RBA to face pat, concentrate on yield containment as aussie settles decrease – Foreign exchange Information Preview

RBA to face pat, concentrate on yield containment as aussie settles decrease – Foreign exchange Information Preview

Posted on April 2, 2021 at 1:05 pm GMTRaffi Boyadjian, XM Funding Analysis Desk

The Reserve Financial institution of Australia meets on Tuesday for its coverage assembly, with a call anticipated at 05:30 GMT. No change in coverage is anticipated on the April assembly regardless of a turbulent month for bond markets that prompted some heavy intervention by the central financial institution, wrong-footing some merchants. However because the upward stress on yields isn’t about to go away anytime quickly, policymakers will in all probability wish to reassert their dedication to preserving borrowing prices low. A dovish assertion might land an additional blow to the battered Australian greenback, which has been in a corrective mode versus the dollar over the past month.

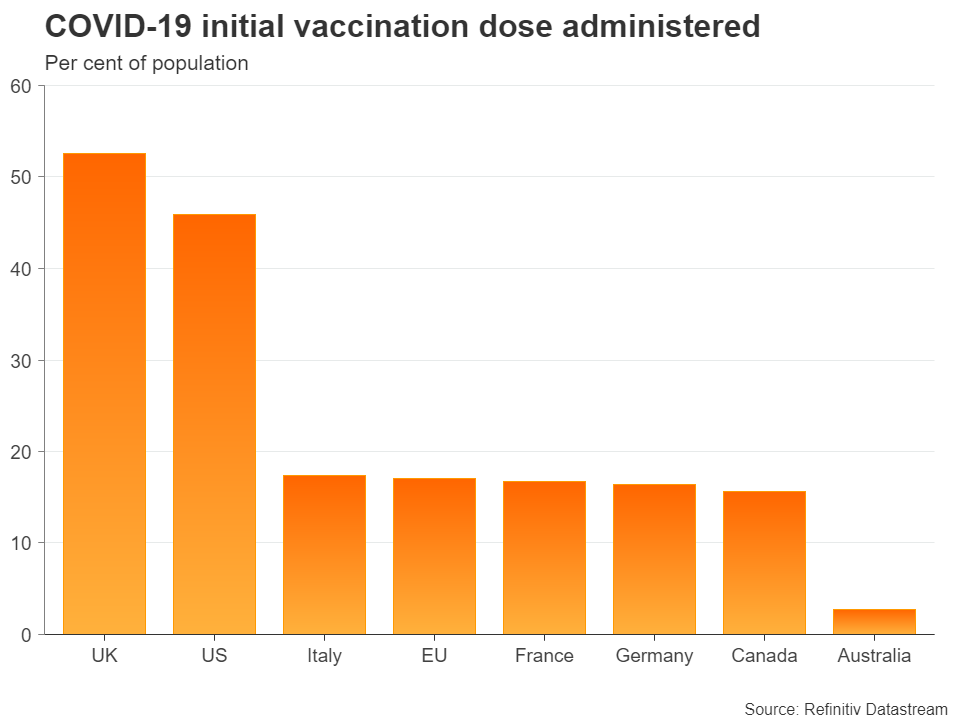

A gradual begin to vaccinations

Australia’s vaccine rollout has gotten off to a really gradual begin. It’s at present lagging the European Union and Canada when it comes to Covid jabs administered per 100 individuals. But, buyers are vastly optimistic in regards to the county’s financial outlook. That’s as a result of Australia’s success in preserving the virus beneath wraps from the onset of the pandemic has meant that lockdowns have been shorter in length and its financial system has remained largely open. Therefore, you would say that the additional leisure of virus measures will in all probability be decided by how effectively different nations’ inoculation programmes go than its personal earlier than restrictions equivalent to these on journey will be lifted.

Exports are booming

Nonetheless, so far as the aussie rally is worried, it was by no means about vaccines and the whole lot about international commerce. Exports to China – Australia’s greatest market – have soared to report ranges in current months, and mixed with greater commodity costs and the general constructive indicators for the worldwide restoration, 2021 must be a bumper 12 months for Australian miners and producers. Add to the combination the upbeat stimulus and vaccine narrative that’s supplied some certainty to the outlook and buyers received a bit carried away in February and March by bringing ahead the primary post-pandemic charge hike to late 2022.

RBA’s dedication to QE is being examined

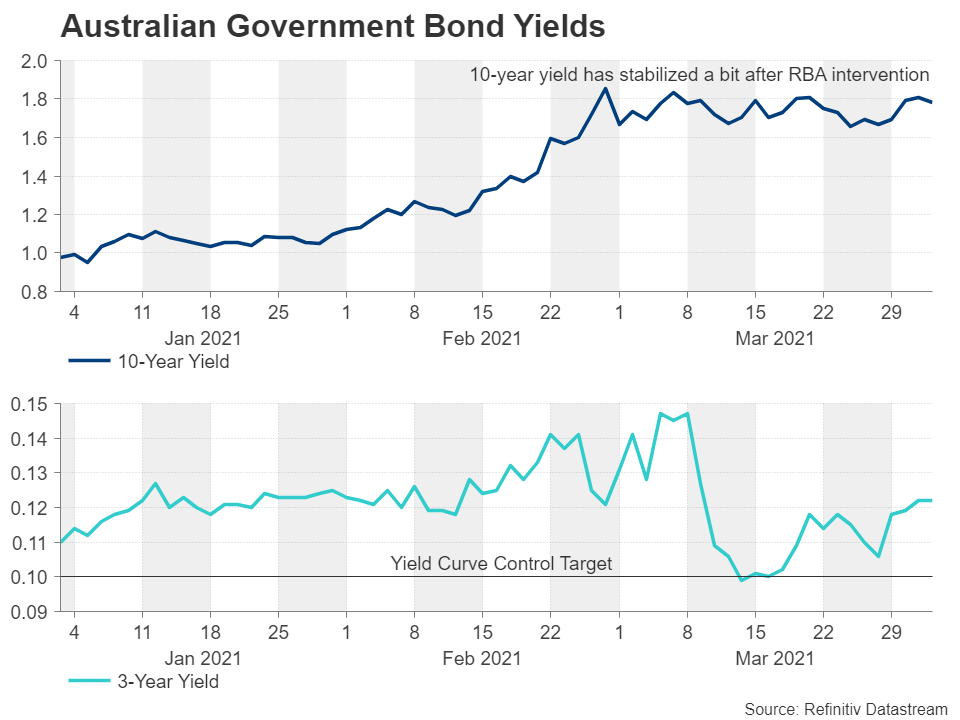

The RBA has set the money charge (at present at 0.1%) because the goal for the three-year yield on Australian authorities bonds (AGB) so the truth that markets assume there will probably be a charge hike earlier than 2024 implies merchants are questioning the central financial institution’s dedication to its yield curve management coverage. The RBA was examined once more in early March when the worldwide bond selloff accelerated. Each the three- and 10-year yields spiked greater earlier than the RBA stepped in to include the fallout.

Policymakers responded by not solely doubling the quantity of each day bond purchases however by additionally squeezing out brief sellers – a transfer that caught merchants unexpectedly however consequently succeeded in bringing the three-yield again all the way down to the 0.1% goal. However that’s not all. Governor Philip Lowe has adopted up these actions by delivering some stern messages to the markets, first by signalling that the Financial institution’s A$200 billion bond buy programme could possibly be expanded additional after which by hinting that the yield curve goal could also be moved from bonds with a maturity of April 2024 to new bonds maturating in November 2024.

Aussie beneath stress

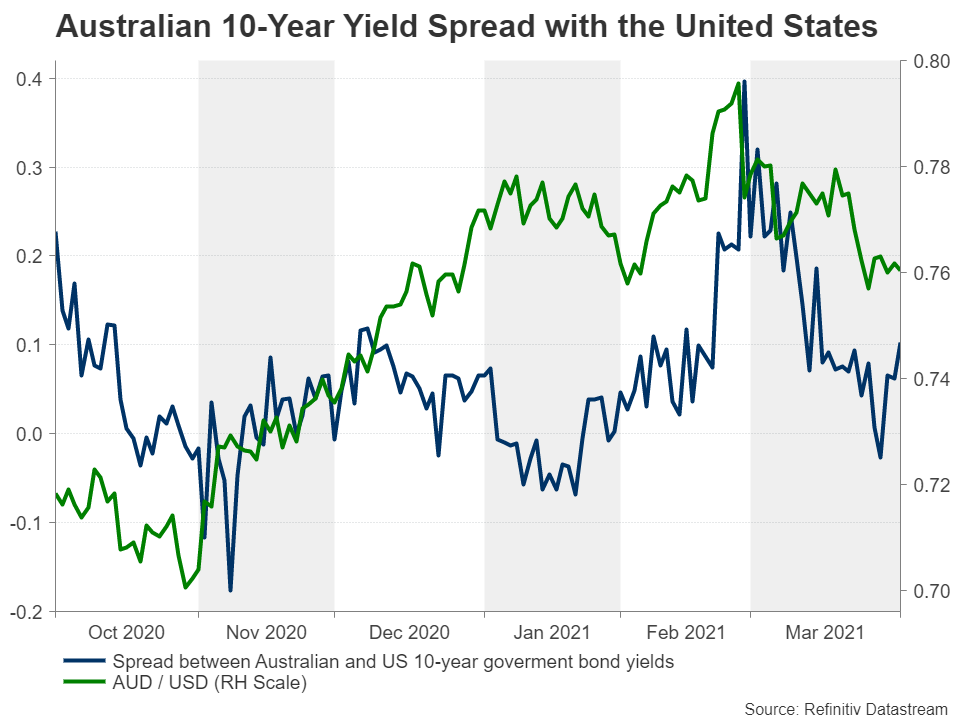

The RBA has additionally set a better bar for assembly its inflation purpose. It now desires to see precise inflation and never forecasted inflation attain its 2-3% goal band sustainably earlier than contemplating elevating charges. All this has put fairly a dampener on the Australian greenback as AGB yields have been steadier currently whereas US Treasury yields have continued to scale recent highs.

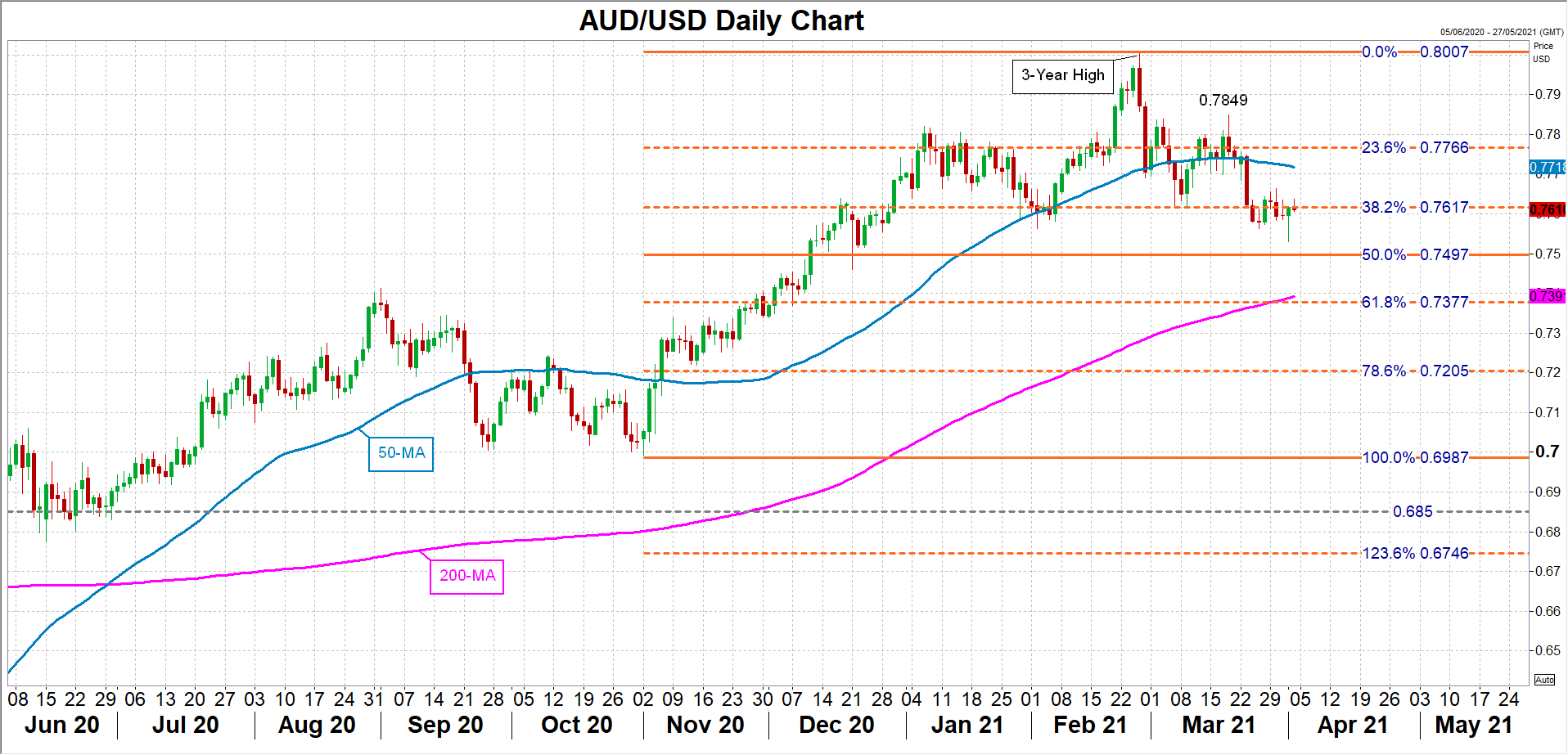

The narrowing unfold between 10-year Australian and US yields has pulled the aussie beneath its 50-day shifting common (MA) towards the US greenback. It’s at present hovering across the 38.2% Fibonacci retracement of the November 2020-February 2021 uptrend round $0.7617. Failure to carry inside this help area might see the aussie slip in the direction of the $0.75 stage, which coincides with the 50% Fibonacci. Additional down, the 61.8% Fibonacci at $0.7377, the place the 200-day MA is converging, could be the subsequent main goal for the bears.

One other dovish assertion

After the current episodes, the RBA is unlikely to again away from its agency pledges to maintain the three- and 10-year yields tamed so buyers mustn’t anticipate something aside from a dovish assertion. At this level, the aussie’s finest likelihood of restoring some bullish momentum is that if the US Federal Reserve had been to observe within the RBA’s footsteps and start concentrating on the lengthy finish of the curve.

That in all probability gained’t occur anytime quickly, if in any respect. However ought to the yield unfold widen once more, the aussie’s speedy problem on the upside could be to climb again above its 50-day MA, at present at $0.7718, earlier than aiming for the March peak of $0.7849.

AUDUSD