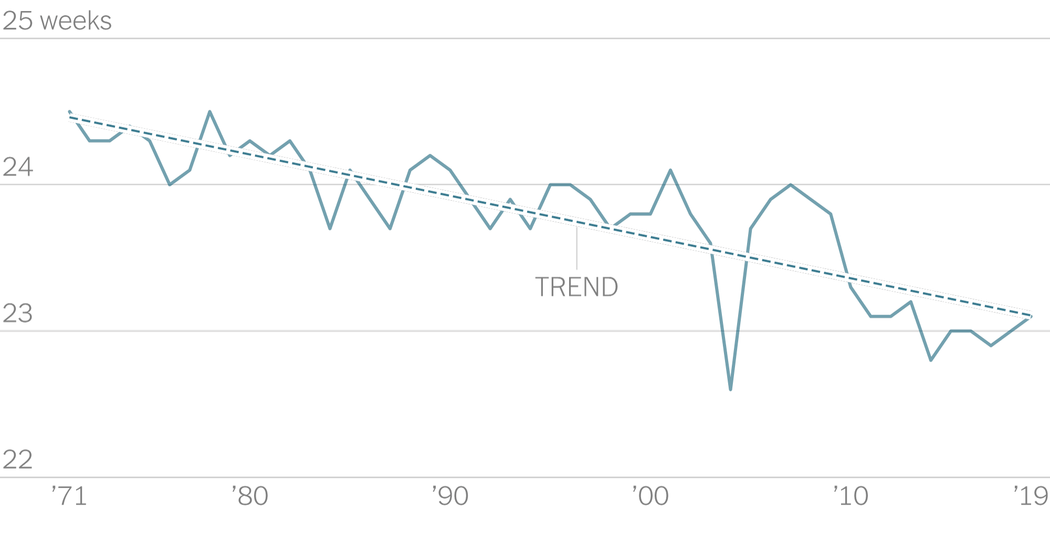

In 2019, solely 27 % of unemployed staff acquired any advantages, a share that has been declining during the last 20 years. The advantages have eroded as effectively, to lower than one-third of prior wages, on common, about eight proportion factors lower than within the 1940s.

The quick purpose is cash. However the issue is sophisticated by this system’s structure: Reluctant to boost taxes from employers, many states have resorted to slicing advantages.

Take into account the wage base towards which unemployment taxes are levied. There’s a ground established by the federal authorities. Nevertheless it has remained caught at $7,000 a employee because the 1970s. In Florida, Tennessee and Arizona, employers should pay taxes solely towards this minimal, and face tax charges that may be as little as one one-hundredth of a penny on the greenback.

As their tax base has didn’t sustain with both inflation or staff’ earnings, these states have shortened advantages, decreased weekly funds or elevated hurdles to qualify, making it tougher for staff with low or irregular earnings to gather something.

In Arizona, practically 70 % of unemployment insurance coverage functions are denied. Solely 15 % of the unemployed get something from the state. Many don’t even apply. Tennessee rejects practically six in 10 functions.

In Florida, just one in 10 unemployed staff will get any advantages. The state is notably stingy: not more than $275 every week, roughly a 3rd of the utmost profit in Washington State. And advantages run out rapidly, after as little as 12 weeks, relying on the state’s total unemployment fee.

“The iceberg underneath the floor is about funding,” mentioned Until von Wachter, a professor of economics on the College of California, Los Angeles. “The problem to reform it’s that it’s a federal-state partnership.”

States competing to be probably the most business-friendly, with the bottom taxes, will kind of naturally enable their unemployment techniques to develop into underfunded, mentioned Robert Moffitt, a professor of economics at Johns Hopkins College. The result is hardly optimum.

“This system was set as much as have large cross-state variation,” he mentioned. “This is unnecessary. It creates large inequities.”

This system has not saved up with modifications in the best way folks work.

Even states with extra beneficiant unemployment techniques depart a lot of folks out. In New Jersey, the place the protection fee is the very best within the nation, fewer than 60 % of unemployed staff acquired advantages in 2019.

For low-wage staff, this system may be pointless. Mr. von Wachter notes {that a} program conceived to offer at most half of unemployed staff’ misplaced wages leaves low-wage staff within the lurch. But in lots of states that doesn’t matter, as a result of minimal earnings necessities to qualify for advantages knock low-wage staff out of the system.

The gaps within the largest social insurance coverage program for working-age Individuals have develop into more and more problematic as financial and demographic modifications have remodeled each the profile of the work pressure and the character of labor.

Deindustrialization and the expansion of low-wage service jobs have been accompanied by a persistent improve within the length of joblessness because the 1970s. This has been pushed, partly, by the decline of non permanent unemployment — furloughs and different short-term preparations — and the corresponding improve of everlasting dislocations, forcing the unemployed to seek out jobs that require new abilities.

The system was designed in 1935 for an industrial financial system by which breadwinners — sometimes males — supported a household with a fairly paid job that may final till retirement. It has proved an unwell match for a labor market the place most working-age ladies are additionally employed, usually in low-paid, part-time jobs which might be inadequate to qualify for advantages. Sure new job varieties, like gig work, will not be inside the design of the unemployment system.

Whereas staff are sometimes required to accumulate abilities or certifications to discover a new job, unemployment insurance coverage applications supply little coaching or re-employment help. And the prospect of shedding jobless advantages as quickly as they earn a penny discourages staff from trying to find non permanent employment whereas ready for one thing higher.

There could also be momentum to rethink the security web’s construction.

Maybe there’s an upside to the present disaster: The obvious insufficiencies of the common unemployment system might encourage states and the federal authorities to undertake complete modifications.

Economists have been proposing modifications for many years. One is to overtake the “prolonged profit” program, created in 1970 to offer the extra weeks of funds in occasions of excessive unemployment, the type of computerized stabilizing function that would take away the necessity for Congress to repeatedly contemplate extraordinary measures.

That program has not labored as marketed. The triggers to place prolonged advantages into impact — principally a operate of the share of staff claiming advantages in a state — are too sluggish to offer speedy help when the financial system declines. The advantages might expire too quickly to cowl staff over the lengthy downturns which have develop into a part of the financial panorama. Most critically, the truth that states should pay for half of the prolonged advantages is a strong incentive for them to erect hurdles to qualifying.

Some who’ve studied the system recommend that the federal authorities may choose up the tab solely for prolonged advantages. Different proposals embrace elevating the wage base and indexing it to wage progress; establishing a federal profit ground and a minimal length; and making it simpler for low-wage and part-time staff to qualify for advantages. Concepts embrace permitting staff to take care of some advantages even after they discover a job or go into coaching, and providing help to staff who stop as a result of a partner has relocated for profession causes. Some specialists have even referred to as for federalizing this system, a politically heavy raise that may run into many states’ distrust of federal energy.

Senator Ron Wyden of Oregon, the Democrat who will lead the Finance Committee, is pushing for President Biden to pursue an overhaul of unemployment help alongside these traces. Mr. Wyden has referred to as for “rising base advantages in order that unemployed staff can cowl necessities” and “guaranteeing all unemployed staff can get a profit no matter their work historical past.”

Whereas Mr. Biden has not dedicated to the enhancements proposed by the senator, he has come out in help of the way to routinely alter the size and quantity of advantages relying on well being and financial circumstances, stopping Congress from blocking or slowing down reduction.

It won’t be straightforward, nevertheless, to deliver states round to construct a extra expansive, uniformly beneficiant program.

Mr. Moffitt of Johns Hopkins notes that Congress could also be reluctant to increase computerized stabilizers just because it likes to maintain management over spending. If the federal authorities goes to bear the price of emergency insurance coverage, members of Congress will need their say.

These on the lookout for a silver lining may contemplate the final recession. The Obama administration supplied billions of {dollars} in incentives for states to make their applications extra beneficiant, to open them extra broadly to part-time staff and people with unstable or low earnings, to increase advantages for folks in coaching applications, and to grant further advantages to unemployed staff with dependents.

Many states went in the wrong way. With their unemployment insurance coverage funds exhausted, states had taken on debt to take care of common funds for an avalanche of dislocated staff. By early 2011 they owed the Treasury about $42 billion. Fairly than elevate taxes to repay the loans, many states, largely within the South and the Midwest, slashed advantages.

As we speak, the unemployment funds in 19 states face an mixture debt of $47 billion to the federal authorities. Stephen Wandner, an professional in unemployment compensation on the Nationwide Academy of Social Insurance coverage, expects many states to make additional cuts in advantages. “These points will all be fought out in state legislatures,” he mentioned.

A extra beneficiant unemployment insurance coverage system might require bypassing states’ incentives. That may require a considerable political effort.

Graphics knowledge sources: Stephen Wandner of the Nationwide Academy of Social Insurance coverage and Christopher O’Leary of the W.E. Upjohn Institute for Employment Analysis.