US Stock Market Key Points:The S&P 500, Dow and Nasdaq 100 surge after rebounding off strong support levels, in context of lower U.S. Treasury yi

US Stock Market Key Points:

- The S&P 500, Dow and Nasdaq 100 surge after rebounding off strong support levels, in context of lower U.S. Treasury yields

- Beige Book confirms economic slowdown and persistent inflation

- All eyes on FED’s Jerome Powell speech tomorrow following the much-anticipated ECB rate decision.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Euro Forecast: Can the ECB Stop the Slide? Setups for EUR/GBP, EUR/JPY, EUR/USD

U.S. equity indices advanced at today’s open, bolstered by a respite in U.S. Treasury yields after their sharp rise in yesterday’s session. Higher participation and increased liquidity were noticeable and kept markets active while investors waited for the release of the Federal Reserve’s Beige Book in the absence of economic data.

The Survey highlighted that the economic outlook remains weak and largely unchanged from the previous month’s report, with expectations pointing to further softening and persistent inflation. On the employment side, the job market remains healthy, though extremely tight. For this reason, Fed officials reaffirmed their commitment to curb inflation even at the cost of higher unemployment and slower growth, but Fed Vice Chair Lael Brainard pointed to the risks of overtightening, setting the stage for U.S. Treasury yields to extend their retreat. In this context, the 2-year tenor dropped 6 basis points to 3.44% and 10-year yield dropped 7 basis points to 3.27%.

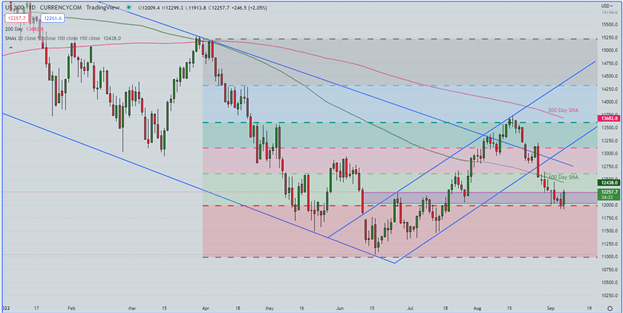

Focusing on risk assets, stocks surged, with the main Wall Street indices breaking several days of losses. At the close, the Nasdaq 100 was up 2%, benefiting from lower interest rates in parallel with growth stocks. Technically speaking, the index rebounded at the 23.6% Fibonacci retracement level, opening the door for a retest of the 100-day SMA around 12,440.

Nasdaq 100 Daily Chart

Nasdaq 100 Daily Chart Prepared Using TradingView

The Dow and the S&P 500 also posted strong gains, rallying 1.40% and 1.83% respectively. All S&P sectors finished in the green except energy, which suffered heavy losses in response to the large sell-off in oil prices. Follow the link to Learn Crude Oil Trading Strategies and Tips

All things considered, it is worth mentioning that, despite the weak economic outlook highlighted in the Beige Book, the U.S. economy remains in a better position than the European Union to weather the storm and heightened risks to the outlook. Also, China’s trade surplus surprised on the downside, falling short of expectations, indicating that domestic and external demand are weakening. (Stringentzero-covid policies and falling crude oil imports add to already existing concerns about domestic demand). This environment brought recession concerns to the limelight, sending crude prices into freefall. The WTI contract for October was trading at $82.25 per barrel at the time of writing, reaching levels not seen since late January, before the Ukraine war.

Looking ahead, it is important to keep an eye on Fed Chairman Jerome Powell’s speech tomorrow as well as the much-anticipated ECB meeting.

Recommended by Cecilia Sanchez Corona

Get Your Free Equities Forecast

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Cecilia Sanchez-Corona, Research Team, DailyFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com