By Giulia Segreti and Simon Johnson

ROME/STOCKHOLM, April 13 (Reuters) – Put up-Brexit commerce guidelines imply prosecco provider Serena Wines 1881 should retailer bottles destined for Britain on costlier, fumigated pallets in their very own nook of its warehouse within the northeast Italian city of Conegliano.

The brand new cargo requirement is one instance of the additional value and complexity that corporations throughout continental Europe face serving British clients since Jan. 1, including to disruption of the COVID-19 pandemic to drive UK-EU commerce volumes decrease.

“These first months have been hectic, hellish for everybody,” mentioned export supervisor Nicola Piovesana. “Supply occasions at the moment are longer, now it takes 2 weeks to get to the (UK) consumer, whereas earlier than it took one week on the most.”

The Dec. 24 deal reached between Britain and the EU after years of wrangling over post-Brexit commerce phrases no less than meant items commerce – roughly half the entire $900 billion of annual EU-UK commerce – was spared from tariffs and quotas.

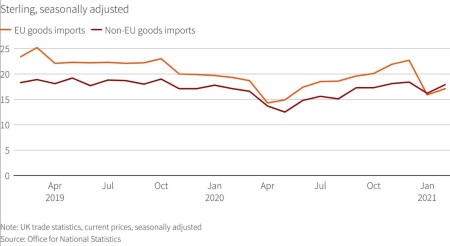

However January commerce volumes crashed as difficulties with the brand new guidelines mixed with a success from pandemic restrictions and substantial stockpiling by corporations on each side of the English channel in late-2020 in anticipation of bother.

UK knowledge launched on Tuesday confirmed solely a partial restoration in February, with British items exports to the EU 12.5% beneath year-ago ranges and imports 11.5% down. Information from Italy, France and Germany – Britain’s greatest EU buying and selling companion – have all proven falls within the quantity of UK commerce in February.

With Britain its second largest export market after Germany, Serena Wines has bent over backwards to safe enterprise with UK motels, eating places and caterers by revamping inside customs processes and dedicating one employees member to Britain alone.

However the pallet subject is typical of the kind of knock-on impacts that firms at the moment are having to take care of: on this case, commerce with any non-EU nation means worldwide guidelines on anti-pest therapy of wooden packaging apply.

Piovesana says the fumigated pallets value about 9.50 euros (8.23 sterling) every, nearly 20% greater than the common ones. UK steerage is for corporations to contemplate switching from wood to plastic pallets.

“EASIER TO SHIP TO ASIA”

Excessive High quality Meals, a Rome-based meals provider to high-end retailers from artisanal bakers to West Finish eateries, struggles most with documentation on speciality meat merchandise like beef from Black Angus cattle crossed with an Italian breed.

“There appears to be a entice in each nook,” lamented managing director Simone Cozzi, including the corporate’s hygiene officer – a educated veterinarian – now wanted to spend further time with them when filling within the essential paperwork.

Cozzi mentioned delays at customs factors had additionally added to move prices as a result of drivers need extra money to compensate for wasted time, whereas air shipments might be held in a UK airport for 24-plus hours in comparison with solely 30-45 minutes in Hong Kong.

“In the mean time it’s truly simpler to ship issues to Asia,” he mentioned.

Italian farmers affiliation Coldiretti cites such hurdles as endangering 3.four billion euros of Italian agri-food exports, pointing to a 38% drop in exports of foodstuffs to the UK in January and nearly 14% in February.

Some corporations have discovered work-arounds – albeit at a value.

Swedish wooden merchandise provider Vida Wooden, using the wave of lockdown-induced booms in DIY residence enchancment exercise, had an present UK subsidiary which now takes care of all of the customs trouble and payments the British end-customer from there.

“So there may be extra administration for us,” mentioned CEO Karl-Johan Löwenadler, acknowledging that resolution wouldn’t be accessible to smaller firms with no UK presence like its 11-person operation in Billericay, 25 miles (40 km) east of London.

MORE CHECKS TO COME

Whereas tales of main disruption are frequent amongst items exporters throughout totally different sectors in Europe, the unanswered query stays what the long-term affect on commerce shall be.

A UK authorities spokesperson mentioned the February knowledge confirmed “welcome progress” within the worth of commerce with the EU from January, suggesting most merchants and hauliers have been now adapting.

“It is untimely to make any agency judgments on the long-term impacts of our new buying and selling relationship with the EU, particularly with the pandemic nonetheless ongoing,” the spokesperson added.

The Financial institution of England expects UK-EU commerce in items and providers to fall by greater than 10% in the long run resulting from post-Brexit restrictions, and for British output to be round 3% decrease than if the federal government had agreed to the EU guidelines wanted for a frictionless commerce deal.

Furthermore, exporters to Britain face added issues within the coming months, with further paperwork for UK meals imports akin to meat, fish and cheese wanted from October and an extra raft of checks to take impact from January 2022.

A gaggle of lawmakers and heads of enterprise will maintain a primary “proof session” on Brexit’s commerce affect on Thursday with a view to creating suggestions on attainable enhancements.

But even earlier than Brexit, the EU’s share of Britain’s commerce had already been declining for years, with figures quoted in a UK parliament report final 12 months displaying UK exports to the EU made up 43% of all its exports in 2019, down from 54% in 2006.

Some main European exporters are resigned to the concept, whereas the early disruption will finally quiet down, the logic of a Brexit deal that spurned nearer ties will inevitably result in an extra drift southwards of UK-EU commerce volumes.

It might already be occurring: A December 2020 survey of members of Germany’s BGA commerce affiliation confirmed one out of 5 firms have been reorganizing provide chains to swap out British suppliers in favour of these within the EU single market.

(1 euro = 0.87 sterling)

Imports into the UKhttps://tmsnrt.rs/3a6PcLz

UK exportshttps://tmsnrt.rs/3a92jvx

(Further reporting by Crispian Balmer, Michael Nienaber, Jan Strupczewski, Richard Lough, David Milliken, Liz Piper; Writing by Mark John; Enhancing by Toby Chopra and Jon Boyle)

(([email protected]; +44 207 542 5816; Reuters Messaging: [email protected]))

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.