The Fed modified its coverage framework final 12 months to give attention to “shortfalls” from full employment, somewhat than “deviations.” In obse

The Fed modified its coverage framework final 12 months to give attention to “shortfalls” from full employment, somewhat than “deviations.” In observe, meaning it doesn’t plan to lift rates of interest simply because the labor market heats up — as an example, if unemployment drops beneath traditionally regular ranges — as long as inflation is beneath management.

“The extra vibrant the labor market is, the extra doubtless it’s to be an inclusive, vibrant labor market,” Charles Evans, president of the Federal Reserve Financial institution of Chicago, mentioned on a name with reporters Thursday. “We’re not going to prematurely reduce off a vibrant labor market.”

Incessantly Requested Questions In regards to the New Stimulus Bundle

The stimulus funds could be $1,400 for many recipients. Those that are eligible would additionally obtain an an identical fee for every of their kids. To qualify for the total $1,400, a single individual would want an adjusted gross revenue of $75,000 or beneath. For heads of family, adjusted gross revenue would must be $112,500 or beneath, and for married {couples} submitting collectively that quantity would must be $150,000 or beneath. To be eligible for a fee, an individual should have a Social Safety quantity. Learn extra.

Shopping for insurance coverage by way of the federal government program referred to as COBRA would briefly grow to be loads cheaper. COBRA, for the Consolidated Omnibus Funds Reconciliation Act, usually lets somebody who loses a job purchase protection through the previous employer. But it surely’s costly: Underneath regular circumstances, an individual might should pay at the least 102 p.c of the price of the premium. Underneath the reduction invoice, the federal government would pay all the COBRA premium from April 1 by way of Sept. 30. An individual who certified for brand new, employer-based medical insurance someplace else earlier than Sept. 30 would lose eligibility for the no-cost protection. And somebody who left a job voluntarily wouldn’t be eligible, both. Learn extra

This credit score, which helps working households offset the price of care for youngsters beneath 13 and different dependents, could be considerably expanded for a single 12 months. Extra individuals could be eligible, and lots of recipients would get a much bigger break. The invoice would additionally make the credit score absolutely refundable, which implies you possibly can accumulate the cash as a refund even when your tax invoice was zero. “That will likely be useful to individuals on the decrease finish” of the revenue scale, mentioned Mark Luscombe, principal federal tax analyst at Wolters Kluwer Tax & Accounting. Learn extra.

There could be an enormous one for individuals who have already got debt. You wouldn’t should pay revenue taxes on forgiven debt in case you qualify for mortgage forgiveness or cancellation — for instance, in case you’ve been in an income-driven compensation plan for the requisite variety of years, in case your faculty defrauded you or if Congress or the president wipes away $10,000 of debt for giant numbers of individuals. This is able to be the case for debt forgiven between Jan. 1, 2021, and the top of 2025. Learn extra.

The invoice would supply billions of {dollars} in rental and utility help to people who find themselves struggling and at risk of being evicted from their properties. About $27 billion would go towards emergency rental help. The overwhelming majority of it could replenish the so-called Coronavirus Aid Fund, created by the CARES Act and distributed by way of state, native and tribal governments, in accordance to the Nationwide Low Revenue Housing Coalition. That’s on prime of the $25 billion in help offered by the reduction bundle handed in December. To obtain monetary help — which might be used for hire, utilities and different housing bills — households must meet a number of situations. Family revenue couldn’t exceed 80 p.c of the world median revenue, at the least one family member should be liable to homelessness or housing instability, and people must qualify for unemployment advantages or have skilled monetary hardship (instantly or not directly) due to the pandemic. Help might be offered for as much as 18 months, in accordance to the Nationwide Low Revenue Housing Coalition. Decrease-income households which have been unemployed for 3 months or extra could be given precedence for help. Learn extra.

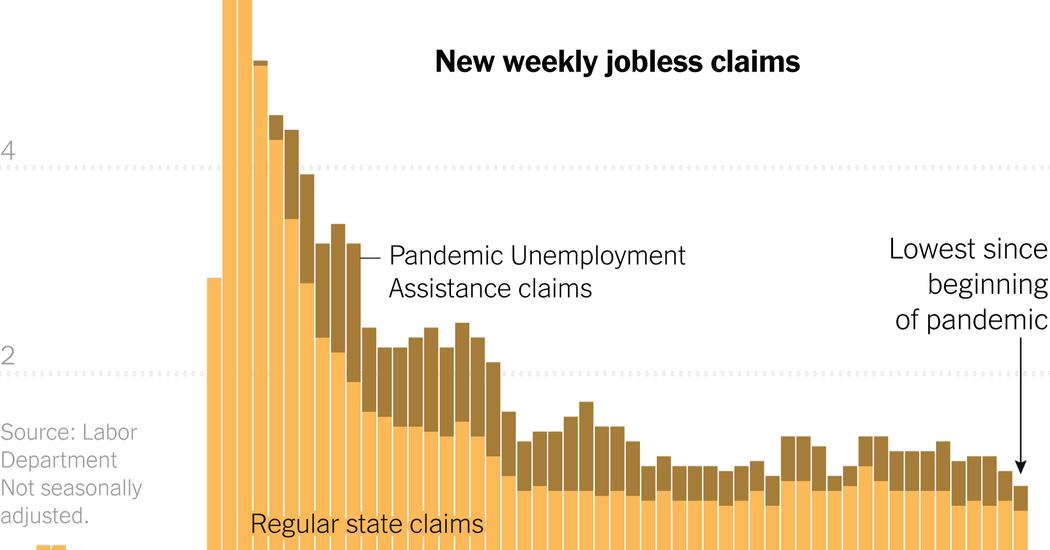

There have been false begins earlier than, specifically a burst of development that pale because the virus worsened within the fall, however final week’s drop in claims was nonetheless notable for its measurement. In February, the financial system remained greater than 9 million jobs in need of the place it was earlier than the pandemic.

Unemployment claims have been at traditionally excessive ranges for the previous 12 months, partly as a result of some employees have been laid off greater than as soon as. Nonetheless, the underside line is that the information not too long ago has been favorable, mentioned Ian Shepherdson, chief economist at Pantheon Macroeconomics.

“Weekly numbers have been uneven however we’ve been on a downward pattern since mid-January,” he mentioned. “As extra enterprise homeowners see a reopening will come, they’re extra keen to hold on to workers.”

Between the state and federal packages, the variety of new jobless claims final week was slightly below 900,000 after being caught for months above a million every week.

There have been 242,000 new claims for Pandemic Unemployment Help, a federal program protecting freelancers, part-timers and others who don’t routinely qualify for state advantages, a lower of 43,000.