By Andy House

By Andy House

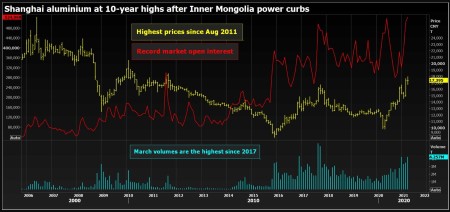

LONDON, March 19 (Reuters) – Shanghai aluminium costs have this week powered to their highest stage since August 2011.

This month’s volumes on the Shanghai Futures Change’s aluminium contract are already the very best since 2017 and market open curiosity is at report peaks.

The surge in speculative exercise follows the mandated curtailment of smelting capability within the metropolis of Baotou in Interior Mongolia, because the provincial authorities tries to satisfy its quarterly power targets.

The suspensions are small, at round 200,000 tonnes of annualised capability, in response to Citi analysts. That is not going to make a lot bodily market impression when China’s nationwide aluminium output manufacturing surged by 8.4% within the first two months of the yr.

However the significance is the route of journey. China is embarking on the street to decarbonisation, a journey that poses arduous questions of a power-hungry sector similar to aluminium smelting.

Interior Mongolia’s power issues often is the harbinger of future waves of “inexperienced” disruption within the Chinese language aluminium market.

FAILING THE TEST

Interior Mongolia was certainly one of three provinces which did not meet targets on power consumption and effectivity over the primary three quarters of 2020, in response to Citi (“Metals Weekly”, March 17, 2021).

It’s now preemptively mandating power cuts to industrial customers, together with aluminium smelters. A handful have taken small quantities of capability off line for upkeep.

The measures are anticipated to be short-lived however there’s the distinct chance of future rolling curtailments if quarterly targets are threatened.

Furthermore, Interior Mongolia has capped its power consumption development over the subsequent five-year plan, inserting doubtful deliberate expansions such because the 400,000 tonne per yr Baiyinhua undertaking, Citi notes.

The province could have reached its de-facto aluminium capability restrict based mostly on power consumption, with the prevailing 6.9 million tonnes of capability now weak to the vagaries of quarterly targets that are solely going to tighten incrementally over time.

It is price noting that one other province to fail the take a look at was Ningxia, which has 1.2 million tonnes of aluminium smelter capability. There was no phrase of curtailments in Ningxia, but it surely’s an additional warning that energy consumption constraints are going to be a recurring theme within the Chinese language aluminium sector.

KING COAL

The sector’s combat for its share of China’s power market is sophisticated by the truth that so many smelters use energy derived from carbon-intensive coal, both by way of the nationwide grid or extra usually within the type of captive energy vegetation.

China produced 36 million tonnes of major aluminium in 2019 and used 484,342 gigawatt hours of power to take action, 88% of which was derived from coal, in response to probably the most not too long ago accessible data from the Worldwide Aluminium Institute (IAI).

There was a big relocation of capability over the past two years to Yunnan province, which boasts a lot of inexperienced hydro energy. That ought to carry the proportion of hydro within the nationwide energy combine from a low 7.7% in 2019.

However not everybody will be capable of squeeze into hydro-rich provinces similar to Yunnan and Sichuan.

Most of China’s smelter sector goes to stay depending on coal for its power, which shops up bother for a rustic now dedicated to carbon neutrality by 2060.

Interior Mongolia’s curtailments presage the larger trade-offs to return.

THE ROAD TO CARBON NEUTRALITY

The ability-intensive smelting course of accounts for round 75% of aluminium’s cradle-to-gate emissions footprint, in response to the IAI.

Additionally it is the section of the worth chain that has the best variability relying on the supply of the facility used.

The carbon footprint of major aluminium can span a variety from lower than 5 tonnes of carbon equal for renewable power similar to hydro to greater than 25 tonnes for coal.

Globally, the aluminium sector should minimize its emissions by 77% by 2050 to satisfy local weather objectives, the IAI stated in an evaluation of the decarbonisation challenges forward. (“Aluminium Inexperienced Home Gases: Pathway to 2050,” March 2021)

Decarbonising the facility used to transform alumina into metallic within the smelting course of is the only greatest lever to scale back emissions.

The dual drivers of change for coal-dependent nations similar to China might be a broader transfer away from fossil fuels in the direction of renewables within the nationwide grid and using carbon-capture know-how for captive vegetation, the IAI stated.

“Relying on the pathway(s) adopted, the capital funding required for electrical energy decarbonisation is within the vary of $0.5-$1.5 trillion over the subsequent 30 years”, it warned.

Fairly evidently, the very best prices might be borne by coal-dependent smelters.

RUNNING OUT OF ROAD

The problem to decarbonise the aluminium provide chain is compounded by the very fact it might want to develop by an additional 25 million tonnes to satisfy demand by 2050, in response to the IAI.

China has been the motive force of major manufacturing development this century, to the purpose that the nation now accounts for round 58% of worldwide manufacturing.

One other three million tonnes of capability is predicted to return on line this yr, however that brings nationwide capability near and even over Beijing’s 45 million tonne cap.

China’s 20-year aluminium juggernaut is working out of street.

It’s now clear that in provinces similar to Interior Mongolia even sustaining current capability goes to be difficult as China appears to be like arduous each at its general power consumption and its power combine.

GREEN DISRUPTION

It is noticeable that whereas Shanghai costs surged to decade highs this week, the London Steel Change worth managed solely a three-year peak of $2,249.50 per tonne, and that solely briefly.

The Interior Mongolia cutback information has fed into an current bull narrative in China centred on the stellar rebound in metals demand since COVID-19 lockdowns a yr in the past.

The nation continues to suck in major metallic, importing 455,000 tonnes of unwrought aluminium within the first two months of 2021.

Previous to final yr China hadn’t imported a lot metallic since 2009-2010.

China’s smelters are evidently struggling to maintain up with demand from the nation’s big semi-manufactured merchandise sector.

Such home supply-chain stress is a uncommon phenomenon, however it’ll turn into extra frequent as China’s inexperienced insurance policies begin reshaping each the facility and aluminium manufacturing sectors

Interior Mongolia’s power issues fireplace up Shanghai aluminiumhttps://tmsnrt.rs/30UBM00

China’s aluminium sector is closely depending on coal for its powerhttps://tmsnrt.rs/2QcF0d4

(Enhancing by Jan Harvey)

(([email protected], 44-207-542-4412 and on Twitter https://twitter.com/AndyHomeMetals))

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.