Financial Overview

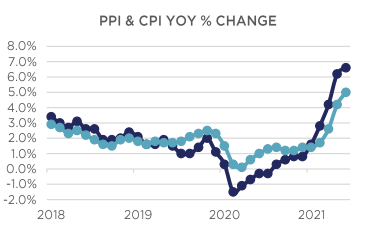

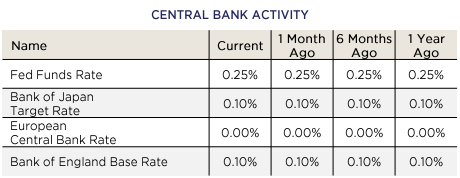

Inflation stays the massive story on the midway level of 2021, because the base-effect impression of Q2 information wanes briefly earlier than doubtless resuming in late Q3. The Fed’s insistence that the broad-based rise in costs is “transitory” has stored fairness markets calm and bond yields subdued. Ought to the Fed show to be incorrect, we may see a dramatic re-rating of danger belongings by year-end.

Headline CPI for Could rose +0.6% MoM and +5.0% YoY (the “base-effect” referring to the interval a 12 months in the past when the economic system was largely shut down and costs had been falling), whereas producer costs edged up +0.8% MoM in Could and +6.6% YoY. Throughout the PPI quantity, grain costs surged +25.7% on the month, metals had been up +6.9%, and beef and veal costs rose +10.5%. We’ve got began to see a decline in some enter prices as lumber is off almost 40% from its current excessive. The PCE Deflator rose +0.4% MoM and is up +3.9% YoY.

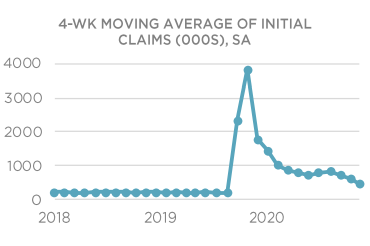

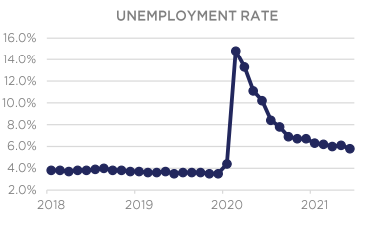

Regardless of this rise in costs, the Fed stays targeted on employment. The June report for Could confirmed +559ok new jobs created and a 5.8% unemployment fee. Chair Powell has insisted he want to see that fee get nearer to pre-pandemic ranges of sub-4% earlier than doubtlessly tightening financial coverage. Common Hourly Earnings rose +0.5% in Could and are up +2.0% YoY. Rising wages proceed to be the story as employers try to coax staff off of enhanced unemployment advantages and again into the labor drive.

With the Fed’s twin mandate heretofore being to advertise steady costs within the context of full employment, this shift to concentrating on inflation ranges (+2%) and unemployment charges has compelled a reconsideration of the Fed’s mission and invited hypothesis as to its political independence. Time will inform if this present bout of inflation is actually temporal, however all eyes might be targeted on August’s Jackson Gap confab for extra clues as to the Fed’s present targets and plans for a doable unwind.

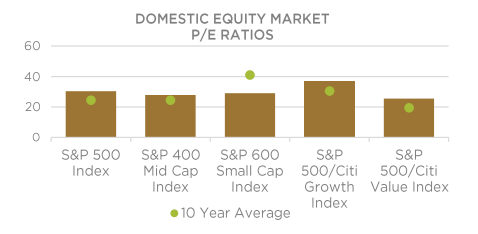

Home Fairness

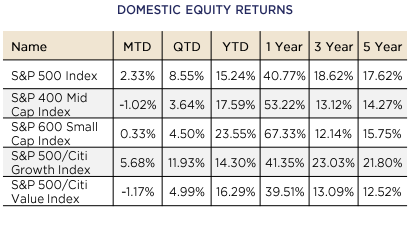

US Equities completed the month of June on a comparatively excessive be aware, with the benchmark S&P 500 Index gaining +2.33% on the month, after notching its 34th document excessive of the 12 months on Wednesday. The Index closed at 4,297, up +15.24% for the 12 months. Small- and Mid-Caps, as measured by the S&P 600 and S&P 400 Indices, returned +0.33% and -1.02%, respectively on the month. On a year-to-date foundation, Small- and Mid-Caps proceed to outpace Giant-Caps, having returned +23.55% and +17.59% respectively on the 12 months.

[wce_code id=192]

For the quarter, the S&P 500, S&P 400, and S&P 600 returned +8.55%, +3.64%, and +4.51%, respectively.

On the sector stage, Mega-Cap Know-how firms had been again in vogue, with Know-how (Apple, Microsoft) and Communications (Alphabet, Fb) sectors gaining +6.95% and +2.72%, respectively on the month, and +11.56% and +10.32% on the quarter. Each Microsoft and Fb made headlines as the previous grew to become the second firm to eclipse a $2 Trillion market worth (subsequent to Apple) and the latter escaped a Federal Commerce Fee (FTC) inquiry seemingly unscathed, propelling it above $1 Trillion in market capitalization. The resurgence of Huge Tech helped propel Development shares (+5.68%), as measured by the S&P 500 Development Index, over Worth shares (-1.17%), as measured by the S&P 500 Worth Index by 685bps. Constructive firm information, coupled with falling rates of interest served as a powerful prescription for outperformance; nevertheless, regardless of this close to time period outperformance, the High 5 firms within the S&P 500 account for much less (22%) of the index than they did mid-Summer time 2020 (24%) showcasing the energy of “smaller” firms since re-opening began to take maintain. Laggards throughout the month included cyclical, with Supplies, Financials, and Industrials giving again -5.30%, -2.96%, and -2.21%, respectively because the Fed Chair Powell sounded a extra hawkish tone.

In different information, all 23 Banks topic to the Federal Reserve’s CCAR stress checks handed, and most main banks introduced dividend and large-scale share buyback operations, which bodes could bode effectively for Financials within the again half of the 12 months, regardless of a flatter yield curve than a month and quarter in the past. The benchmark 10-12 months Treasury yield closed the month yielding 1.46%, down from 1.58% final month, and 1.73% on the finish of the primary quarter.

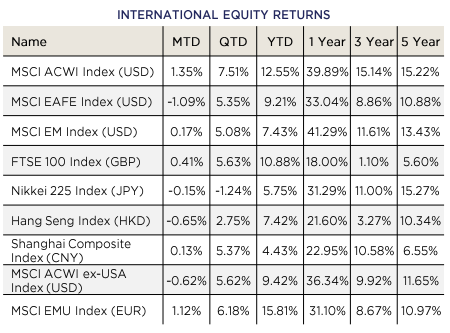

Worldwide Fairness

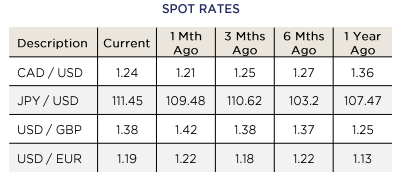

Worldwide Equities confronted continued headwinds in June as constructive information on the vaccination entrance in Developed Markets (DM) was offset by US greenback energy and Chinese language financial information weak spot in Rising Markets (EM). DM equities, as measured by the MSCI EAFE Index, returned -1.25% in June, in contrast with a +0.17% return for EM equities, as measured by the MSCI EM Index. Eurozone equities, as measured by the MSCI EMU Index, posted constructive returns as effectively, gaining +1.12% on the month.

For the quarter, worldwide equities posted constructive returns, with DM, EM, and Eurozone equities posting returns of +5.35%, +5.08%, and +6.18%, respectively.

From a rustic standpoint, Japanese equities, as measured by the Nikkei 225 Index returned -0.15% in JPY phrases on the month. Chinese language equities, as measured by the Shanghai Composite returned +0.13% in CNY phrases, affected by slowing financial information, a rise in covid circumstances, and a weaker Yuan. A flood of Chinese language IPOs launched in June, with a major variety of main and secondary listings in Hong Kong, however most notably Chinese language ride-sharing big DiDi within the US. DiDi has a dominant 80% share in China, and closed its first day of buying and selling with a market cap of $68B, in comparison with $94B for Uber and $20B for Lyft. From an EM standpoint, MSCI EM ex-China has returned +11.06% 12 months to this point, in comparison with +7.45% for MSCI EM, highlighting the relative drag that China has been on EM as a complete given its outperformance in 2020.

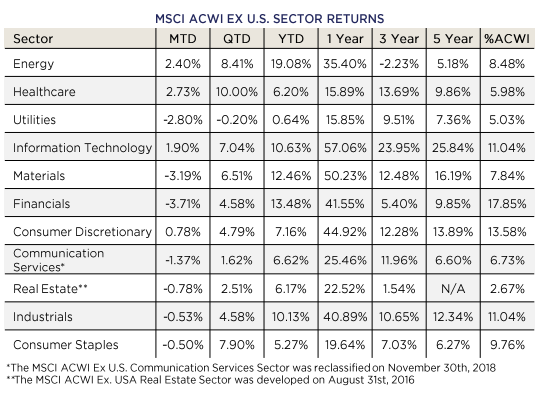

On the sector stage, the top-performing Worldwide sectors included Power, Healthcare, and Know-how, which returned +2.40%, +2.73%, and 1.90%, respectively on the month. For the quarter the top-performing sector was Healthcare (+10.00%) and the worst performer was Utilities (-0.20%).

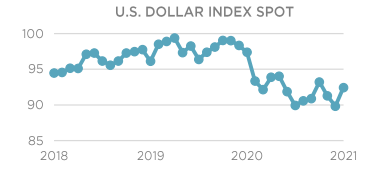

Transferring ahead, the reopening commerce ought to proceed to make progress, with elevated vaccinations and financial exercise; nevertheless, current energy within the U.S. Greenback stays a key headwind. Regardless of current Greenback energy, as sentiment internationally improves, current traits could reverse, offering a tailwind for each DM and EM equities relative to U.S. equities within the second half of the 12 months. Additional momentum may ensue ought to the Delta variant stay contained and vaccination traits in EM particularly flip the nook, as worldwide markets as a complete are more likely to pattern on sentiment over fundamentals within the close to time period till Jackson Gap in August.

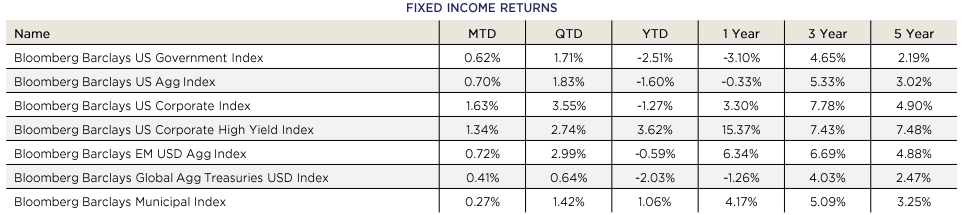

Mounted Revenue

June bond market information was dominated by two items of knowledge, the inflation (CPI) studying that got here out on June 10th on the highest stage in over a decade, and the Federal Reserve’s response to it after their assembly on June 16th. Inflation has been rising faster than anticipated, with among the rise attributable to base results (measuring the rise from pandemic lows). Members of the Fed have admitted that they underestimated the rise. As their eyes have been opened by the info, they’ve up to date their expectations for future coverage tweaks. The Fed meets once more on July 28th, however any main announcement could also be held till their annual convention in Jackson Gap, August 26th-28th.

These coverage updates embrace starting to speak about asset buy tapering (cut back/finish Quantitative Easing – QE) and elevating rates of interest earlier than beforehand projected. The market response to those changes was swift. Treasury bonds maturing in lower than 7 years noticed their yields rise, whereas longer-maturity Treasury bond yields declined. The pivot or twist within the yield curve acknowledged the Fed’s affect on short-term rates of interest whereas expressing doubt in its capacity to boost charges with out hurting financial progress.

No progress considerations are exhibiting within the credit score markets. Funding Grade (IG) bonds have carried out effectively, with their spreads tightening additional. Present valuations are a bit dear however needs to be pretty sturdy as financial energy continues.

Excessive Yield (HY) bond spreads additionally tightened. On a historic foundation, they do seem costly, however once more, so long as the economic system is operating sturdy, there isn’t a speedy impetus for spreads to maneuver wider. Ought to progress/stimulus start to wane, the riskiest elements of the bond market will doubtless develop into a risky area.

Municipal bonds stay in excessive demand, protecting yield ratios on the decrease finish of historic valuations. Credit score danger on this market has declined because the economic system (and tax income) comes again on-line. The Federal Authorities’s money infusion into State and Native governments has left many flush with money. Credit score Score businesses have acknowledged the advance with ranking upgrades and extra constructive outlooks.

Treasury bonds have benefited from falling yields on longer maturities, pushing costs increased. If inflation proves to be transitory and financial progress fades, present ranges could also be smart. That is the state of affairs the market is at the moment pricing in. The CPI readings launched on July 13th and August 11th ought to supply further visibility.

Different Investments

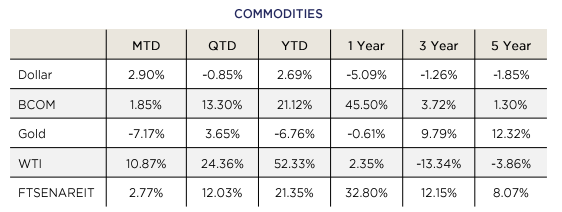

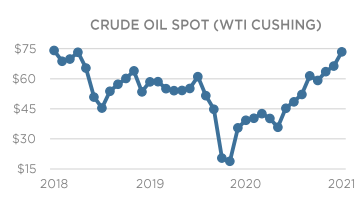

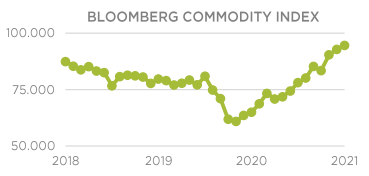

Different Investments had been combined in June, with the US Greenback ending sturdy. The US Greenback as measured by the DXY Index concluded in June at +2.90% was helped by a seemingly hawkish flip by the Fed. Commodities, as measure by the Bloomberg Barclays Commodity Index, had been up +1.85% for the month. Power, which is the biggest part of the index, directed commodities increased regardless of some weak spot by treasured and industrial metals. WTI Crude Oil rose +10.78% throughout the month as crude oil inventories continued to say no.

Lumber was one of many standout performers throughout the pandemic as a red-hot housing market and restricted lumber provide prompted an enormous run-up in worth by means of Could. Nevertheless, lumber completed June at $737.40 per thousand board ft, down over 50% from its excessive of over $1,500 per thousand board ft set simply over a month in the past. Manufacturing is lastly catching as much as demand and folks could begin to be favoring holidays over house renovation.

Throughout mid-June, China introduced that it might launch authorities stockpiles of business metals to fight shortages and excessive metallic costs. China will particularly goal copper, aluminum, zinc, and another metals in efforts to maintain commodity costs steady. Copper, particularly, completed the month at $4.29 per pound, down from its excessive of $4.75 per pound in Could.

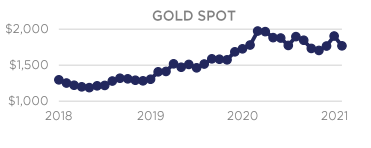

Gold was one other laggard within the alternate options area, ending down -7.17% for the month and erasing all positive factors from Could. The newest Fed assembly result in a stronger US Greenback and set-up for doubtlessly increased actual charges, thus placing downward strain on gold costs.

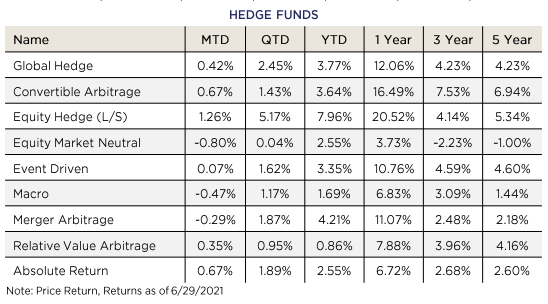

Hedge Fund methods had been principally constructive throughout the month, with six out of 9 methods tracked posting constructive returns on common. Fairness Hedge (Lengthy/Brief) methods had been the highest performer, up +1.26% on the month, and stay the highest performer for the 12 months up +7.96%. Fairness Market Impartial methods had been the worst performer, down -0.80% for the month.

ESG

The month of June delivered combined outcomes for the ESG built-in methods. Whereas they held their floor general, there was a little bit of efficiency giveback in a number of of the methods.

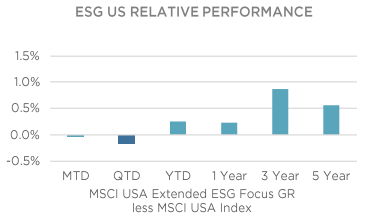

The ESG aligned U.S. index was near flat in comparison with the non-ESG built-in counterpart. The 2 shortest intervals replicate some lag, however 12 months-to-Date and all longer intervals proceed to indicate sturdy outperformance.

ESG built-in EAFE returns have been extra combined than the U.S. or Rising Markets. All three shorter-term outcomes are trailing, together with the 5-year quantity, however 1 and 3-year efficiency has been additive vs. non-integrated publicity.

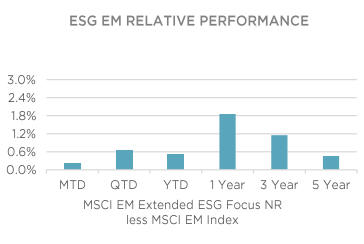

Rising Market ESG built-in returns posted one other achieve vs. the benchmark in June. ESG integration stays additive to efficiency throughout all intervals in EM. This allocation continues to face out as a shining instance of how ESG issues can result in higher outcomes over time.

Funding Grade company bonds have continued to put up outperformance resulting from ESG integration. The ESG built-in fastened revenue publicity returns are correlated with the non-ESG index, as they’ll have comparable period and credit score traits, permitting them to maneuver collectively directionally. Safety choice seems to be giving ESG integration a sturdy edge. Avoiding unhealthy investments in fastened revenue is essential, in an asset class with such an uneven return profile. The danger administration properties of monitoring ESG exposures assist with this.

Engine No. 1, an activist funding store which grew to become an in a single day sensation within the Accountable Investing world this 12 months by profitable three board seats in a Proxy battle with Exxon (whereas solely proudly owning 0.02% of the inventory excellent), has launched their first ETF. This fund will give Engine No. 1 an possession stake within the 500 largest U.S. firms, which they’ll use to agitate for constructive change (impression), with the expectation that the modifications for good will also be financially useful to the corporate implementing the change.

Initially printed by Nottingham Advisors

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.