Manufacturing bounced again fairly fairly quick within the US, proper after the reopening of the county in Could-June final 12 months and the manuf

Manufacturing bounced again fairly fairly quick within the US, proper after the reopening of the county in Could-June final 12 months and the manufacturing exercise has continued to broaden fairly quick, now being at report ranges. In Europe manufacturing has been surging as effectively, which is likely to be defined by the brand new industries which can be arising, such because the renewable vitality and the coronaviru trade to some extent.

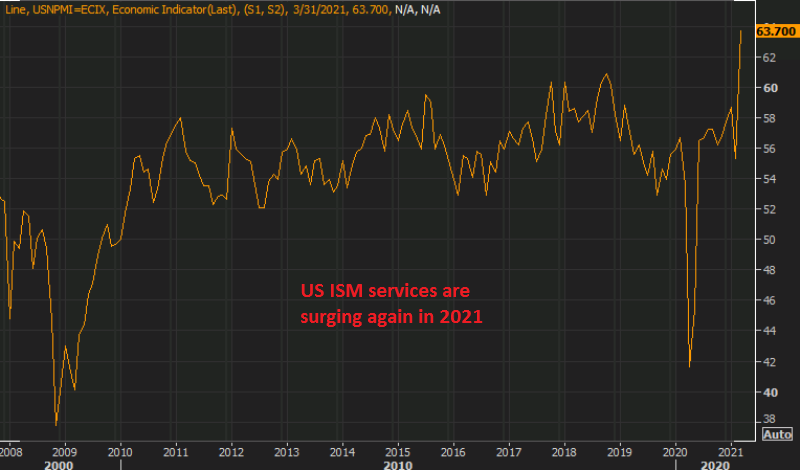

However, now the service sector is surging as effectively. In opposite, providers are nonetheless in recession in Europe. Within the US although, ISM non-manufacturing surged additional in March, leaping to 63.7 factors, beating expectations and growing to the best stage on report.

This reveals that the US economic system is faring a lot matter than the European one and the reason being apparent, the restriction are hurting providers immensely. So, no stopping for the US economic system, which is staring to have an effect on the USD positively and I anticipate the bullish momentum to proceed because the FED is pressured to simply accept the higher fundamentals and better inflation that’s coming.

- March ISM non-manufacturing 63.7 factors vs 59.zero anticipated

- Document excessive (since 2008)

- February non-manufacturing was was 55.three factors

- New orders 67.2 factors vs 51.9 prior

- Costs paid 74.zero factors vs 71.eight prior (highest since 2008)

- Employment 57.2 factors vs 52.7 prior

- Full report

This can be a scorching print and an all-time excessive. New orders crushed estimates. The market response has been middling, maybe as a result of this was foreshadowed in some earlier sturdy March information. In any case, the US reopening goes effectively.

This report has solely been out since 2008 however the ISM notes that utilizing among the sub-indexes, it could possibly be estimated again to 1997 and this might nonetheless be the very best studying.

Extra particulars:

- backlog of orders 50.2 vs 55.2

- new export orders 55.5 vs 57.6 prior

- imports 50.7 vs 50.5 prior

- provider deliveries 61.zero vs 60.eight prior

- stock change 54.zero vs 58.9 prior

- stock sentiment 52.7 vs 54.three prior

Feedback within the report:

- “Logistics delays and uncertainty are creating vital issues with suppliers and inventories. Additionally, [there are] price issues relating to inflated pricing resulting from logistics and shortages.” (Lodging & Meals Companies)

- “Our 4 Southern California places are lastly open after being closed for 12 months. We’re presently experiencing extreme provide chain and distribution disruptions associated to a number of components. Reopening of the California and New York movie show markets [is] making a surge in demand; additionally, producers and a distributor associate are coping with labor shortages.” (Arts, Leisure & Recreation)

- “Residential new house building demand continues to outpace provide. Constructing materials delays, discontinuations and shortages are starting to develop. Transport delays on the L.A. and Lengthy Seaside ports have contributed to longer lead occasions. Chilly climate in Texas has damage a number of part producers for constructing supplies. We’ve got encountered the ‘excellent storm’ for constructing materials shortages and worth will increase.” (Building)

- “There may be optimism in greater schooling that Fall 2021 will likely be close to regular with vaccinated college students, staff and employees returning to their roles on campus.” (Instructional Companies)

- “Native and nationwide outlook stays constructive, regardless of return-to-work issues [and] work-from-home-related points/purchases.” (Finance & Insurance coverage)

- “Vaccination charges are rising, and coronavirus [COVID-19] infections are falling within the area, resulting in optimistic outlooks and forecasts for elevated enterprise exercise. Affected person census numbers are trending upward, primarily resulting from a greater ratio of sufferers searching for elective procedures versus COVID-19 hospitalizations. Nevertheless, revenues are nonetheless comfortable, indicating {that a} full rebound in enterprise exercise has not but been realized.” (Well being Care & Social Help)

- “Resin/oil worth will increase are starting to filter all the way down to merchandise that we procure. Along with worth will increase, we’re additionally seeing longer lead occasions as provide chains pivot to search out cheaper provide choices.” (Data)

- “Lack of chemical compounds and the latest freeze in Texas has delayed some orders and is making a micro [price] will increase for sure merchandise. Suppliers are utilizing the short-term scarcity to their benefit to lift charges.” (Mining)

- “Increased ranges of demand associated to further enterprise reopening, and elevated exercise associated to vaccination distribution.” (Skilled, Scientific & Technical Companies)

- “Enterprise is choosing up as mandated restrictions appear to be easing and spring is correct across the nook.” (Actual Property, Rental & Leasing)

- “Outlook stays cautiously optimistic for the second half of the 12 months as companies proceed to open up and tasks come on-line.” (Retail Commerce)

- “Total, there are nonetheless delays in import shipments of products, although [the situation has] barely improved. The market forecast on ocean shipments and logistics continues to be the identical for subsequent quarter; enhancements is likely to be seen in Q3. COVID-19 points proceed to influence demand and provide throughout the globe, and the brand new stimulus assist is anticipated to assist the economic system and result in a rise in retail spending over the subsequent few months.” (Wholesale Commerce)