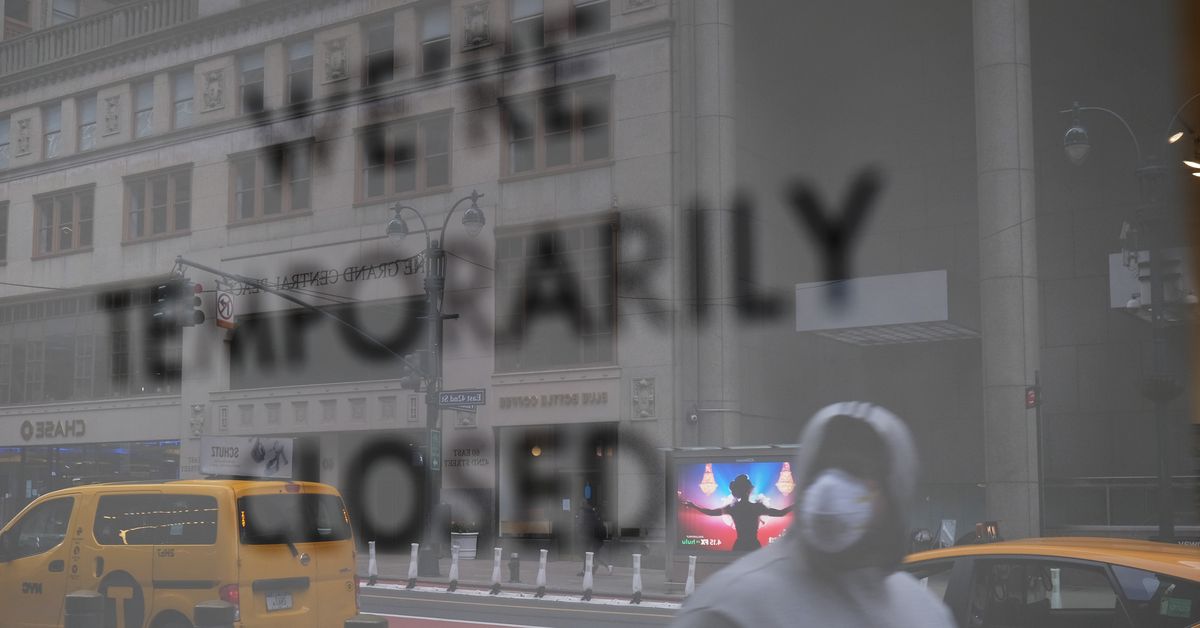

America is within the midst of its second main financial decline within the span of simply over a decade, and this one is, in some ways, large

America is within the midst of its second main financial decline within the span of simply over a decade, and this one is, in some ways, larger and scarier.

“This disaster is way worse than the one which we confronted in 2008,” Sen. Elizabeth Warren, who was within the trenches of the final downturn, advised me. “It began with a pandemic, and the financial fallout can’t be arrested till the pandemic is beneath management.”

Thousands and thousands of individuals are at the moment unemployed, with a whole bunch of hundreds of staff newly reporting they’ve misplaced their jobs almost each week. States and cities are going through huge price range shortfalls, and hundreds of small companies are going beneath. Households throughout the nation are going through the prospect of shedding their properties. Girls and other people of colour are experiencing significantly acute financial hurt.

This decline goes to take effort and time to dig out of, partly as a result of many People are nonetheless making an attempt to get again on their ft from the final time round. The restoration from the Nice Recession was skilled in deeply unequal methods throughout the US. The inventory market recovered a lot faster than the job market, not to mention wages. Years after the recession ended, staff within the hardest-hit areas had been nonetheless behind, and Black households particularly had been nonetheless working to rebuild misplaced wealth.

The consequence: a rebound that not solely failed to repair inequality however that in lots of instances really made it worse. Policymakers stepped in to save lots of the monetary system and banks that had brought about a lot of the disaster within the first place and did a lot much less when it got here to serving to the person victims of the disaster, comparable to individuals who misplaced their properties and jobs. In an effort to keep away from doing even barely an excessive amount of to spur the restoration, lawmakers in the end did too little.

“We’re making the identical main mistake this time as we did final time, which is we’re assuming an financial system that rebounds faster than it’s going to,” Aaron Klein, a fellow on the Brookings Establishment who labored on Dodd-Frank, advised me. “Job recoveries and the influence on working folks lasts a lot longer, and markets rebound a lot sooner than jobs, significantly jobs for folks with out faculty levels.”

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/21894207/85802440.jpg.jpg)

Now, Congress is dragging its ft on extra stimulus, whilst state and metropolis governments proceed to sound the alarm and staff of colour disproportionately proceed to battle. The more serious the financial system is allowed to turn out to be, the longer and tougher it takes for it to get higher, and people already at a drawback in the end are those that suffer most.

“The slower we’re to supply the assistance that households want, the higher the possibility {that a} restoration stalls out and that individuals’s lives are altered completely,” Warren stated. Momentary job losses turn out to be everlasting, missed mortgage funds turn out to be foreclosures, and piling-up payments turn out to be chapter. “All of these items begin to cascade within the unsuitable route.”

However this isn’t inevitable. America may do issues in a different way.

The present disaster brings with it a possibility to rethink what the financial system ought to appear like and attempt to rebuild in a manner that’s useful to everybody, not solely these on the prime. And if Joe Biden wins the White Home and Democrats handle to take a majority within the Senate, they may have an actual probability at making it a actuality. It’s a troublesome job, however not essentially an inconceivable one.

I spoke with almost a dozen economists and consultants about what an equitable manner of rebuilding the financial system would possibly appear like. There are already loads of coverage proposals that should do that, however what ties them collectively is an overhaul in how we take into consideration the position of presidency, the way it units priorities, and who it really works for. This new paradigm entails a authorities that takes a extra energetic position in shaping the financial system and sees past top-line indicators to take a look at what totally different teams are actually experiencing of their on a regular basis lives.

In order for you a fairer financial system, you’ve bought to deal with the folks for whom it’s most unfair and ensure they’re not being left behind, particularly whereas those that have already got benefits prosper.

“The coronavirus pandemic and the next financial disaster have hit economically susceptible People and communities of colour the toughest,” Warren stated. “We should make sure that our response matches the dimensions of this huge disaster in order that staff, households, and state, native, and tribal governments don’t pay the worth for years and years to return.”

Or, as Rakeen Mabud, director of analysis and technique at Time’s Up, put it: “We’d like a elementary rethinking about the way in which we method our social contracts, and that’s a really, very long-term undertaking. However it wants to begin in some unspecified time in the future, so why not now?”

It’s all the time higher to be wealthy in America than it’s poor, particularly in occasions of disaster

Already, the present downturn is popping out to be much less traumatic for rich and well-established folks than it’s marginalized teams and the poor.

The inventory market is hovering, despite the fact that tens of millions of individuals are out of a job. The Federal Reserve has actually stepped up by way of financial coverage to inject liquidity into the financial system and maintain markets afloat, whereas Congress hasn’t actually saved up its finish of the discount. It handed the Coronavirus Help, Aid, and Financial Securities Act, or the CARES Act, in March, however a lot of the assist from it has dried up, and it’s not clear what, if something, Capitol Hill plans to do subsequent on the financial system.

“The wealthy expertise these recessions a lot in a different way than the remainder of us,” Bharat Ramamurti, managing director of the Roosevelt Institute’s company energy program, advised me. “The ache is way more time-limited, it’s not as deep, and because of this, they recuperate way more shortly, after which they’re able to make the most of the truth that different actors within the financial system are nonetheless struggling and might use that to additional consolidate their management and their energy.”

Even earlier than the coronavirus, inequality was already rampant throughout the nation. It’s being made worse proper now. And no matter occurs in comparatively brief durations of financial downturn in the end units the stage for the financial system for years to return.

In 2017, President Donald Trump signed into legislation a tax lower invoice that disproportionately benefited firms within the wealthy, permitting them to hoard extra wealth. That principally allowed the financial system to “spiral upwards,” defined Heather Boushey, who heads the Washington Heart for Equitable Progress and is advising the Biden marketing campaign on the financial system. So a part of the trail to an equitable restoration is growing taxes for these with more cash. However that’s solely half of it.

“One factor Covid underscores is that we positively have to shore up our methods to guard staff and households,” Boushey stated.

Within the instant time period, that would imply measures the CARES Act took (a few of which have now expired), comparable to expanded unemployment insurance coverage, eviction moratoriums, and mortgage and pupil mortgage forbearance. If folks fall much less behind, it’s not as onerous to catch up. They usually want a good period of time to do it.

“Even when Congress manages to get it collectively and supply some assist to lower-income and middle-income households, it’s time-limited, and the inclination is to show it off on the slightest trace that issues could also be getting higher,” Ramamurti stated.

That’s actually taking part in out within the present context. After coming back from recess in September, Senate Republicans put forth a “skinny” stimulus to counter a way more formidable package deal proposed by Democrats within the Home in Might. However even the GOP’s invoice failed within the Senate — as Vox’s Li Zhou defined, partly as a result of it was extra of a messaging invoice than a honest effort at serving to the American public. The financial system isn’t as dangerous as a number of the doomsday predictions, so some lawmakers appear to have determined extra help isn’t obligatory.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/21894213/1271778731.jpg.jpg)

However it’s essential to notice that to essentially rebuild higher requires greater than combating the instant issues. It means wanting a lot farther down the horizon.

“I don’t suppose we will flip too shortly to issues like constructing employee energy, growing wages, lowering inequality, and taxing wealthy folks,” Angela Hanks, deputy government director on the Groundwork Collaborative, advised me.

Measure Black unemployment, not the inventory market

If you happen to checked out what was taking place on Wall Avenue proper now and knew nothing else about what was taking place within the US, you’d suppose issues had been superior. Like, actually unicorns and butterflies. However the inventory market, which has been pretty persistently climbing since late March, doesn’t mirror the entire of what’s happening within the financial system. The truth is, there’s been fairly a divergence between the inventory market and the financial system, not solely now, however throughout latest many years.

“Once we see the inventory market so excessive, that’s cash within the palms of people that don’t have to spend it, and it’s not a very good scenario for the financial system generally,” Ken-Hou Lin, a sociologist on the College of Texas at Austin and co-author of Divested: Inequality within the Age of Finance, advised me.

However it’s not simply wanting on the inventory market as a proxy for a way the financial system’s doing that’s problematic — loads of the measures we use to gauge coverage selections may use an improve. Constructing again in a manner that actually is healthier means ensuring that individuals who have been structurally excluded are centered in decision-making.

When the financial system is rising, it’s essential to know who’s — and isn’t — experiencing that development.

In February, earlier than the pandemic hit, the general unemployment charge was 3.5 %, however for Black staff, it was 5.Eight % — the general unemployment charge in November 2014.

“If white unemployment was nonetheless at 6 % [in early 2020], we might have been speaking about an actual disaster,” Hanks stated.

Now, the scenario is worse. The general unemployment charge in August was 8.Four %, however when damaged down by race, how totally different the scenario is for various teams turns into obvious: white unemployment was 7.Three %, whereas Black unemployment was 13 %, Hispanic unemployment 10.5 %, and Asian American unemployment 10.7 %. As Vox’s Aaron Ross Coleman just lately wrote, on this situation, Republicans and even some Democrats are saying much less help is important for the unemployed, which can in the end hurt communities of colour most:

However now, because the top-line unemployment numbers have come down, Congress has failed to return to any consensus on support for its most susceptible residents, significantly minorities. And this failure has left these People with no support in any respect, abandoning them to endure the results of excessive unemployment on this unprecedented recession. And regardless of previous warnings concerning the problem folks of colour have in recovering from recessions, lawmakers are repeating the errors.

Traditionally, the unemployment charge for Black and Hispanic People has trended greater than white unemployment — however we shouldn’t simply settle for that.

If the federal government assesses progress by way of the lens of those that are most marginalized and targets benefiting them, it will make a distinction in how insurance policies are applied and gauged. In June, Jared Bernstein and Janelle Jones laid out an argument in a paper on the Heart for Finances and Coverage Priorities that the Federal Reserve ought to goal the Black unemployment charge when setting insurance policies. If a sure unemployment charge isn’t acceptable for white People, what would make it acceptable for Black People? As an alternative of specializing in the top-line quantity when making fiscal stimulus selections now, why not deal with actually bettering the quantity for Black staff?

“It isn’t that radical that we be sure that we heart the pursuits of the huge inhabitants of working folks — Black and Latin communities, working ladies — which have so lengthy been neglected over the pursuits of a really small group. A part of that’s the manner that we assess success,” Mabud stated.

Spending cash and setting guidelines

A variety of large sweeping change requires important funding from the federal government, a undertaking on the dimensions of the $1.5 trillion tax lower the GOP-led Congress handed in 2017.

Folks I spoke with talked about numerous concepts for main spending initiatives that would have a huge impact — an infrastructure package deal, a federal jobs assure, child bonds. They deal with near-term issues but in addition have long-term, widespread advantages.

Infrastructure spending to improve transportation, communications, water, and power would create jobs and in addition assist the encompassing communities. “We have to have a imaginative and prescient that builds one thing, and that one thing ought to supply optimistic returns for society,” Klein stated. “There’s loads of issues we may do as a society and we’re not, and a part of it’s we’re viewing the issue as short-term.”

A federal jobs assure wouldn’t simply give somebody one thing to do for work — it will additionally create competitors with the non-public sector. “Even for present staff, by eradicating the specter of unemployment, they will higher discount with out the concern of being destitute as a result of they’ve restricted to no different choices,” Darrick Hamilton, the manager director of the Kirwan Institute for the Research of Race and Ethnicity at Ohio State College, advised me.

And simply getting cash from the federal government to bizarre People would make a distinction. A variety of federal authorities stimulus has gone to the highest within the hope it’s going to trickle all the way down to everybody else. Why not forgo hoping that the intermediary method will work out?

“As a way to generate wealth, essentially the most important ingredient is capital itself, irrespective of somebody’s need to save lots of, someone’s ingenuity,” Hamilton stated.

Ramamurti additionally pointed to the concept of canceling pupil debt. “You may cancel all pupil mortgage debt administratively, or cancel an enormous chunk of it. That might have an infinite influence, proper? It could assist shut the racial wealth hole, it will assist push again on declining charges of homeownership and small enterprise formation amongst folks of their 20s and 30s,” he stated.

However even in a world the place Biden wins the White Home, Democrats are accountable for the Senate, and there’s a actual political impulse to place some progressive, inequality-reducing insurance policies in place, there’ll doubtless be fairly a little bit of consternation about spending and the deficit. With out stepping into whether or not the debt actually issues, the excellent news is there are measures that may be taken that don’t require a dime of spending. As an alternative, they’re about resetting the foundations of the street.

“You actually must deal with the foundations and establishments that proceed to supply suboptimal outcomes for the entire financial system, and particularly for black staff, immigrants, ladies, and so forth.,” Felicia Wong, president and CEO of the Roosevelt Institute, advised me. “That you must focus not solely on the outcomes however you additionally must deal with the foundations and the mindset that produces these issues within the first place.”

Altering guidelines with out spending new cash may are available numerous types: elevated antitrust scrutiny, extra sturdy regulatory oversight, a transfer towards industrial coverage, stronger unions, and extra employee energy.

However the clock is ticking. The longer the nation goes with out motion now, regardless of the consequence of the presidential election, the more severe this all turns into. “Look how far off we nonetheless are from the top of January. It’s not like Joe Biden and Kamala Harris can are available and flick a swap. There’s going to be a lot for them to do,” Warren stated.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/21894348/1271597309.jpg.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/21856458/1228132618.jpg.jpg)

The Massachusetts Democrat significantly sounded the alarm about state and native authorities funding. Most states have balanced price range amendments, and so they’ve seen their prices skyrocket as revenues fade, which means in the event that they don’t get federal assist, they’ll must make cuts that may have penalties for years.

“The entire enterprise round state and native governments, that is the one which simply stuns me, that states and native governments and tribal governments are on the hook for delivering companies day-to-day by day, and so they’re all caught on this enormous squeeze,” she stated. Whereas Senate Majority Chief Mitch McConnell has tried to solid the problem as a blue-state one, it’s being skilled by crimson states, too. “There are Republican governors, Republican-controlled legislatures, who want that cash to maintain colleges open and to maintain public well being initiatives operational. The Republicans in Washington merely say, ‘Too dangerous,’” Warren stated.

“America can afford what we determine to do collectively”

A January 2021 the place Joe Biden is president and Democrats have a majority within the Senate doesn’t assure some sweeping progressive financial agenda that actually will get on the coronary heart of inequality.

For one factor, you’ve bought the filibuster, which Democrats would nearly must do away with to get large items of laws by way of. However for one more factor, whereas Biden has actually moved to the left, it’s not like we’re headed towards some progressive utopia, and it’s not clear how dedicated he might be to progressive financial insurance policies. A Democratic president and Democratic Senate oversaw the restoration from the final recession.

“A Democratic authorities led the jobless restoration [after the Great Recession], let’s be very clear about that,” Demond Drummer, government director of the progressive coverage suppose tank New Consensus, advised me. “I believe we’re most likely nearer to creating the identical errors structurally that we did in 2008, 2009, 2010 if we don’t reexamine and actually, to cite Lincoln, ‘disenthrall ourselves’ of the considering that creates jobless recoveries, of the considering that has created a dematerialized, jobless financial system, of the considering that has closely constrained the position of the general public sector within the lifetime of the nation and, extra particularly, within the financial lifetime of the restoration.”

To inject some optimism, it’s not that broad, structural change isn’t doable — take a look at the New Deal that, whereas not good, actually reshaped a lot of the nation’s financial system.

“The New Deal was on a scale that utterly is a lot bigger than what our latest stimuluses have been,” stated Megan Tobias Neely, a sociologist on the Copenhagen Enterprise Faculty and co-author of Divested: Inequality within the Age of Finance. “The important thing a part of it was not solely the dimensions but in addition the truth that it was actually geared towards bolstering infrastructure and using folks to do this.”

And the present disaster has actually proven that the federal government can do large issues if it desires to. The Fed has taken extraordinary measures to assist assist the financial system, and to a lesser however nonetheless important extent, so has Congress. The US authorities sending $1,200 checks to folks would have appeared fairly unthinkable pre-Covid-19.

The nation is at a crossroads proper now, and there’s a potential path forward that’s fairer and extra affluent for extra folks. However it actually would require an overhaul in what we worth, who we design insurance policies for, how we spend, and the way we make the foundations. There are myriad concepts on the market for what this might appear like on a particular stage, however there’s no silver bullet on financial insecurity. Rebuilding an financial system that’s equitable means conserving inequality prime of thoughts each step of the way in which because the federal authorities charts a path ahead.

“This financial crash … hit susceptible folks and communities of colour the toughest and is most probably to have long-term results there if we don’t use this as a second to make investments in these communities, and that’s what we have to do now,” Warren stated.

“There may be this lie that authorities intervention is anathema to the American undertaking, when certainly the American undertaking is authorities intervention within the financial system from the start,” Drummer stated. His takeaway: “America can afford what we determine to do collectively.”

Assist maintain Vox free for all

Thousands and thousands flip to Vox every month to know what’s taking place within the information, from the coronavirus disaster to a racial reckoning to what’s, fairly presumably, essentially the most consequential presidential election of our lifetimes. Our mission has by no means been extra important than it’s on this second: to empower you thru understanding. However our distinctive model of explanatory journalism takes sources. Even when the financial system and the information promoting market recovers, your assist might be a important a part of sustaining our resource-intensive work. If in case you have already contributed, thanks. If you happen to haven’t, please take into account serving to everybody make sense of an more and more chaotic world: Contribute right now from as little as $3.