By Tommy Wilkes and Thyagaraju Adinarayan LONDON, Dec 18 (R

By Tommy Wilkes and Thyagaraju Adinarayan

LONDON, Dec 18 (Reuters) – Retail merchants have ridden 2020’s inventory market rally higher than the professionals, with their hottest picks outperforming market indexes and well-resourced buyers akin to hedge funds.

On-line buying and selling platforms have reported a retail rush for the reason that COVID-19 pandemic hit markets in March, with near-zero rates of interest and a roaring rebound luring a brand new technology of stuck-at-home merchants eager to sharpen their abilities on shares.

And whereas the scramble into fast-growing however highly-valued shares has echoes of the 2000 dotcom bubble, plentiful low-cost money means retail merchants don’t but look able to money in.

COVID-19 WINNERS

File sums of central financial institution stimulus have turbocharged markets in 2020, inflating asset costs, usually to report ranges and significantly in U.S. tech.

Retail buyers have picked the largest beneficiaries, together with Amazon AMZN.O, electrical automobile makers Tesla TSLA.O and Nio NIO.N, in addition to pharma hopefuls on the lookout for a break within the COVID-19 vaccine hunt.

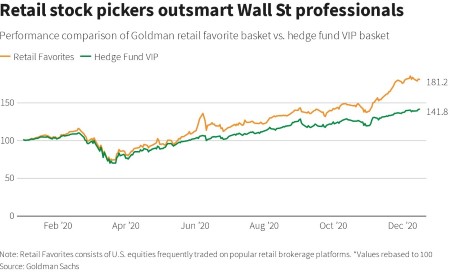

A basket of 58 U.S.-listed shares in style with retail merchants is up greater than 80% this 12 months, outstripping the S&P 500’s .SPX 14.5% rise and a hedge fund basket’s return of 40%, two Goldman Sachs-compiled indexes present.

Novice merchants have additionally piled into electrical truckmaker Nikola NKLA.O, which is but to promote a truck, and large lockdown winners in train bike maker Peloton PTON.O and Zoom ZM.O.

Market veterans draw comparisons with the frenzy in little-known web shares earlier than the 2000 dotcom crash.

“In fact it is a bubble. However cash is free, liquidity is excessive, its by no means been simpler to commerce for retail punters, there is not any financial savings charge or bond yield and everybody desires the bubble to pop,” Mark Taylor, a gross sales dealer at Mirabaud Securities, mentioned.

AT A STRETCH

Most of the shares retail merchants have been shopping for look costly, based mostly on the commonly-used price-to-earnings ratio.

The P/E ratio for shares in Goldman’s ‘Retail Favourites’ index is deeply unfavorable, as the businesses lose cash.

For the ‘Hedge Fund VIP’ index, the ratio is 32.

Many institutional buyers have poured money into the identical pumped-up shares, however they normally diversify.

Retail portfolios subsequently have a lot weaker steadiness sheets, as proven by the online debt to working revenue ratio for Goldman Sach’s hedge fund basket of 1.8, in opposition to retail’s 4.8.

Stretched valuations and a focus of retail buyers in some shares, Refinitiv information exhibits they personal 20% of Tesla shares in opposition to 0.17% of 117-year-old Ford F.N, might exacerbate a selloff if confidence in ever-rising costs wanes.

EVASIVE EUROPE

In Europe, the place retail share possession tends to be decrease than within the U.S., small buyers have had far much less luck.

Shares hit exhausting by the financial downturn are amongst their hottest purchases, buying and selling platforms instructed Reuters.

Closely purchased shares embody Airbus AIR.PA and Rolls Royce RR.L, British financial institution Lloyds LLOY.L, Lufthansa LHAG.DE and Worldwide Consolidated Airways ICAG.L, information from Saxo Financial institution, IG Group, AJ Bell, Interactive Investor and eToro exhibits.

Regardless of a vaccine-inspired rebound since November, these shares stay deep within the pink and approach off the 4% year-to-date drop within the broader European market .STOXX.

Retail inventory pickers outsmart Wall St professionalshttps://tmsnrt.rs/2Kc9KIv

Retail favorites commerce at excessive multipleshttps://tmsnrt.rs/2LByytQ

European shares in style amongst retail tradershttps://tmsnrt.rs/2Wo7XCL

(Modifying by Alexander Smith)

(([email protected]; +44 (0) 7769 955711;))

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.