By David Lawder WASHINGTON, Nov 2 (Reuters) - U.S. Presiden

By David Lawder

WASHINGTON, Nov 2 (Reuters) – U.S. President Donald Trump’s “America First” commerce coverage torched a 70-year consensus on commerce liberalization, drew a tougher line in opposition to China’s state-driven financial mannequin and erected new tariffs on imported metal and aluminum, alienating allies.

Trump is touting his efforts to guard American staff and a Section 1 commerce take care of China that guarantees to spice up U.S. exports as closing arguments in Tuesday’s presidential election.

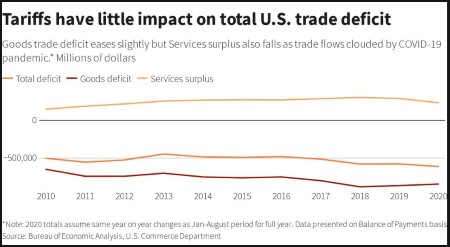

Financial knowledge thus far exhibits combined outcomes from that effort, with some sectors gaining on the expense of others, however with little change within the total U.S. commerce deficit for items and companies.

Since 2018, Trump has imposed punitive tariffs on imported washing machines, photo voltaic panels, metal, aluminum and items from China and Europe, with Chinese language imports accounting for a lot of the almost $80 billion collected thus far. https://tmsnrt.rs/3kIptfx

The tariff battle in opposition to China began with a 2017 investigation into longstanding U.S. complaints about Chinese language state-driven financial insurance policies, together with mental property theft, pressured expertise transfers and rampant subsidies to state-owned companies that had been pushing the U.S. commerce deficit increased.

Enterprise pursuits largely supported the targets of the “Part 301” probe, however warned that tariffs would harm U.S. competitiveness by elevating enter prices.

Retaliations and escalations ultimately imposed tariffs on $370 billion in Chinese language items earlier than the Section 1 deal was signed in January, committing Beijing to spice up purchases of U.S. farm and manufactured items, power and companies by $200 billion over two years.

Up to now, the tariffs have lowered imports of products from China however haven’t considerably altered the worldwide U.S. items and companies commerce deficit. https://tmsnrt.rs/2HLPKvh

Firms responded by diversifying provide chains, shifting some manufacturing out of China – however largely to different low-wage nations, resembling Vietnam and Mexico, to not the USA. https://tmsnrt.rs/2Jg8mnz

One in all Trump’s targets was to enhance American manufacturing jobs. The numbers have grown since he took workplace in 2017, partly due to an enormous company tax reduce. But manufacturing employment development slowed after he launched the tariffs in 2018, changing into a trickle earlier than the coronavirus pandemic hit in early 2020. https://tmsnrt.rs/2HLIeQV

The Federal Reserve’s measure of U.S. manufacturing output additionally peaked in 2018. https://tmsnrt.rs/2HFFoNd

STEEL SLIDE

Trump angered U.S. allies in Europe, Asia and the Americas by imposing 25% tariffs on metal and 10% on aluminum in 2018 on nationwide safety grounds.

The tariffs prompted new funding within the sector and restarts of some idled mills, together with U.S. Metal Corp’s X.N Granite Metropolis Works in Illinois. However the hiring renaissance was short-lived as decrease costs precipitated some closures, together with certainly one of two blast furnace at Granite Metropolis, the place Trump heralded the business’s renaissance in July 2018. https://tmsnrt.rs/31OH120

Metal business executives have argued that with out the tariff protections, home steelmakers can be in far worse form due to a world manufacturing glut largely centered in China. The tariffs have reduce the market share of imports, permitting home steelmakers to make the most of extra of their capability. https://tmsnrt.rs/3kDYe5E

“NO DISASTERS”

Backers of Trump’s commerce technique argue that it didn’t result in the foremost dislocations predicted by business and received greater concessions from China than any earlier U.S. president did.

It pushed U.S. firms to diversify away from China and transfer some essential provide chains to the USA, mentioned Stephen Vaughn, former basic counsel on the U.S. Commerce Consultant’s workplace.

“All the kinds of disasters that individuals on the opposite aspect predicted actually by no means occurred,” mentioned Vaughn, now a commerce accomplice on the King and Spalding regulation agency. “Even in case you assume that the entire tariffs had been paid by customers, an $80 billion tax enhance was by no means going to tank a $22 trillion economic system.”

Whereas Trump’s Section 1 commerce deal is now beginning to enhance agricultural exports to China after a gradual begin amid the COVID-19 pandemic, it failed to handle lots of the points that basically matter to U.S. firms. These embrace China’s expertise switch insurance policies, industrial subsidies and obstacles to digital companies entry in China.

“There’s nonetheless a respectable query about what all this ache was paying for,” mentioned Nasim Fussell, who served till August because the Republican commerce counsel on the U.S. Senate Finance Committee. “There might be stress from stakeholders to work in direction of a Section 2” to handle extra substantive points, added Fussell, now a commerce lawyer at Holland and Knight.

However China stays barely greater than midway to its first yr buy targets on the Section 1 commerce deal, notably for manufactured items throughout the COVID-19 pandemic, in response to commerce knowledge calculations by Chad Bown, a senior fellow with the Peterson Institute for Worldwide Economics.

Financial components resembling commodity costs, Chinese language tariffs, slack demand for air journey and a swine flu epidemic in China are weighing closely on the export flows, Bown mentioned.

“The dictum of ‘You could purchase extra’ would not essentially appear to work.”

Trump’s commerce treatment tariff collections Trump’s commerce treatment tariff collectionshttps://tmsnrt.rs/3kIptfx

Tariffs have little impression on whole U.S. commerce deficit Tariffs have little impression on whole U.S. commerce deficithttps://tmsnrt.rs/2HLPKvh

U.S. commerce deficit substitution U.S. commerce deficit substitutionhttps://tmsnrt.rs/2Jg8mnz

Manufacturing facility job beneficial properties gradual after tariffs hit Manufacturing facility job beneficial properties gradual after tariffs hithttps://tmsnrt.rs/2HLIeQV

U.S. manufacturing output peaks in 2018 U.S. manufacturing output peaks in 2018https://tmsnrt.rs/2HFFoNd

U.S. iron and metal mill jobs rise, fall after tariffs U.S. iron and metal mill jobs rise, fall after tariffshttps://tmsnrt.rs/31OH120

U.S. metal mill capability use rises, dips, plunges U.S. metal mill capability use rises, dips, plungeshttps://tmsnrt.rs/3kDYe5E

(Reporting by David Lawder; enhancing by Heather Timmons and Richard Chang)

(([email protected]; +1 202 354 5854; Reuters Messaging: [email protected]))

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.