reuters://realtime/verb=Open/url=cpurl://apps.cp./Apps/econ-polls?RIC=IDTRDpercent3

reuters://realtime/verb=Open/url=cpurl://apps.cp./Apps/econ-polls?RIC=IDTRDpercent3DECI ballot knowledge

Feb exports seen at 8.73% y/y, vs Jan’s 12.24%

Feb imports seen at 12.60% y/y, vs Jan’s -6.49%

Feb commerce surplus of $2.21 billion forecast, vs Jan’s $1.96 billion

Commerce knowledge due at 0400 GMT on Monday, March 15

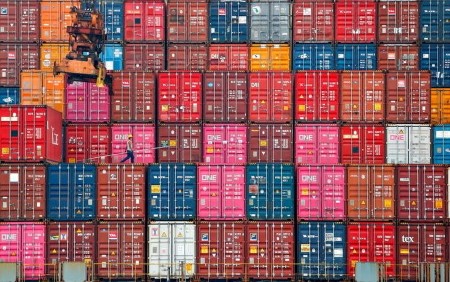

JAKARTA, March 12 (Reuters) – Indonesia’s commerce surplus seemingly widened in February from a month earlier on the again of upper commodity costs, which might be a 10th straight month-to-month surplus for Southeast Asia’s largest economic system, in line with a Reuters ballot on Friday.

The median forecast of 12 economists within the ballot was for the resource-rich nation to file a $2.21 billion commerce surplus in February, up from $1.96 billion in January.

The ballot predicted export progress slowed to eight.73% yearly final month from 12.24% in January, which Financial institution Mandiri analyst Faisal Rachman attributed to slowing demand in China balancing out greater costs of the nation’s principal commodities corresponding to palm oil and coal.

In the meantime, imports seemingly grew 12.60% on-year, their first progress since June 2019 and adopted January’s 6.49% decline, as a consequence of a low base impact, the ballot confirmed.

The February commerce knowledge can be launched on Monday, days earlier than Financial institution Indonesia meets to overview financial coverage.

Indonesia’s month-to-month commerce surpluses, which got here from stronger export restoration from the affect of the coronavirus pandemic amid weak import demand, have helped the nation slim its present account deficit.

This gave room for the central financial institution to chop charges by 150 foundation factors through the pandemic.

“In 2H21, import will begin to catch up as financial progress accelerates pushed by strengthening home consumption and significantly rising fastened capital funding actions,” Faisal of Financial institution Mandiri mentioned.

“Larger funding actions will result in greater import progress of uncooked supplies and capital items.”

(Polling by Nilufar Rizki; Writing by Tabita Diela; Enhancing by Gayatri Suroyo and Martin Petty)

(([email protected]; +628111135032;))

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.