By Andy Residence

LONDON, Might 7 (Reuters) – A rising tide lifts all boats however some are heavier than others.

Industrial metals are glowing white scorching in a fusion of post-pandemic manufacturing restoration and an rising narrative of a commodities supercycle.

Copper has hit all-time highs above $10,000 per tonne, with London Metallic Alternate (LME) three-month metallic final buying and selling at $10,350. Tin hit a 10-year excessive on Thursday and aluminium is charging up in direction of its 2018 peak of $2,718, final buying and selling at $2,530 per tonne.

However not each metallic is on a supercycle surge.

Lead and zinc have been lifted by the broader metallic rally however appear reluctant contributors. Whereas the copper worth has greater than doubled from its COVID-19 low level in March 2020, zinc has appreciated by a extra modest 58% and lead by simply 30%.

The explanation, because the Worldwide Lead and Zinc Examine Group (ILZSG) has famous, is that each markets recorded large provide surpluses final yr and are on target to do the identical once more this yr.

Furthermore, neither suits nicely into the supercycle narrative, leaving the 2 metals the ugly sisters on the supercycle ball, simply as they have been over the past worth get together in 2009-2010.

HEAVY WEIGHTS

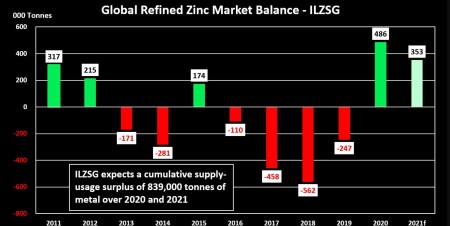

The refined zinc market recorded a supply-demand surplus of 486,000 tonnes final yr and is forecast to document one other hefty surplus of 353,000 tones in 2021, ILZSG’s newest twice-yearly evaluation discovered.

Lead manufacturing, in the meantime, exceeded utilization by 172,000 tonnes final yr and can accomplish that once more this yr to the tune of 96,000 tonnes, ILZSG mentioned. Will probably be the third consecutive yr of oversupply.

Zinc mine manufacturing was hit arduous by lockdowns in provider international locations final yr, falling by 4.9% relative to 2019. However the world’s smelters managed to carry metallic manufacturing by 1.6%, at the same time as utilization slumped.

Lead manufacturing – each mined and refined – fell final yr however demand fell tougher, unsurprisingly given the metallic’s publicity to the automotive sector.

Critically, China has not come to the rescue by hoovering up the remainder of the world’s surplus metallic because it has in different markets, together with copper and aluminium,

China’s internet refined zinc imports fell by 6% to 512,000 tonnes final yr. It was the second consecutive yr of decline.

Web imports of refined lead have collapsed during the last two years from 102,000 tonnes in 2018 to simply 17,000 tonnes in 2020.

Final yr’s surplus metallic, it follows, remains to be in storage, albeit not absolutely statistically seen.

LME zinc stock rose by 150,000 tonnes final yr however there was a shadow construct of 100,000 tonnes in off-warrant shares – metallic warehoused with express contractual reference to potential LME supply.

The LME zinc market will get the occasional sharp reminder of surplus within the type of concentrated deliveries on to LME warrant, such because the 105,800 tonnes that hit the system over two days in January and the same 31,700-tonne burst final month.

SUPERCYLE STRAGGLERS

Bodily surplus is weighing down each metals, neither of which has an apparent tie-in to the electrification and decarbonisation drivers which have set different metals abuzz.

Certainly, within the case of lead, the metallic would appear to be an apparent loser within the transition from inside combustion engines to electrical automobiles, even when its utilization in stationary battery storage is a forgotten a part of the inexperienced story.

Zinc batteries are an increasing a part of the battery panorama however nonetheless symbolize a small part of a utilization profile that is still dominated by galvanising metal.

Each metals will proceed to learn from a worldwide manufacturing restoration however neither is prone to generate the identical funding pleasure rolling over different battery metals comparable to lithium and cobalt.

Lead and zinc look set to be the supercycle stragglers, simply as they have been final time.

The China-led supercycle of the 2000s noticed copper peak at its earlier all-time excessive of $10,190 per tonne in February 2011. Zinc’s all-time excessive got here in 2006 and lead’s one yr later in 2007. Each rose with the 2009-2010 worth tide however with out getting near their earlier summits.

RELATIVE VALUES

Zinc’s supply-usage cycle is out of sync with a lot of the different metals presently having fun with an “old-economy” resurgence.

That signifies that lead’s cycle is equally out of kilter since nearly all of the world’s main lead comes from zinc deposits.

Zinc is the dominant sister each geologically and within the buying and selling area.

Within the ever-popular relative-value commerce between the 2 metals, lead tends to be the bear part. Zinc’s premium to guide is round $750 per tonne.

That extensive hole appears at odds with the ILZSG’s forecasts since relative to international utilization – 13.2 million tonnes within the case of zinc final yr and 11.5 million for lead – the zinc market would seem like carrying the heavier weight of surplus metallic.

Lead’s massive low cost can be shocking since, in distinction to zinc, the market reveals indicators of bodily tightness.

U.S. premiums are at nine-year highs, based on Fastmarkets, because the shuttering of a secondary smelter in South Carolina leaves consumers uncovered to rolling disruption within the freight sector.

The discrepancy is all the way down to buyers’ deal with the zinc uncooked supplies story on the expense of what is taking place within the refined phase of both market.

The zinc concentrates market is far tighter than anybody anticipated it to be after zinc’s bull surge over 2017-2018.

The anticipated wave of mine provide has didn’t materialise and following COVID-19 lockdowns, remains to be working late.

The excessive zinc premium relies on this uncooked supplies constraint, which impacts lead much less as a result of it wants much less mined materials to stability what is basically a secondary provide chain.

The deal with zinc mine provide, nonetheless, leaves the relative-value commerce open to unexpected developments within the refined metallic phase of the markets, such because the mass arrival of zinc shares in LME warehouses or indicators of stress in lead’s bodily provide chain.

Zinc and lead look set to proceed combating it out on this long-running reverse magnificence contest. The worth hole between the 2 will inform you which is successful.

The primary bull get together is happening someplace else.

Lead and zinc are the “supercycle” laggardshttps://tmsnrt.rs/3uuTQeh

Zinc market is going through a cumulative surplus of 839,000 tonnes in 2020 and 2021https://tmsnrt.rs/3nVl9Mk

Lead is heading for a 3rd consecutive yr of provide surplushttps://tmsnrt.rs/3nTNKSn

(Modifying by Barbara Lewis)

(([email protected], 44-207-542-4412 and on Twitter https://twitter.com/AndyHomeMetals))

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.