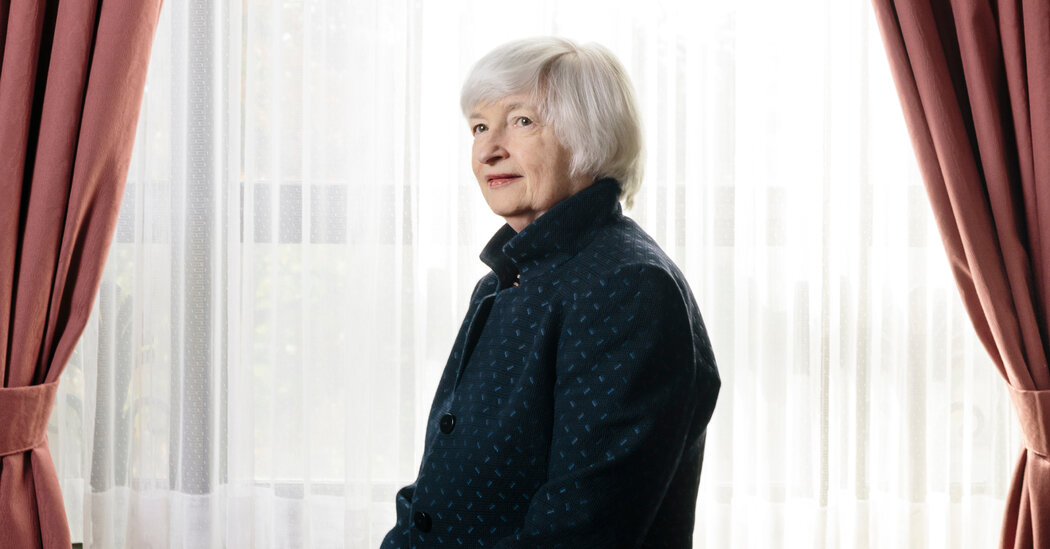

WASHINGTON — Janet L. Yellen’s anticipated nomination as Treasury secretary will place the previous Federal Reserve chair right into a vital functi

WASHINGTON — Janet L. Yellen’s anticipated nomination as Treasury secretary will place the previous Federal Reserve chair right into a vital function overseeing President-elect Joseph R. Biden Jr.’s financial and nationwide safety agenda at an company that has more and more turn out to be a middle of energy.

Whereas Ms. Yellen’s views on financial coverage are well-known from her time main the central financial institution, her perspective on a variety of points which can be a part of the Treasury Division’s portfolio are much less recognized.

As Treasury secretary, Ms. Yellen would be the Biden administration’s chief financial diplomat and can face the problem of re-engaging with American allies which have been delay by President Trump’s “America first” financial insurance policies, together with his use of tariffs. She is going to most certainly be the purpose individual in negotiations with China and may have substantial enter on commerce coverage, together with using U.S. sanctions on nations resembling Iran and North Korea.

Domestically, Ms. Yellen would be the driving drive behind the Biden administration’s tax coverage — a big function on condition that Mr. Biden made elevating taxes on rich Individuals and companies a central a part of his marketing campaign. Ms. Yellen will even have the prospect to tweak rules stemming from Mr. Trump’s 2017 tax cuts, which left an ideal deal as much as the Treasury by way of placing a brand new taxing regime in place for multinational companies. Beneath a Biden administration, the division may revise these rules to boost taxes on some firms that function overseas.

And she or he will even be on the middle of the federal government’s borrowing spree, which is financed by issuing Treasury securities and has pushed the U.S. price range deficit to ranges not seen since World Warfare II.

Here’s what we all know, thus far, about Ms. Yellen’s views in a number of areas the place she may have a job to play.

A financial ‘dove’ however a (considerably) fiscal ‘hawk’

Whereas Ms. Yellen is understood for being dovish on financial coverage — which means she helps decrease rates of interest — she has on many events expressed concern concerning the fiscal path of the USA and the sum of money it’s borrowing.

Ms. Yellen’s fiscal worries got here earlier than the coronavirus pandemic and the present downturn, a second when most economists have inspired the USA to not fear concerning the deficit and to spend as a lot as crucial to assist households and companies climate the droop.

Nonetheless, Ms. Yellen’s earlier feedback counsel that she may very well be reluctant to push for large spending packages with out elevating taxes to offset the budgetary hit. The federal price range deficit soared to a file $3.1 trillion within the 2020 fiscal yr and Republicans, who’re anticipated to regulate the Senate, have as soon as once more began expressing considerations about how a lot the nation is borrowing.

In a 2018 interview on the Charles Schwab Impression convention in Washington, Ms. Yellen stated the USA’ debt path was “unsustainable” and supplied a treatment: “If I had a magic wand, I might increase taxes and lower retirement spending.”

Final yr, Ms. Yellen touched on the third rail of Democratic politics when she prompt extra instantly that cuts to Medicare, Medicaid and Social Safety may very well be so as.

“I feel it won’t be solved with out some extra revenues on the desk, however I additionally discover it onerous to consider that it gained’t be solved with out some modifications to these packages,” Ms. Yellen stated on the Nationwide Funding Heart for Seniors Housing & Care Fall Convention.

Ms. Yellen added that political candidates and Congress didn’t wish to take care of overhauling America’s social security web packages which — in keeping with McKnight’s Senior Dwelling, a commerce publication — she described as “root canal economics.”

Ms. Yellen can be a board member of the Committee for a Accountable Federal Funds, a nonpartisan group that preaches fiscal restraint.

A free dealer at coronary heart

As Treasury secretary, Ms. Yellen will inherit a battered international buying and selling system destabilized by Mr. Trump’s aggressive strategy to U.S. commerce coverage. She should confront quite a lot of choices, together with whether or not to proceed Mr. Trump’s escalating sanctions on Chinese language companies and officers, or his restrictions on the presence of Chinese language firms on American inventory markets and in retirement portfolios.

Ms. Yellen is understood for her robust help of open commerce and the worldwide buying and selling system, although she has not hesitated to criticize China’s commerce practices.

Like many on Mr. Biden’s group, Ms. Yellen seems to agree that most of the issues typically ascribed to commerce coverage really stem from the reluctance of American officers to make use of home insurance policies to help staff experiencing the worst results of globalization.

Ms. Yellen has credited globalization and commerce liberalization with elevating progress and reducing poverty world wide, however she has additionally stated that these developments fueled inequality and the rise of populism, resulting in a backlash towards America’s commerce practices. She has expressed concern concerning the nation’s retreat from a job of worldwide management below Mr. Trump, and help for the World Commerce Group.

The Presidential Transition

Ms. Yellen was the president of the American Financial Affiliation main into its annual assembly in January, which drew 1000’s of economists to San Diego. She organized the schedule of the convention, she stated in an interview, to focus closely on periods outlining the advantages of free commerce and immigration to nationwide economies and the world — a place very a lot at odds with the Trump administration. “I organized this system, and I feel it’s not an accident you’re seeing it,” she stated. “I feel it’s essential.”

Like many economists, Ms. Yellen criticized Mr. Trump’s give attention to bilateral commerce deficits, described his tariffs on China as a tax on American shoppers and warned that his commerce wars posed a recession threat for the U.S. financial system.

She additionally expressed skepticism about Mr. Trump’s eventual commerce take care of China, saying it left hefty tariffs in place that did little to assist American producers and didn’t resolve a “troublesome” conflict with China over applied sciences like 5G and synthetic intelligence.

“We’ve got very tough points that lie forward,” Ms. Yellen stated in a speech in Hong Kong in January, during which she urged nations to stay open to the “synergies” from sharing and exchanging know-how world wide.

However Ms. Yellen has additionally acknowledged that the USA has “actual points” and “many legitimate considerations” in its commerce relations with China, specifically China’s infringement of American mental property, its subsidization of state-owned enterprises and its walling off of essential know-how markets to overseas competitors.

As with many moderates in Mr. Biden’s administration, any coverage suggestions Ms. Yellen makes on China are more likely to be constrained by Beijing’s more and more aggressive and authoritarian conduct, in addition to harsh China sentiments amongst each Democrats and Republicans in Washington.

Swinging the pendulum towards extra, not much less, monetary regulation

From her perch on the Brookings Establishment, Ms. Yellen has voiced concern over the Trump administration’s regulatory rollbacks, together with these being accomplished on the Fed.

Ms. Yellen stated this spring that the 2008 disaster confirmed that the Fed needs to be proactive in suspending financial institution payouts.

“We realized that we let method an excessive amount of cash out the door in that disaster,” she stated in an April interview. “We don’t know the place that is going. That is actually a tail occasion and an ideal menace to the nation.”

Within the months since, Fed officers have stopped banks from shopping for again their very own shares however solely curbed dividends.

However it isn’t simply the banks she has apprehensive about. She has additionally singled out cash market mutual funds as a supply of monetary system instability. And, talking on a Brookings panel in June, Ms. Yellen stated the coronavirus uncovered lingering vulnerabilities within the monetary system, which choked up in March earlier than the Fed stepped in to appease it.

“The pandemic confirmed that the dangers have been very actual and critical” when it got here to a preferred monetary place that hedge funds had amassed after which tried to unwind when buying and selling bought robust in March, exacerbating market volatility. She additionally flagged cash market funds, the place traders park financial savings to earn extra return than financial institution accounts supply, and the observe of lending to already-indebted debtors — referred to as leveraged lending — as acknowledged however unfixed weak spots.

“These have been issues that have been recognized; they weren’t addressed,” she stated.

As Treasury secretary, Ms. Yellen would lead the Monetary Stability Oversight Council, a bunch arrange after the 2008 disaster to observe and reply to monetary stability dangers. That will give her important leeway to coach regulatory give attention to the areas of concern she has been flagging.

Placing a value on carbon

In her post-Fed years, Ms. Yellen has additionally centered on local weather change dangers. She served as a chair of the Group of 30 Working Group on Local weather Change and Finance, which launched a report this yr urging governments, regulators and monetary firms to make strikes that might sharply curb carbon emissions.

“Carbon costs ought to progressively enhance over time to incentivize companies and pace the shift to web zero,” Ms. Yellen stated when the report was launched.

Her place on the head of the oversight council will give her an essential podium from which to speak about inexperienced finance. A report sponsored by the Commodity Futures Buying and selling Fee this yr urged the council to start specializing in local weather threat extra concretely.