One other Friday, one other report low Baker-Hughes Rig Depend. As of at this time’s report, there are 188 U.S. oil rigs in operation, an all-time

One other Friday, one other report low Baker-Hughes Rig Depend. As of at this time’s report, there are 188 U.S. oil rigs in operation, an all-time low. This determine is down from 189 final week and reveals that though WTI is again round $40 per barrel, there’s no hurry to fireside up North American fracking operations.

So far as the Baker-Hughes report goes, essentially the most telling stat is the year-over-year drop in lively U.S. oil and fuel rigs. In comparison with final yr at the moment, the depend is down by 702, coming in at 265. That is an epic lower and one that may have a profound influence on North American shale for years to come back.

Regardless of the plunge in lively rigs, August WTI crude oil is holding agency close to $38.50. Whereas the drop in U.S. fracking output is supporting costs, there may be modest volatility in WTI futures at this time.

Rig Depend Falls, USD/CAD Holds Agency

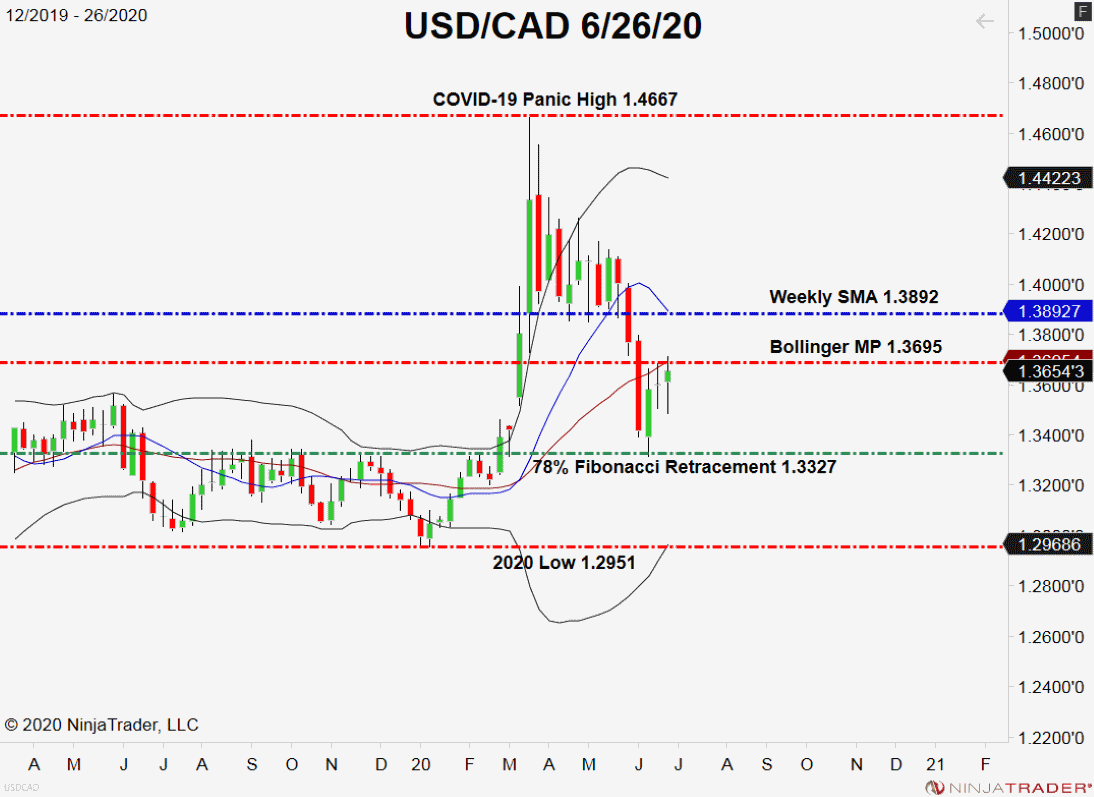

It’s been one other comparatively quiet week for the USD/CAD. The WTI market has been muted and the motion of the Loonie tells the story ― each bulls and bears are treading evenly.

+2020_26+(11_21_28+AM).png)

Going into Monday’s commerce, there are two ranges to keep watch over:

- Resistance(1): Bollinger MP, 1.3695

- Help(1): 78% Fibonacci Retracement, 1.3327

Overview: If at this time’s Baker-Hughes Rig Depend is any indication, there isn’t plenty of optimistic sentiment towards the oil markets. Accordingly, the USD/CAD could also be poised to interrupt to the bull if oil provides proceed their upward trajectory subsequent week. Nevertheless, till we see charges break outdoors of the assist/resistance ranges listed above, this market is prone to stay caught within the mud between 1.3600 and 1.3700.