By Clyde Russell

LAUNCESTON, Australia, June 28 (Reuters) – The rally in commodity costs is more likely to see a shift from metals to vitality assets, comparable to crude oil, liquefied pure gasoline (LNG) and coal, in keeping with the newest forecasts from the Australian authorities.

Whereas the June quarter report from the Division of Trade, Science, Power and Assets would not foresee a serious retreat within the costs of metals comparable to copper, iron ore, zinc, aluminium and nickel, it does forecast stronger performances from vitality commodities.

The headline quantity from the report is that Australia’s commodity exports are anticipated to succeed in a report A$310 billion ($235.three billion) within the 2020-21 fiscal yr that ends on June 30.

That is up some 6% from the earlier report in 2019-20, and the outlook stays constructive with the federal government forecasting an extra 7.7% acquire to A$334 billion in 2021-22.

Australia is the world’s largest exporter of iron ore, LNG and coking coal used to make metal.

It ranks second behind Indonesia for thermal coal and third in shipments of copper ore, and is a serious producer of each aluminium and alumina, the uncooked materials used to make the refined steel.

Australia can be the world’s third-largest gold producer and the largest internet exporter of the dear steel, and is a prime provider of battery metals comparable to nickel and lithium.

Iron ore is the heavy hitter of Australia’s useful resource exports, with the nation chargeable for 53% of the world’s exports, or greater than double that of quantity two Brazil’s 21% share.

It has additionally been a stellar performer within the 2020-21 yr as strong Chinese language demand collided with provide points because the coronavirus pandemic affected shipments from Brazil and quantity three exporter South Africa, and Australia skilled some climate disruptions.

This despatched the spot value MT-IO-QIN62=ARG from a 2020 low of $79.60 a tonne to a report excessive of $235.55 on Might 12, with the steel-making ingredient largely holding on to its features, ending at $217.75 on June 25.

The Australian authorities forecasters are usually cautious of their value assumptions and so they anticipate iron ore to common $137 a tonne in 2020-21, earlier than retreating to $129 in 2021-22 and $100 in 2022-23.

Australia’s iron ore exports are anticipated to be round 871 million tonnes in 2020-21, earlier than rising to 904 million in 2021-22 and 954 million in 2022-23.

This additional provide will drive costs decrease, particularly as China, the world’s largest purchaser of iron ore, is forecast to maintain imports largely regular over the approaching years.

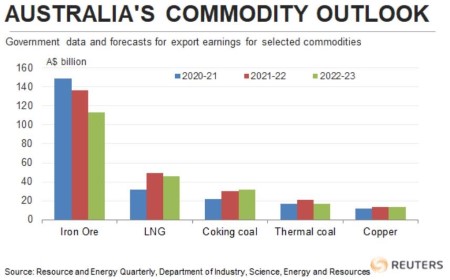

Total, the report forecasts the worth of iron ore exports to say no from A$149 billion in 2020-21 to A$137 billion in 2021-22 and A$113 billion in 2022-23.

For copper, the forecast is that the economic steel has already had its run, and the subsequent couple of years will see consolidation, with the worth retreating from its latest report above $10,000 a tonne to a median $8,579 in 2021-22 and $7,994 within the following fiscal yr.

Australia’s export earnings from copper are forecast to be largely regular at A$13 billion in each 2021-22 and 2022-23.

It is a related story for different metals with costs and earnings anticipated to be pretty secure to softly increased for aluminium and alumina, nickel and zinc.

Lithium export income is forecast to surge to A$2.5 billion in 2022-23 from A$900 million in 2020-21, however this due to a 53% bounce in output.

BULLISH ENERGY

In distinction to the regular image for metals, the outlook for vitality commodities appears brighter, with LNG a standout as export earnings are forecast to rise from A$32 billion in 2020-21 to A$49 billion in 2021-22 and keep at A$46 billion in 2022-23.

It is because costs are forecast to rise from A$7.80 a gigajoule, equal to $5.61 per million British thermal models (mmBtu), to A$11.2 a gigajoule in 2021-22, or about $8.06 per mmBtu.

Australia is not a serious producer or exporter of crude oil, however even its modest exports are forecast to rise to A$10.9 billion in 2021-22 from A$7.7 billion in 2020-21.

This may imply that LNG and crude oil mixed will earn greater than the full for coking and thermal coal, although each coal grades are forecast to see sturdy export income progress.

Earnings from coking coal, used to make metal, are anticipated to rise to A$30 billion in 2021-22 from A$22 billion the prior yr, whereas these for thermal coal, used for energy technology, are forecast to extend to A$21 billion from A$17 billion.

Given volumes are forecast to be largely regular, the features are all all the way down to increased costs.

Total, the outlook is for regular to decrease costs for metals, with battery metals lithium and nickel being exceptions, whereas LNG, crude oil and coal are set to carry out strongly.

One other level value making is that the Australian authorities’s forecasts do not precisely scream out {that a} commodity supercycle is underway, somewhat they level to a interval of cyclical energy for vitality and at greatest consolidation for industrial metals.

(Enhancing by Muralikumar Anantharaman)

(([email protected])(+61 437 622 448)(Reuters Messaging: [email protected]))

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.