Markets:Gold up $15 to $1716WTI crude oil down $4.76 to $82.12US 10-year yields down 8 bps to 3.26%S&P 500 up 72 points, or 1.8%, to 3980EUR leads

Markets:

- Gold up $15 to $1716

- WTI crude oil down $4.76 to $82.12

- US 10-year yields down 8 bps to 3.26%

- S&P 500 up 72 points, or 1.8%, to 3980

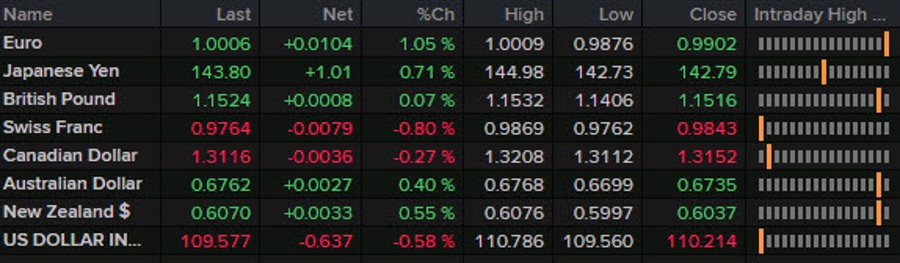

- EUR leads, JPY lags

The yen train-wreck continued on Wednesday as it touched 144.98 before reversing down to 143.77 late. That’s still up 100 pips on the day as market participants get increasingly uneasy about some kind of intervention. It’s been a one-way move and Japanese MoF officials have said as much but it will take real money or a change in monetary policy to spark a lasting turnaround.

The bounce in the yen was in line with broader US selling in the latter half of the day. Yields were lower today and stocks higher so that explains some of the move but traders also closely read Brainard’s comments. The wire headlines didn’t say much but the speech itself offered a far-more nuanced view on inflation dynamics than Powell at Jackson Hole, including many old Team Transitory talking points.

The ECB decision is also looming and that may have led to some position-squaring in the crowded USD-long space. EUR/USD touched below 0.9900 again but couldn’t break yesterday’s low before a steady bid hit back to parity.

Cable found a big technical level as it tested the pandemic low of 1.1404. It came to within two pips of that and some headlines argued it was the lowest since 1985 but the proof is in the price action and support held leading to a big rally to 1.1529. The fundamental backing is the increasing realization that the government is going to eat the energy crisis losses in the UK and while that’s going to create a debt problem, it won’t mean broad consumer and business insolvencies in the near term.

The Bank of Canada decision was the fundamental highlight of the day but didn’t leave a lasting impression. The 75 bps hike was mostly pricied in and the BOC was vague on guidance, only saying that rates will have to rise further. On the whole, it was hawkish but the loonie only rallied in tandem with AUD and NZD. The plunge in oil prices was certainly a headwind.

www.forexlive.com