Subsequent Tuesday, the Supreme Courtroom will hear Seila Law v. CFPB, which asks whether or not the president is allowed to fireside the top of

Subsequent Tuesday, the Supreme Courtroom will hear Seila Law v. CFPB, which asks whether or not the president is allowed to fireside the top of the Client Monetary Safety Bureau (CFPB) at will. That query could appear minor and esoteric, however the stakes underlying Seila Legislation are enormous.

There may be an off likelihood that the Courtroom may use this lawsuit to strike down the whole CFPB — a choice that might dismantle a lot of the infrastructure Congress inbuilt response to the 2008 monetary disaster. In the meantime, there’s a a lot better likelihood that the Courtroom will use this case to essentially alter the steadiness of energy between the president and the federal authorities’s “unbiased” companies.

The “Seila Legislation” within the Seila Legislation case is a regulation agency that’s being investigated by the CFPB for allegedly participating “in unlawful acts or practices within the promoting, advertising and marketing, or sale of debt reduction providers.” This lawsuit is its Hail Mary try to finish that investigation by having the whole company conducting the investigation struck down. But, whereas that end result is unlikely, the Courtroom’s choice in Seila Legislation is prone to essentially rework the steadiness of energy between the president and numerous “unbiased companies.”

Numerous federal officers, starting from the CFPB director, to Federal Reserve governors, to members of the Federal Commerce Fee, serve in unbiased companies. That implies that the company’s leaders get pleasure from a certain quantity of job safety. They are often fired by the president, however solely “for cause” or for “inefficiency, neglect of duty, or malfeasance in office.”

The authorized principle animating Seila Legislation is that the CFPB director, at the least, might not be given this sort of job safety. As a constitutional matter, the legal professionals behind Seila Legislation argue, the president has the authority to supervise the CFPB — and that features the facility to fireside its director if the president objects to how the CFPB is being run.

Within the brief time period, a choice permitting the CFPB director to be fired at will by the president may gain advantage Democrats — the present director, Kathy Kraninger, is a Trump appointee whom a Democratic president would in all probability choose to interchange as quickly as doable. However there are additionally excellent the reason why the heads of unbiased companies are protected against being fired. And, if the Supreme Courtroom strips these company heads of their safety, President Trump may simply discover new methods to abuse his energy.

If the president had the facility to fireside Federal Reserve governors at will, for instance, he may take away Fed governors except they goose the financial system by maintaining rates of interest low throughout a presidential election 12 months — doubtlessly altering the end result of that election.

The “unitary government,” defined

Seila Legislation could possibly be the end result of a conservative campaign that started greater than three many years in the past, with Justice Antonin Scalia’s dissenting opinion in Morrison v. Olson (1988).

Morrison concerned a federal regulation, which expired in 1999, that offered for “unbiased counsels” — a type of particular prosecutor who may solely be fired for trigger. The Courtroom upheld this regulation in a 7-to-1 choice, with Scalia the one voice in dissent.

As Scalia argued, the Structure supplies that “the chief Energy shall be vested in a President of the United States.” This provision, in keeping with Scalia, “doesn’t imply a few of the chief energy, however all of the chief energy.” Thus, as a result of the facility to deliver prosecutions is vested within the government department, there can’t be a prosecutor who’s “unbiased” of the president. Below Scalia’s view, federal officers should both serve on the pleasure of the president, or be accountable to an official who serves on the will of the president.

Scalia’s Morrison dissent laid out the “unitary government” principle of the presidency. Below this principle, the president sits on the prime of the chief department’s org chart — and everybody beneath him have to be accountable to that president.

Justice Scalia’s Morrison dissent, it ought to be famous, is a dissent. Scalia’s concept of a unitary government misplaced out in 1988 — he couldn’t even persuade a single one in every of his colleagues to affix his jeremiad in opposition to company officers who act independently from the president.

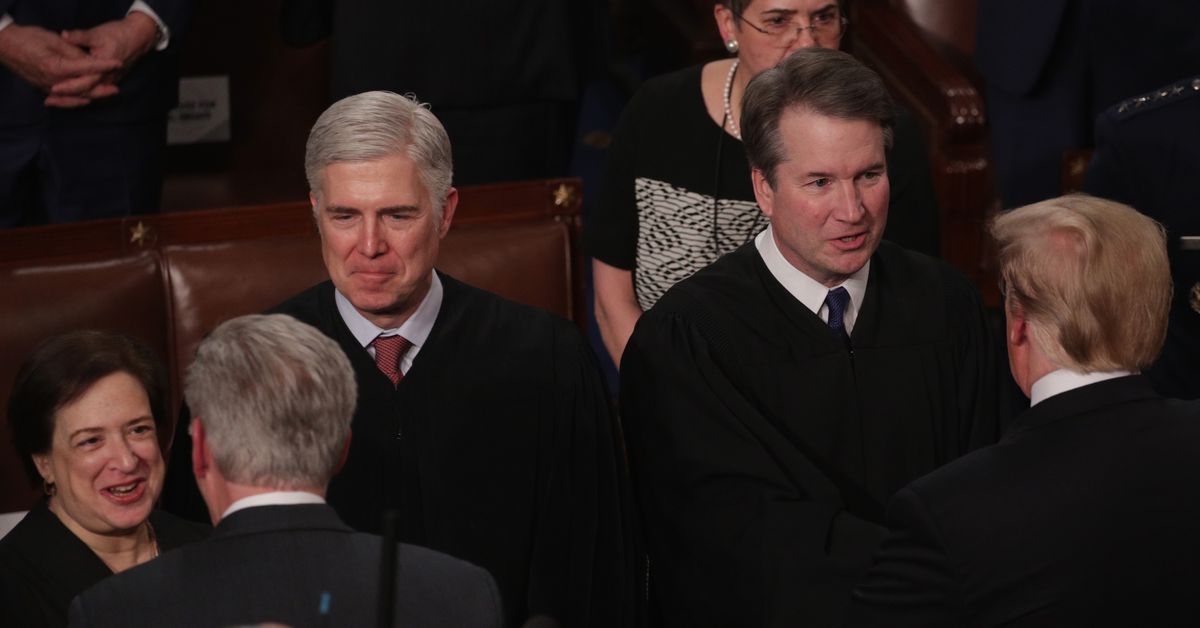

However Scalia’s dissent has additionally garnered a cult following amongst conservatives within the greater than three many years because it was written, and lots of of its most loyal followers are actually in very highly effective jobs. Considered one of them is Justice Brett Kavanaugh, who mentioned in 2016 that he needed to “put the final nail” within the Morrison majority opinion’s coffin.

Considerably, the Trump Justice Division additionally filed a brief arguing that the CFPB director’s job protections are unconstitutional. The unitary government might not be the regulation of the land, but, however it’s the dominant viewpoint in conservative authorized circles.

Two massive questions on the coronary heart of Seila Legislation

Although it’s doubtless that 5 members of the Supreme Courtroom will agree that the president ought to be allowed to fireside the CFPB director, it’s much less clear whether or not the Courtroom’s choice could have important implications past the CFPB.

In Humphrey’s Executor v. United States (1935), the Supreme Courtroom held that Congress may create unbiased companies led by multi-person, bipartisan boards — and that the members of those boards could possibly be given job safety protections. However the CFPB shouldn’t be led by such a board. It’s led by a single director.

Based on the Trump administration, this uncommon association, a single director shielded from accountability to the president, is completely different in sort from a multi-member board. “A single-headed unbiased company presents a better threat than a multimember unbiased company of taking actions or adopting insurance policies inconsistent with the President’s government coverage,” the Trump administration argues in its Seila Law brief.

Thus, it’s doable that the Supreme Courtroom may protect the core holding of Humphrey’s Executor — that unbiased companies are positive as long as they’re led by a multi-member board — whereas additionally placing down the CFPB’s single-director construction.

One other open query is whether or not the Courtroom will hand down a sweeping invalidation of the CFPB, or merely change the foundations governing when its director could also be fired.

The legal professionals difficult the CFPB’s single-director construction counsel that the company ought to cease to exist. “Congress’s foremost purpose in structuring the CFPB was to create an company unbiased from outdoors affect,” they declare. So if the company can’t be unbiased, it ought to be struck down in it entirety (or, at the least, it ought to be prevented from bringing enforcement actions).

Realistically, there are unlikely to be 5 votes for such a radical end result. Even the Trump administration rejects the argument that the whole company ought to be struck down — it argues in its temporary that there’s “no foundation to conclude that Congress would have most well-liked to don’t have any Bureau in any respect relatively than a Bureau headed by a Director who can be detachable.” Equally, although Kavanaugh is among the Courtroom’s most outspoken defenders of the unitary government principle, he additionally heard a very similar lawsuit to Seila Law when he was a decrease courtroom choose — and his opinion in that case was comparatively measured.

Though Kavanaugh agreed that the president ought to have the facility to fireside the CFPB director, he additionally wrote that the CFPB might proceed to function with the president in a position “to take away the Director at will at any time.” Thus, Kavanaugh would preserve the company largely intact.

With out Kavanaugh’s vote, it’s tough to see how litigants hoping to kill the CFPB in its entirety will discover a majority on this Supreme Courtroom.

The brief time period impact of Seila Legislation, in different phrases, may doubtlessly be excellent for Democrats. As a sensible matter, the Courtroom might merely permit the following Democratic president to fireside Trump’s CFPB director on day one of many new administration.

However the Courtroom may additionally give Trump broad new powers to intimidate members of the Federal Reserve board and different key companies. And there’s, at the least, a small likelihood that it’s going to strike down the CFPB in its entirety.