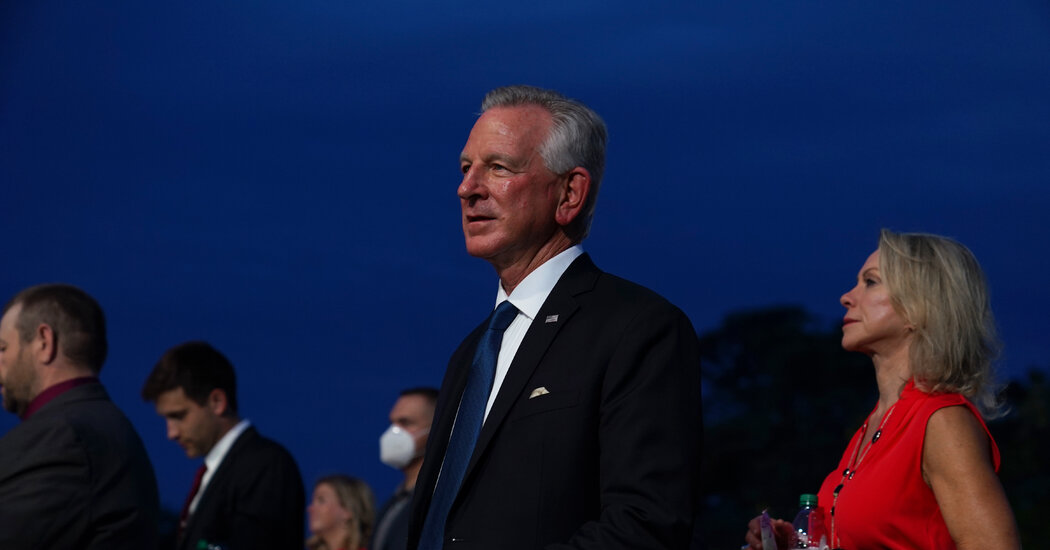

Tommy Tuberville, the Republican candidate for Senate in Alabama, is working in giant measure on his expertise in school soccer’s Southeastern Conv

Tommy Tuberville, the Republican candidate for Senate in Alabama, is working in giant measure on his expertise in school soccer’s Southeastern Convention, often known as the S.E.C., the place he coached Auburn College.

However he has had expertise with one other S.E.C., the Securities and Trade Fee, and different monetary regulators.

A evaluate by The New York Instances discovered that Mr. Tuberville, who’s main Senator Doug Jones within the polls, has a historical past of involvement with not less than three individuals who had been later convicted of monetary fraud in what had been described as Ponzi schemes. Mr. Tuberville was largely seen as a sufferer and was by no means charged with a criminal offense.

In two episodes, Mr. Tuberville misplaced thousands and thousands of {dollars}. A 3rd was extra minor, when Mr. Tuberville and his spouse, Suzanne, purchased a house by means of an organization created by a lawyer who was later convicted of working an actual estate-related Ponzi scheme.

The Instances evaluate included a small charitable basis created by Mr. Tuberville, discovering that its tax data indicated that lower than a 3rd of its proceeds went to the veterans’ causes it was set as much as advance. The muse additionally had bookkeeping points.

The evaluate raised questions on Mr. Tuberville’s judgment and monetary acumen. Whereas he has stated on the marketing campaign path that he hoped to serve on the “banking finance” committee — the Senate has separate, and prestigious, banking and finance committees — he has at instances undercut his personal {qualifications}. With reference to an ill-fated hedge fund enterprise, he as soon as informed a reporter, “I’m not sensible sufficient to grasp all of the numbers.”

In a press release, Paul Shashy, Mr. Tuberville’s marketing campaign supervisor, largely deflected questions on Mr. Tuberville’s monetary dealings. “Doug Jones, Chuck Schumer, and different liberal, Swamp Democrats are spreading lies in an try to smear Coach Tuberville’s profession, accomplishments, and charitable service,” Mr. Shashy stated, including, “Coach is targeted solely upon serving his fellow Alabamians and faithfully representing their conservative values, beliefs, and wishes.”

The Instances beforehand reported on one fraudulent scheme through which Mr. Tuberville was an investor and a 50/50 proprietor of a monetary agency, TS Capital, that was shut down by state and federal regulators. A 2012 criticism from the Commodity Futures Buying and selling Fee stated that Mr. Tuberville’s associate, John David Stroud, had buying and selling losses of almost $1.2 million and misappropriated almost $2.three million for “automobile funds, journey bills, leisure and retail purchases.” As one in every of Mr. Stroud’s lieutenants put it, in line with court docket filings, the agency had “the optics of a Ponzi scheme.”

Mr. Tuberville has portrayed himself as an unwitting sufferer of the monetary agency. However he made introductions to traders, was saved within the loop on hiring selections and traveled to New York with Mr. Stroud to fulfill potential brokers.

Mr. Stroud was ultimately sentenced to a decade in jail, and Mr. Tuberville misplaced greater than $2 million, together with his funding, authorized charges and the price of settling a lawsuit from traders.

Victor L. Hayslip, a former lawyer who represented Mr. Tuberville then, has stated of him, “Being naïve just isn’t a criminal offense.”

However TS Capital — brief for Tuberville and Stroud — was not the one questionable funding alternative. Mr. Tuberville additionally invested in GLC Enterprises, which the S.E.C. referred to as “an $80 million Ponzi scheme.” GLC was run by Jim Donnan, a former soccer coach on the College of Georgia, and a associate named Gregory Crabtree. The enterprise ensnared a number of coaches and former gamers earlier than it was closed in 2011.

Mr. Tuberville invested $1.9 million, and misplaced about $150,000, an individual with data of his investments stated.

“Jim was the recruiter,” Mr. Tuberville stated, referring to Mr. Donnan, in a remark to ESPN on the time the scheme was revealed. “I feel Jim was slightly like the remainder of us. He thought it was going to be a very good deal and it simply went dangerous.”

Mr. Donnan was ultimately acquitted however his associate, Mr. Crabtree, was sentenced to 5 years in jail and needed to pay again greater than $20 million.

Actual property data reviewed by The Instances revealed a 3rd transaction through which Mr. Tuberville had enterprise dealings with a person who later pleaded responsible to fraud.

In 2004, Mr. Tuberville and his spouse purchased their residence in Santa Rosa Seaside, Fla., by means of a restricted legal responsibility firm setup by a Georgia lawyer named Robert P. Copeland. From not less than 2004 to 2009, Mr. Copeland was accused of working what the S.E.C. referred to as “a traditional Ponzi scheme” that raised $35 million for actual property transactions, although the cash was typically pocketed as a substitute. He pleaded responsible in 2009 and was sentenced to greater than a decade in jail on a wire fraud cost.

Associates of Mr. Tuberville stated that he and his spouse had been referred to Mr. Copeland by means of an middleman and the acquisition of the Florida residence was unrelated to the Ponzi scheme.

“The Tubervilles by no means met, interacted with, communicated with and positively by no means invested with Robert Copeland,” Mr. Shashy, the marketing campaign supervisor, stated however didn’t elaborate.

As an alternative of the Tubervilles merely shopping for the home in their very own identify, public data, together with court docket filings, present that the restricted legal responsibility firm was setup by Mr. Copeland for the couple as a part of an actual property deal referred to as a “reverse 1031 trade,” through which traders attempt to defer their tax payments by exchanging comparable properties.

The 1031 deal, which will get its identify from a bit of the federal tax code, finally fizzled, although the Tubervilles saved the home. However the restricted legal responsibility firm created by Mr. Copeland didn’t relinquish the title, a problem that dragged on unresolved for years. In 2012, the Tubervilles, who by then had been dwelling on the home on and off for years, needed to go to court docket to say the title.

Tim Cronic, an actual property lawyer who was concerned within the preliminary transaction, confirmed that the Tubervilles “would’ve by no means talked to Copeland” and Mr. Copeland would have solely been employed by means of an middleman.

One other notable enterprise of Mr. Tuberville’s is a charity he based in 2014 to help veterans. A evaluate of 5 years of the inspiration’s tax data confirmed that lower than a 3rd of the cash raised went to its charitable mission. (The Higher Enterprise Bureau recommends not less than 65 %.)

“For a really small charity, you’ve got these big bills,” stated David Nelson, a retired associate at Ernst & Younger who has specialised in tax-exempt teams, and who reviewed the inspiration’s public filings at The Instances’s request. “The opposite factor that jumped out is that out of the quantities of cash they collected, a comparatively small quantity was being directed to charitable actions,” Mr. Nelson stated.

The marketing campaign, together with folks linked to the inspiration, stated there was a far better stage of spending on the inspiration’s charitable mission than the I.R.S. data point out, and produced inside data for 2018 that confirmed almost $20,000 was raised for a brief mission to offer a retreat for veterans. However the data raised bookkeeping questions, since they confirmed greater than $61,000 of 2018 income, roughly twice what the charity reported to the I.R.S. that yr.

Mr. Nelson stated the general public data confirmed different indicators of sloppiness, together with one yr when the inspiration filed the mistaken tax type.

Mr. Shashy stated Mr. Tuberville was impressed to start out the charity as a result of his father was a veteran who took half within the Normandy touchdown.

“It appears that evidently any criticism of the inspiration, its measurement and its work argues {that a} man who was beneficiant, selfless and charitable together with his personal cash merely wasn’t beneficiant, selfless and charitable sufficient,” he stated. “That’s an unfair, arbitrary and subjective commonplace that merely can’t be met.”

Mr. Tuberville’s opponents have already pounced on his historical past with Mr. Stroud. Mr. Tuberville’s “agency cheated folks out of thousands and thousands,” his major opponent, the previous U.S. Lawyer Common Jeff Periods, stated in a single commercial earlier than he was defeated.

Mr. Jones, in a newer advert, says, “An Alabama trainer and oldsters saving for his or her youngsters’s schooling misplaced every thing,” including, “Tuberville’s associate received 10 years in jail. And Tuberville? You guessed it. He stated he didn’t have a clue.”

Mr. Tuberville, nonetheless, looks as if a very good guess to win. Polls usually give him a double-digit lead over Mr. Jones, who is taken into account probably the most susceptible Democrat within the Senate. Mr. Tuberville’s technique has been to hew intently to President Trump, and depend on his personal identify recognition. Whereas trendy soccer coaches within the state of Alabama are overshadowed by Nick Saban, the coach of the College of Alabama, Mr. Tuberville had his moments, most notably a 2004 workforce that went undefeated.

Requested whether or not Mr. Tuberville nonetheless wished to be on the finance or banking committees, Mr. Shashy stated, “Whereas the Swamp focuses upon points like Senate committee assignments, Coach is targeted solely upon serving his fellow Alabamians and faithfully representing their conservative values, beliefs, and wishes.”