It’s Occupy Wall Avenue, the sequel. It’s components of the Tea Occasion, once more. It’s Bernie bros and MAGA-maniacs.The hordes of younger mercha

It’s Occupy Wall Avenue, the sequel. It’s components of the Tea Occasion, once more. It’s Bernie bros and MAGA-maniacs.

The hordes of younger merchants who this week fueled a spectacular surge within the worth of the online game retailer GameStop might lack a unified political ideology. However they’ve compelled a counting on Wall Avenue, and caught the eye of leaders in Washington who acknowledge a populist rebellion once they see one.

Wall Avenue has lengthy been a straightforward villain for a lot of on Capitol Hill. However the rush to facet with speculative merchants by each Democrats and Republicans displays the broad recognition of the impulses which have pushed American politics in recent times, fueling each the ascension of President Donald J. Trump and a liberal wing of the Democratic Occasion that grew stronger in opposition.

The choice by the web brokerage app Robinhood to impose buying and selling limits as hedge funds had been hammered by the wild market fluctuation has prompted the rarest of all political occurrences — bipartisan settlement. Lawmakers from throughout the political spectrum condemned the transfer and known as for hearings into the choice, amongst them Senator Ted Cruz of Texas, a Republican and staunch conservative, and Consultant Alexandria Ocasio-Cortez of New York, a standard-bearer of the left. The conservative lawyer common of Texas and his progressive counterpart in New York have each initiated inquiries into Robinhood.

“For years, the inventory market has been much less and fewer in regards to the worth of enterprise and increasingly more like on line casino playing,’’ mentioned Senator Elizabeth Warren, Democrat of Massachusetts, who known as for elevated regulation of Wall Avenue shortly after the market frenzy over GameStop started this week.

“GameStop is simply the most recent and most seen instance,’’ she mentioned in an interview on Friday. “We have to take this not as a one-off drawback however as a systemic drawback that requires systemic regulation and enforcement.”

Whereas President Biden defeated Mr. Trump with a centrist message of restoring political norms, the buying and selling frenzy this week offered a potent reminder of the sturdy undercurrent of grievance and institutional mistrust within the nation. Many consider that can solely intensify because the nation wrestles with the financial fallout from a devastating pandemic.

As Wall Avenue booms, unemployment has hit document highs with practically 10 million fewer individuals holding jobs than in the beginning of final yr — a state of affairs that reminds some former officers of the 2008 financial disaster that led to each the Occupy Wall Avenue and the Tea Occasion actions.

“It’s not about Republicans and Democrats,” mentioned Newt Gingrich, the previous Republican Home Speaker and an ally of Mr. Trump. “It’s heaps and plenty of regular, on a regular basis individuals who started to determine they actually obtained ripped off for the final yr identical to they obtained ripped off in 2008 and 2009.” He added, “What you’re seeing is an nearly spontaneous cultural response through which the little guys and gals are getting collectively and going after the bigs, so the bigs are having to rig the sport with the intention to survive.”

The truth is extra sophisticated. There’s little signal of any central political mission shared by the hundreds of thousands of novice merchants who mixed to squeeze no less than two hedge funds that guess towards the shares of corporations like GameStop and the film chain AMC. One of many originators of the scheme is much from a “little man,” with the monetary assets to allegedly remodel an preliminary funding of $53,000 into $48 million. General, solely about half the nation owns any inventory in any respect.

On Reddit, the web website that helped gas the surge, few of the largely younger members body their flood of investments in clearly partisan phrases. But many write of being pushed by anger over the 2008 monetary bailouts that saved the massive banks afloat whereas 10 million People misplaced their properties.

“When that disaster hit our household, we had been in a position to maintain our little home, however we lived off of pancake combine, and powdered milk, and beans and rice for a yr,’’ one particular person recognized as ssauronn posted on Reddit. “Your ilk had been bailed out and rewarded for awful and unlawful monetary selections that negatively modified the lives of hundreds of thousands.”

Different posters responded with their very own tales of financial battle and political rage.

“Neglect republican/democrat, left/proper… the bankers play either side and have nearly at all times come out on high,” a poster recognized as ChrisFrettJunior wrote, after recounting watching his mother and father battle via the 2008 recession.

The choice to bail out the largest banks and in addition decline to prosecute any of their high executives led to a lot of the populist fervor that has pushed American politics up to now decade. The Tea Occasion surged to political prominence within the wake of the $700 billion monetary rescue bundle that handed in 2008, ultimately changing into a pressure that defeated each reasonable Republicans and Democrats.

After Republicans received management of the Home in 2010, Democrats started to face their very own backlash, starting with Occupy Wall Avenue — a free coalition of largely liberal protesters who fueled a nationwide dialog about financial inequality.

Lately, political strategists warn, hedge funds, personal fairness traders and bankers are unlikely to search out the identical form of deep assist in Washington. Anger over the bailouts fueled the campaigns of political outsiders, making a Congress that’s much less receptive to the pleas of Wall Avenue and way more keen to utilize upheaval to advance their agendas.

“There’s a ton of political forex in holding hedge funds’ ft to the fireplace from Democrats and Republicans,” mentioned Josh Holmes, a Republican strategist and longtime adviser to Senator Mitch McConnell. “Should you’re sitting on Wall Avenue this, dismissing individuals as people who don’t perceive the way in which that the markets work, I believe you’re going to be in numerous bother.”

For Republicans, the market upheaval was a referendum on elitism. Democrats noticed pure company greed and the necessity for larger regulation.

“Large Hedge, with outposts in South Hedge-i-stan (Wall Avenue) and North Hedge-i-stan (Greenwich, CT), has made trillions shorting nice American corporations dealing with a tough patch,” mentioned Consultant Jeff Fortenberry, a Republican of Nebraska. “Now they’re getting a comeuppance from flash mobs of day merchants and are paying dearly.”

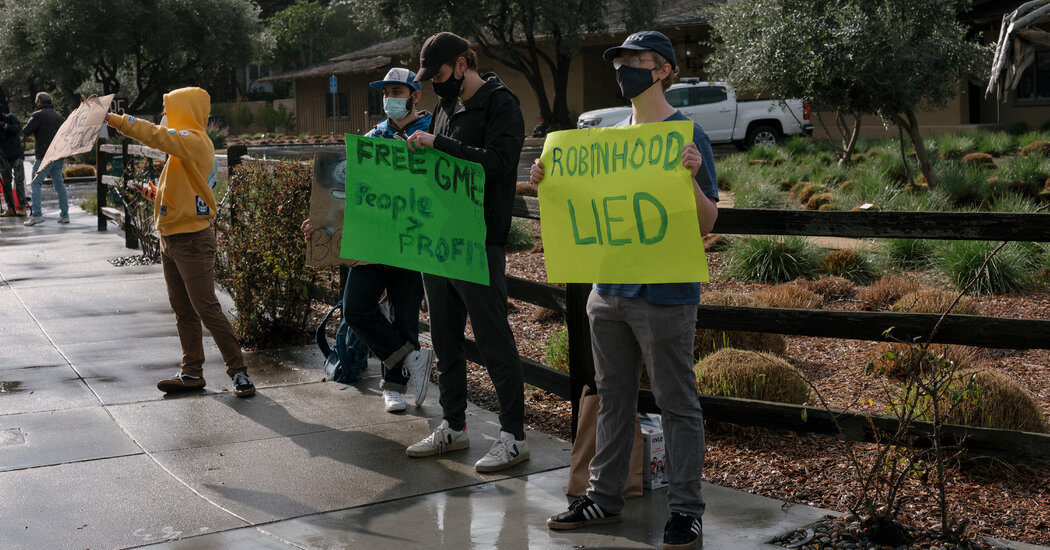

A lot of the ire this week was directed at Robinhood, a brokerage app catering to youthful traders, which out of the blue restricted buying and selling in GameStop, AMC and different shares. Lawmakers argued that the app was defending hedge funds and different large traders over retail traders. Robinhood mentioned the extra restrictions had been essential to adjust to authorities monetary necessities.

But even centrists like Senator Pat Toomey of Pennsylvania, who’s poised to turn out to be the highest Republican on the Senate Banking Committee, expressed issues in regards to the lack of transparency within the on-line firm’s determination making.

“I discover it disturbing when retail traders who’re merely searching for to purchase a inventory are frozen out of the market,” Mr. Toomey mentioned in an announcement. “Retail traders ought to be free to buy even extremely speculative shares, simply as hedge funds ought to be free to quick them.”

Although politicians from either side joined requires larger scrutiny, it was hardly a kumbaya second for the 2 events.

After Mr. Cruz tweeted that he agreed with Ms. Ocasio-Cortez’s name for a probe into Robinhood’s motion, she shortly disavowed any assist from the Texas Republican, who was a distinguished backer of Mr. Trump’s baseless claims of election fraud.

“I’m blissful to work with Republicans on this difficulty the place there’s widespread floor, however you nearly had me murdered three weeks in the past so you’ll be able to sit this one out,” she responded. “Pleased to work w/ nearly some other GOP that aren’t making an attempt to get me killed. Within the meantime if you wish to assist, you’ll be able to resign.”

Mr. Cruz condemned her response as “partisan anger” that’s “not wholesome for our nation,” drawing one other response from Ms. Ocasio-Cortez, whereas his allies within the Home known as for an apology.

The uproar over GameStop and Robinhood comes at a difficult time for the Biden administration, which took workplace promising to revive a way of calm to the nation. The Senate Banking Committee has but to schedule a listening to to substantiate Gary Gensler, Mr. Biden’s decide to guide the Securities and Alternate Fee, leaving the company with an appearing chair for the indefinite future. On Friday the White Home press secretary, Jen Psaki, deferred questions on the difficulty.

“It’s an excellent reminder, although, that the inventory market isn’t the one measure of the well being of our economic system,” she mentioned, an obvious reference to Mr. Trump’s persistent fixation on inventory costs throughout his tenure. Mr. Biden has not but commented on the difficulty.

Consultant Ro Khanna of California, a progressive who represents a district that features Silicon Valley, mentioned this week’s occasions ought to alert lawmakers to the necessity to tighten monetary laws and improve transparency and fairness.

He mentioned the big selection of Republicans and Democrats who’ve spoken out are a mirrored image of “an actual populist anger on this nation.”

“Some individuals go get fancy levels, know the fitting individuals, and spend all day in entrance of their computer systems quick promoting,” Mr. Khanna mentioned. “And it’s a type of manipulation that has harm our nation. That has enriched the few on the expense of many People.”

Although many People personal no inventory in any respect, the sense that Wall Avenue has gamed a rigged system cuts throughout demographic obstacles, he argued.

“I believe this has been effervescent up because the Wall Avenue crash of 2008,” Mr. Khanna mentioned. “And it’s coming to a boiling level.”